For 8 consecutive sessions, the USD/JPY is stable in a limited range amid boring performance according to Forex traders. Bearish performance is dominating, as the pair that is at the doorstep of the 107.00 support, and despite technical indicators reaching oversold areas, fears of a second COVID-19 wave in the US is still weakening the US Dollar, although it was the most profitable in the first wave of the virus. New cases reaching record numbers in some American states pushed Trump administration to think of more stimulus plans to face the pandemic.

In return, with the Chinese economy being the first economy in the world to recover from the COVID-19 effects, which originated in China, the Chinese Central Bank kept main interest rates as is for the 3rd consecutive month, as the economy showed signs of recovery from the unprecedented recession resulting from COVID-19. Therefore, the main interest rate for a year loan remained at 3.85%, 5 year main interest loan remained at 4.65%. The bank was expected to keep rates at their current levels, as the average loan interest rate remained at 2.95% earlier this month.

Interest rates for one and five years loans were last reduced in April. The main interest rate for a one year loan was reduced by 20 base points, and for the 5 year loan by 10 base points in April. The main interest rate for the loan was defined monthly based on 18 banks’ application, despite that Beijing has an influence on specifying interest rates. The new rate replaced the traditional standard loan rate applied by the bank in August 2019.

Commenting on that, Iris Bang, an economic expert at ING, said that wide range facilities are not only necessary, as the economy shows recovery signs, but it could also speed up the asset price rise. The economic expert expects the PBoC continues easing approach aimed at small companies. He added that regardless of the targeted facilities, it is unexpected that any large scale reductions will take place in interest rates, or any RRR reductions during the economic recovery.

Data released last week showed the Chinese economy growing by 3.2% on annual basis in the 2nd quarter, against a contraction of -6.8% in the first 3 months of the year, the first since 1992.

This good Chinese economic performance is upsetting the US president who accuses China of being responsible for the pandemic, and he will not hesitate in imposing more sanctions on them because of that. Especially as it affects Trump’s future in the coming presidential elections in November at risk.

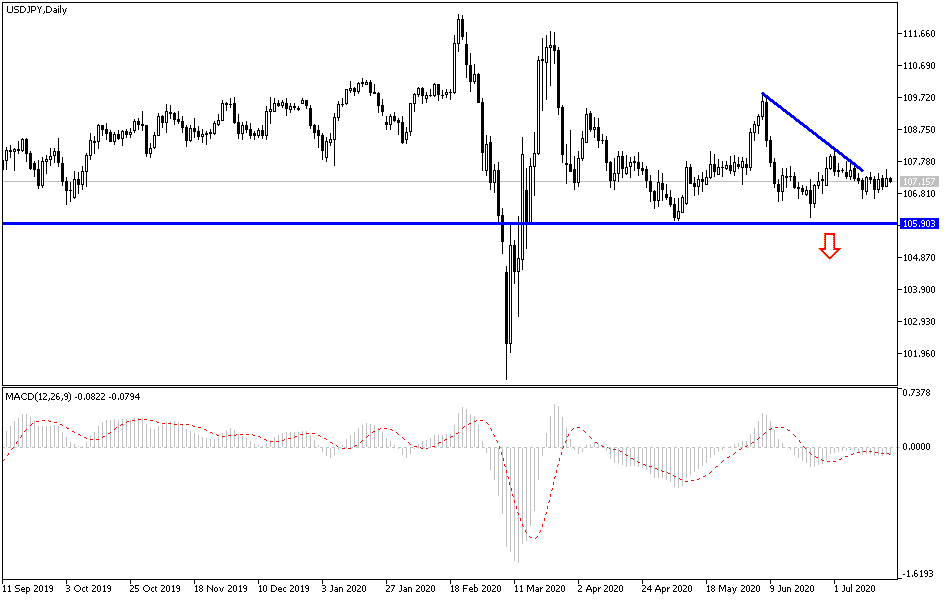

According to the technical analysis of the pair: There isn’t much change in my view to the USD/JPY price, as the bears control over performance remains stronger, especially with the pair settling below the 108.00 support. A move towards 107.25, 106.85 and 106.00 support levels is possible, but it must be taken into account that technical indicators reached oversold areas, and long trades can take place without taking the risk from the above mentioned support levels, as investors began to think of consecutive international announcements regarding successful COVID-19 vaccines. On the other hand, the 100.00 psychological resistance will continue to be an important key for the bulls’ control of performance.

Amid an absence of American and Japanese economic releases, the pair will interact with investors’ risk appetite, new coronavirus numbers, and government measures to contain the new outbreak.