For two weeks in a row, the USD/JPY pair moved in a stable downward correction range below the 108.00 support, and last losses reached the 106.63 support, the lowest level in three weeks, before closing trading around the 106.92 level. This is with investors giving up the American currency despite the frightening numbers of new Coronavirus cases, which threatens the possibility of shutting down the economic activity of the largest economy in the world. To counter the devastating effects of the epidemic, the Federal Reserve is buying more bonds to revive the economy and to prevent companies from collapsing. The Fed has bought nearly $8 billion in sets of bonds held in exchange-traded funds, which operate similarly to mutual funds.

In this regard, a Fed official said that the central bank has slowed the bond-buying process in recent weeks and may continue to do so if the market remains in relatively good condition. Fed purchases are still far below the original $750 billion program ceiling. The Treasury provided $75 billion in taxpayer money to make up for any losses. Therefore, Dalip Singh, Deputy Executive Director of the Federal Reserve in New York, said last week, "If market conditions continue to improve, the purchases of the Federal Reserve may slow further, and may reach very low levels or stop completely." And added: "This will not be a sign that the doors of the bonds purchase program were closed, but rather that the markets are working well".

And for the Japanese yen - the safe-haven currency - you may see stronger gains as the number of COVID-19 cases increases, especially in the United States of America, which is the largest economy in the world. The United States is stimulating more demand for anti-risk assets, and additional efforts to somehow mitigate the spread of COVID-19, which means the extension or re-implementation of the closures that negatively affect the US economy. COVID-19 coronavirus has sent nearly all global economic activities to the ground level.

Essentially, the United States has less than 20% of all confirmed cases worldwide. Hotspots such as Florida and Texas are currently reporting very large numbers. The medical standards in these areas have caused great concern to the already troubled traders who are already thinking about the current geopolitical risks in the United States. All this is happening as the United States prepares for the presidential election and the growing tensions with China. This also improved the trade balance for Japanese goods.

The Japanese yen could extend its gains if profits from companies such as Blackrock, Wells Fargo, Goldman Sachs and other high-end companies do not achieve forecasted earnings this week.

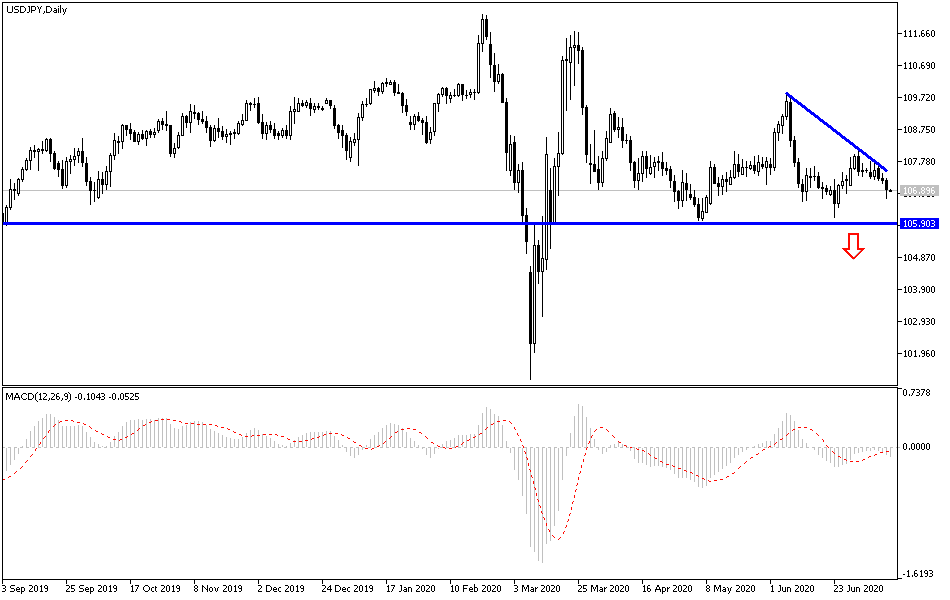

According to the technical analysis of the pair: On the daily chart, the USD/JPY pair is still in the downtrend channel that pushed the technical indicators to oversold areas, so investors may consider returning to buying the pair, and the support levels at 106.65, 105.85 and 104.90 may be best suited to do so. On the other hand, there will be no stronger bulls’ control over the current situation without crossing the resistance barrier at 108.60. The pair does not expect any important and influential data today, whether from the United States of America or Japan. Therefore, it will be affected by the new Coronavirus outbreak figures, along with the strength of tensions between the United States and China. The risk appetite is a strong influence on the pair’s performance.