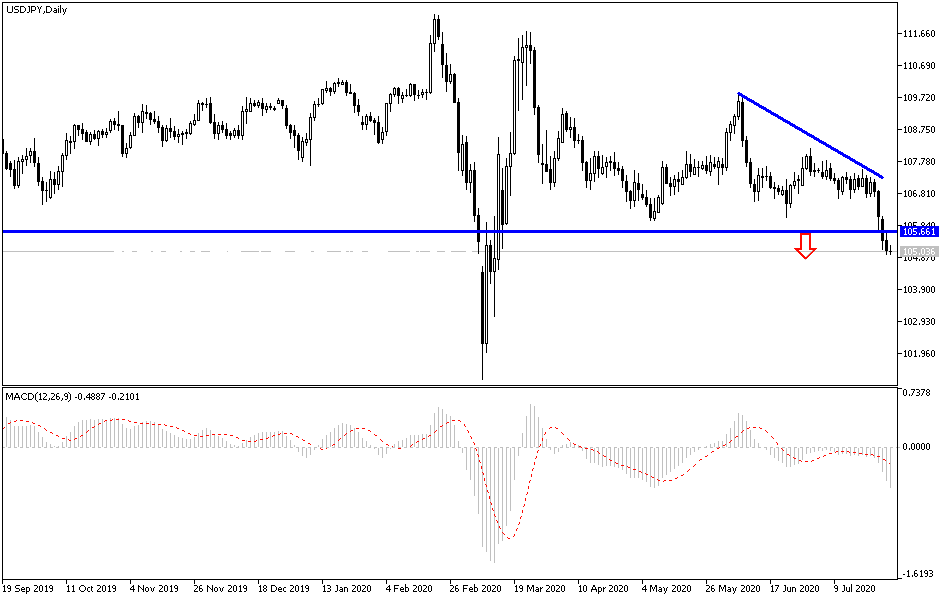

Will the recent US dollar collapse affect the monetary policy decisions of the US Federal Reserve today? We believe not, because the exchange rate was not a goal for the bank as much as the continued recovery of the American economy, especially in the COVID-19 era, which caused the collapse of all the American economy gains in the Trump era, which makes his gains in the upcoming presidential elections at stake. Bleeding losses pushed the USD/JPY to move towards the 104.93 support at the time of writing, which is the lowest in more than four months.

Fed officials this week are dealing with the timing and scope of their next policy moves at a time when the raging COVID-19 pandemic has weakened the US economy.

No major changes are expected when the Federal Reserve issues a statement Wednesday at the end of a two-day policy meeting and before Governor Jerome Powell holds a press conference. The US central bank is providing more specific guidance on conditions that it may need to see before considering raising the record short-term interest rates, which is now near zero. Economists describe such an approach as a "forward guidance", and the Fed used it extensively after the 2008-2009 recession. Economists say that the Fed may not provide such guidance until its next meeting in September. Given the indications that the economy is stalling in the face of the pandemic, and that many aid programs have expired as Congress discusses another bailout package, there is a chance that Fed officials can update their guidance earlier on Wednesday.

After its previous meeting last month, the Federal Reserve indicated that it expects to keep the key short-term interest rates close to zero until 2022. Since then, the pandemic's threat to the economy seemed worse. According to the minutes of their June meeting, "different" Fed officials felt that "it will be important in the coming months ... to provide greater clarity" regarding the future path of interest rates.

Some Fed watchers expect that interest rates will not increase before 2024, given their gloomy outlook for the economy and expectations for very low inflation to continue. But more determination by the Federal Reserve could provide more guarantees for companies and families in a low-price environment for years to come. As the pandemic intensified in March, US central bank policymakers cut the key short-term interest rates to near zero and directed that the Federal Reserve buy nearly $2 trillion worth of Treasury and mortgage-backed securities. These purchases aim to ensure that low borrowing rates remain available to families and companies to help stimulate spending and growth.

The Fed also launched nine lending programs to enable companies and Wall Street banks to borrow at lower rates. On Tuesday, the Federal Reserve said it would extend seven of those programs, which were scheduled to end on September 30, until the end of the year.

According to the technical analysis of the pair: The bearish momentum of the USD/JPY pair is getting stronger and does not care that technical indicators reach strong oversold areas, as investors abandon the US currency and markets depend on the decisions of the US Federal Reserve today in the event of any change. Currently, the support levels will be 104.75, 104.00 and 103.30 closest to the extent of the bear's control. On the upside, there is no change to my point of view, as the actual reversal of the current path will not happen without testing the 108.00 resistance. Besides the Federal Reserve policy, the pair will react to the extent of the tensions between the United States and China and the course of the Coronavirus.

As for the economic calendar data today: All focus will be on the US session data and the announcement of the monetary policy decisions of the Federal Reserve Bank and then statements by Governor Jerome Powell.