Instability was the characteristic of the USD/JPY performance during last week's trading, where the pair tried to correct upward, but gains did not exceed the 108.16 resistance. Despite the positive US employment figures for June, which were better than expected, the pair moved back down to the 107.32 support before closing trading around the 107.49 level. The numbers of new coronavirus cases increased with the return of the American economic activity, and the resort of some states of the United States to impose some restrictions, and even reached the point of partial closure, means that a second wave of the outbreak would be tough in a politically sensitive time with the nearing date of the U.S presidential elections, putting Trump’s future at stake.

The Japanese yen, which is well known as one of the best safe havens, is heading to the third quarter looking to the markets sentiment, based on the inverse relationship between the Japanese currency and the performance of US stock indexes on Wall Street. As global central banks maintain a cautious tone to support economic growth that has been prevented by the outbreak of the Covid-19 epidemic, the Japanese yen is very vulnerable to drop, as the NASDAQ, S&P500 and Dow Jones are gaining momentum. In general, fiscal policy is uncertain, especially as the gradual recovery from a coronavirus may reduce the urgent need to resubmit and support more political challenges. Just last week, the House of Representatives approved the $1.5 trillion infrastructure plan. There are high expectations that the package will be passed on by US President Trump.

Any delay to the upcoming support could restore volatility, and there is a high possibility that this may open the door for a sharp yen appreciation, especially with the increase of COVID-19 cases to a higher level in some states, where other countries take precautionary measures to stop or reverse closure mitigation engines.

S&P500 and Dow Jones stock indexes have performed at their best since 1938 after compensating for the March crash. As since it reached 2.237.40 again on March 23, the S&P500 has risen 38% to around 3100, and the Dow Jones has increased 38.5%. It is also important to note the fact that the Nasdaq Composite Index also rose at about 46%. The main issue now is that there are no clear guidelines on where the market will go from now, and traders have focused on raising the S&P500 end-of-year forecasts rather than lowering them, as the stock market is advancing slightly above the target and at the same time, the epidemic is on the rise again in the United States. This explains the unstable performance of the USD/JPY pair in the recent period.

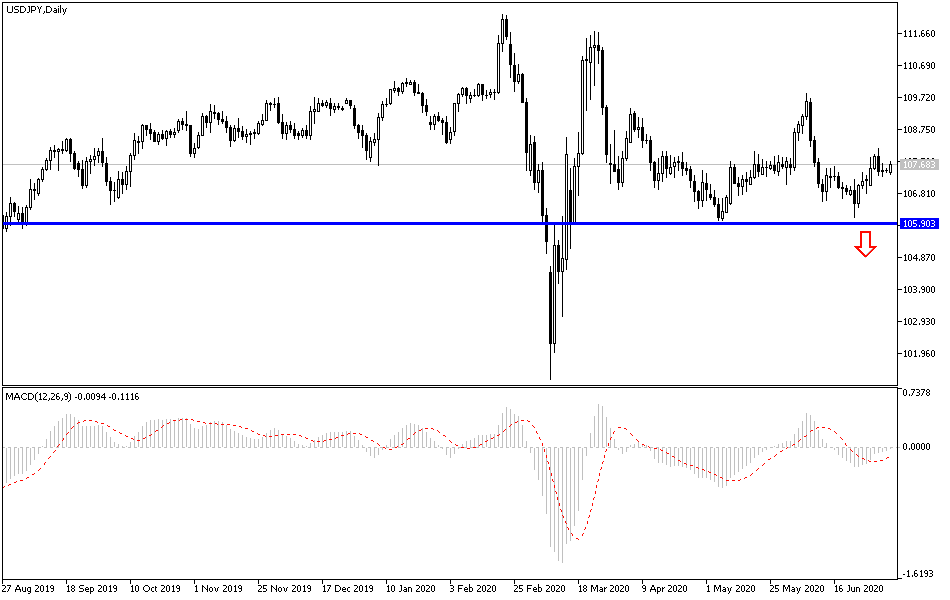

According to the technical analysis of the pair: The USD/JPY bearish momentum will remain stronger as long as it remains stable below the 108.00 support, and the closest support levels for the pair are currently 107.35, 106.80 and 105.90 respectively, which are establishing the strength of the bear's control over the performance for a longer period. On the other hand, psychological resistance at 110.00 will remain key to the trend reversal. Markets will continue to monitor new announcements of COVID-19 cases and US decisions regarding restrictions, closure or virus containment. The announcement of a vaccine to eradicate the disease at any time will increase the risk appetite in the markets and thus weaken the Japanese yen.

Today, the pair will react to the announcement of the ISM services PMI from the US.