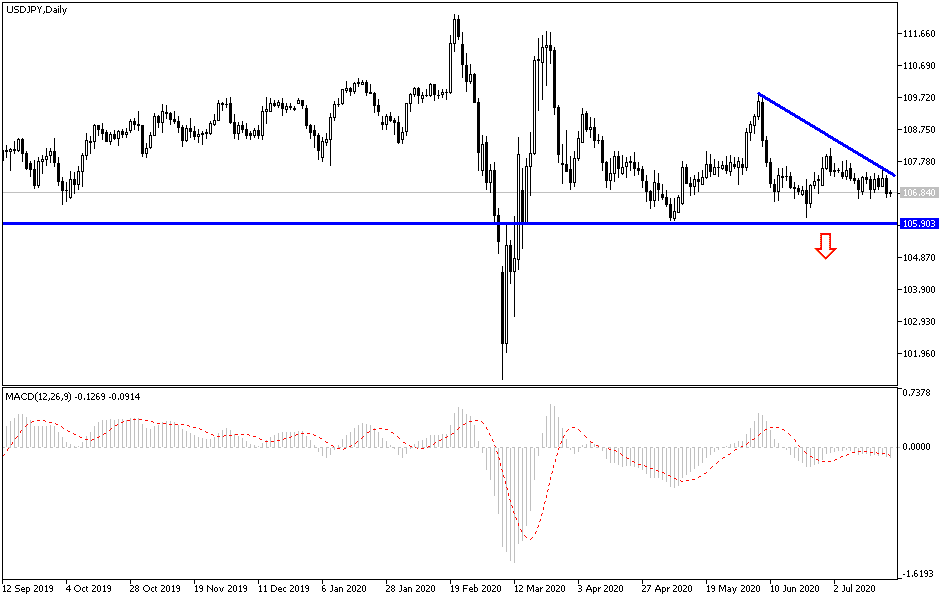

Investors have abandoned the US currency, temporarily, since the announcement of reaching vaccines to counter the COVID-19 pandemic, despite new and record numbers of infections in the United States and some countries of the world. Accordingly, the downward momentum of the USD/JPY performance has increased and has fallen back to the 106.68 support before settling around the 106.85 level at the time of writing. The US dollar came under pressure after improved risk sentiment in the markets as European Union leaders agreed to a stimulus package, and hopes for COVID-19 vaccines rose. Therefore, the US dollar index, DXY, fell below the 95.00 level.

After marathon talks over the past four days in Brussels, the European bloc will jointly issue the debt, which will be provided to the member states most affected by the Covid-19 crises. Of the 750 billion Euro recovery plan, 390 billion Euros will be in grants and 360 billion Euros in low-interest loans. Now the deal must be approved by the parliament of the 27 member states.

On economic news from Japan, data from the Ministry of Internal Affairs and Communications showed that Japan's inflation rose 0.1% year-on-year in June - in line with expectations, and was unchanged from the May reading. The core CPI, which excludes volatile food prices, remained unchanged on an annual basis - against expectations for a 0.1% decrease after a 0.2% drop in the previous month. There will be a Japanese holiday until the end of the week.

On the other hand, in light of the ongoing conflict between the two largest economies in the world, the US Justice Department announced new accusations against China, saying that there are pirates working with the Chinese government targeting companies that develop vaccines against coronavirus and steal hundreds of millions of dollars in intellectual property and trade secrets from companies around the world. The indictment does not accuse the Chinese defendants of actually getting COVID-19 virus researched, but it confirms how scientific innovation has been a major target for foreign governments and criminal hackers looking to find out what US companies are doing during the pandemic. In this case, hackers looked for vulnerabilities in computer networks of biotechnology and diagnostic companies that were developing vaccines and test kits and looking for antivirals.

The charges are the latest in a series of aggressive Trump administration measures targeting China. It comes as US President Donald Trump has accused China of being the primary responsibility for the coronavirus outbreak which caused damage to prospects of his re-election. That accusation is the first from the US Department of Justice accusing foreign intruders of targeting coronavirus-related innovation, although, US and Western intelligence agencies, have for months warned of such threats.

Last week, for example, authorities in the United States, Canada, and the United Kingdom accused a pirate group linked to Russian intelligence with trying to target researches related to the disease, which has killed more than 140,000 people in the United States and more than 600,000 people worldwide according to figures compiled by Johns Hopkins University.

According to technical analysis of the pair: The bears still have stronger control over USD/JPY performance, as long as it remains stable below the 108.00 support, and from my point of view, it is better to buy the pair from each lower level, as the technical indicators have reached strong oversold areas. Support levels at 106.70 and 105.90 will be best suited for this. As I mentioned before, I stress now that psychological resistance will remain a symbol of bulls' control of performance. We await the awakening of the US dollar. Today, the dollar will react to the announcement of existing US home sales and the extent of investors risk appetite.