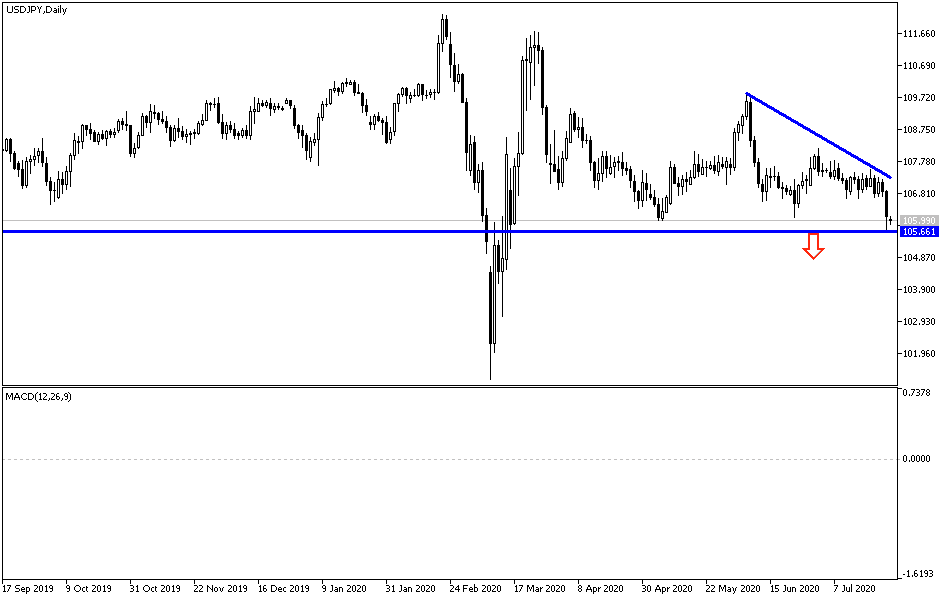

In the latest USD/JPY technical analysis, we noted that the performance over the recent several trading sessions in a row is a technical warning that in the near future the pair will move in one of the two directions. It will be leaning more towards the decline, especially with stability below the 108 support, which is what happened, where it fell to the 105.67 support, its lowest in more than four months, and it closed the week's trading around 106.12. Its gains throughout the past week's trading did not exceed the resistance barrier at 107.56. Bears are having stronger control, as investors abandon the US dollar as a safe haven, despite fears of a COVID-19 pandemic and increased tensions between the United States and China. The world's two largest economies continue to provoke each other, which increases the demand for safe-haven assets, the most important of which is the Japanese Yen. After the United States demanded the closure of a Chinese embassy in Houston last week, Beijing also responded by calling for the closure of the US embassy in Chengdu. While relations between these two superpowers are quite bleak, any increase in hostilities between them will see an increase in demand for the Japanese Yen.

Economically, activity in Japan was limited to the first few days of last week, before a long holiday. Japan's revised trade balance figures for June missed expectations of -302.3 billion yen, by recording - 423.9 billion yen. The trade balance figures for total commodities came in less than -35.8 billion yen, with a reading of -268.8 billion yen. The change in imports for June exceeded expectations (on an annual basis) at -16.8% with a reading of -14.4%. On the other hand, exports fell to -24.9%, by -26.2%. Earlier, it was announced that the Japanese consumer price index was the best on all fronts, food and energy, and the national consumer price index.

From the United States, the house price index for May fell 0.3% from what was expected, falling by-0.3%. Initial jobless claims came more than 1.3 million, with 1.416 million claims registered, while ongoing claims reached 16.197 million, compared to 17.067 million. By the end of the week, the July PMI reading for the manufacturing and primary services sectors was lower than expected, while new home sales hit a record high despite the outbreak of the COVID-19 pandemic.

According to the technical analysis of the pair: it appears that the USD/JPY is suffering from short-term downward pressure, according to market sentiment. The pair has recently bounced off the oversold levels of the 14-hour RSI in the 60-minute chart. Therefore, bulls will target short term profits at around 106.41 or higher at 106.72. On the other hand, bear will look to extend downward towards 105.68 or lower at 105.00.

In the long-term, and according to the performance on the daily chart, it appears that the USD/JPY is trading within a falling wedge. This indicates a slight downward bias in the long run, depending on market sentiment. Thus, bears will be looking to maintain long-term control by targeting profits at around 104.55 or less at 102.64. On the other hand, bulls will target profits at around 107.61 or higher at 109.64.

As for the economic calendar data today: From Japan All Activity Index and the consumer price index from the Japanese Central will be released. From the US, durable goods orders data will be announced.