After several trading sessions during which the price of the USD/JPY pair attempted to correct higher, and at a slow pace, the pair was unable to overcome the barrier at the 108.16 resistance. The pair quickly collapsed to the 107.35 support before settling around the 107.45 level in the beginning of Thursday’s trading, and before the announcement of important US economic data. The reason for the weak upward correction is the continuing concern in the markets of a new outbreak of the deadly Corona virus. Amid strong signals, the second wave of the epidemic will be catastrophic both economically and humanly. This makes safe havens always in a winning position for a longer period.

The US dollar fell against some of the major currencies, as risk sentiment improved in the market thanks to the somewhat encouraging economic data from the United States, Europe and China. However, concerns persisted over the pace of the global economic recovery due to sharp increases in new coronavirus cases in many parts of the world, especially in the United States, which limited the dollar's decline.

On the economic side. A report from the Institute of Supply Management showed that manufacturing activity in the United States grew unexpectedly in June. ISM said that the PMI jumped to a reading of 52.6 in June from 43.1 in May, and any reading of the index above the 50 level indicates growth in manufacturing activity. Economists had expected the index to rise to a reading of 49.5, which still indicates a modest contraction in manufacturing activity.

Before that, a separate report issued by the ADP Payroll processor showed a significant increase in US private sector employment in June as well as a large upward revision of the data for May. ADP said that private sector employment jumped by 2.369 million jobs in June, lower than economists' estimates for an increase of nearly 3,000 million jobs. The revised data showed that the employment in the private sector increased by 3.065 million jobs in May compared to the previously reported loss of 2.760 million jobs.

The US dollar index, DXY, which measures the performance of the dollar against a basket of six competing currencies, fell to a low of 97.03 after advancing to 97.62 earlier in yesterday's trading, and was last seen at 97.14, down 0.25% from the previous close.

Elsewhere, China's manufacturing sector continued to grow in June, and at a faster rate, the latest survey from Caixin showed that the manufacturing PMI reading reached 51.2. It was up from 50.7 in May and is moving further above the 50 level that separates growth from deflation.

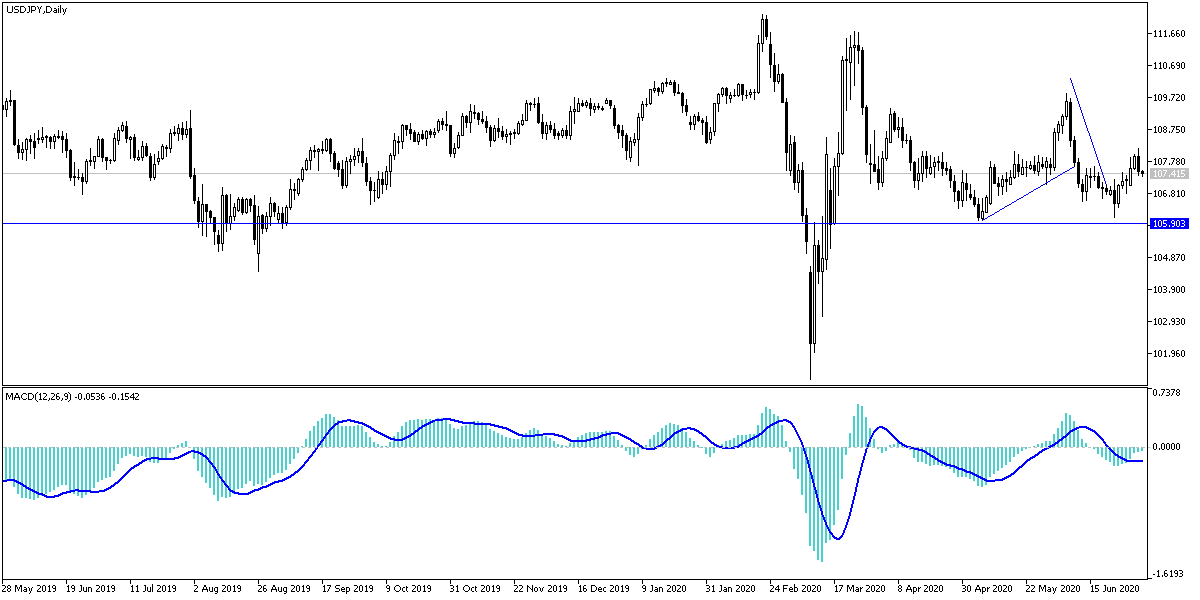

According to the technical analysis of the pair: On the long term, the general trend of the USD/JPY pair remains bearish, supported by remaining stable below the 108.00 support. The closest support levels for the pair are now 107.35, 106.80 and 106.00, respectively. The true reversal of the downward trend will not be achieved without moving towards the 110.00 psychological resistance, and this may be achieved only if the increasing number of new coronavirus cases are contained, and responsible coexistence with the virus is achieved until a vaccine is reached. Reopening the global economy is very important, but it still faces risks. At the same time, increasing global trade and geopolitical tensions will be in favor of the Japanese yen more than one dollar.

The pair's performance will interact today with the announcement of the results of a package of important US economic data, the most prominent of which is the US job numbers.