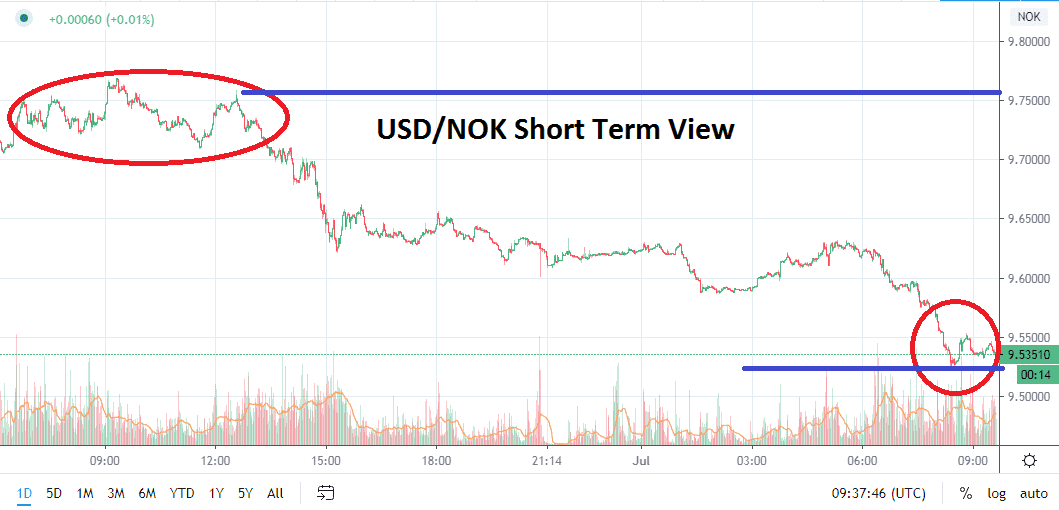

The month of June provided choppy trading for the USD/NOK currency pair. However, the trend for the Norwegian Krone continues to prove the currency has the fortitude to pick up value against the US Dollar. Short selling of the USD/NOK remains highly contested for speculative short term trades, but current support levels are showing signs of potential vulnerability.

The current price range of the USD/NOK is hovering between the 9.53500 and 9.65000 marks early today. Support near the 9.52300 juncture should be the focal point for speculative traders looking to short the USD/NOK at its current price levels.

Resistance is evident too and has proven itself near 9.66000 recently, but this level may prove vulnerable and a high water mark of 9.74500 is not out of the question. June provided a rather bumpy range for the USD/NOK. Support proved capable near the 9.28500 level around 10th of June, and resistance near the 9.70000 held last week. The USD/NOK finds itself susceptible to risk appetite like many currency pairs. The past few trading sessions have seen the Norwegian Krone become stable and add incremental value and suggest it has the ability to reestablish its stronger trend against the US Dollar.

The USD/NOK provides speculators with plenty of opportunities to challenge their desire for risk. The currency pair provides volatility with the promising aspect that its fluctuations are not violent. Traders need to practice solid risk management with the USD/NOK, but the pair does offer worthwhile trends to pursue if stop losses and take profits are effectively used.

Shorting the USD/NOK at its current prices levels with an eye on support levels below may prove to be an interesting trade. Early June saw the USD/NOK touch values of 9.22000 and it has the potential to test these support levels again, it will likely not happen today, but if risk appetite remains solid globally and commodity prices in the energy sector continue to stabilize the Norwegian Krone may find that it attracts sellers of the USD/NOK who believe the currency pair will continue to produce a bearish trend.

Norwegian Krone Short Term Outlook:

Current Resistance: 9.66000

Current Support: 9.52300

High Target: 9.74500

Low Target: 9.47900