Traders should always try to identify their bias before speculating on a forex pair. Perceptions via technical charts are easier to embrace than compared to trying to change your thoughts about the dynamics of a particular currency due to your core beliefs. The USD/PRK has produced a slightly bearish trend the past week of trading, which has given me reason to reflect and wonder if my perceptions about the Pakistani Rupee may be biased.

Yes, the USD/PKR remains within the higher boundaries of it long term value via its exchange rate. The Pakistan Rupee has not exactly won over a parade of admirers recently either. However, sources from the Pakistan government have made it known in media circles they believe the Pakistani economy will rebound after struggling the past six months. However, do you trust these official statements enough to wager on them?

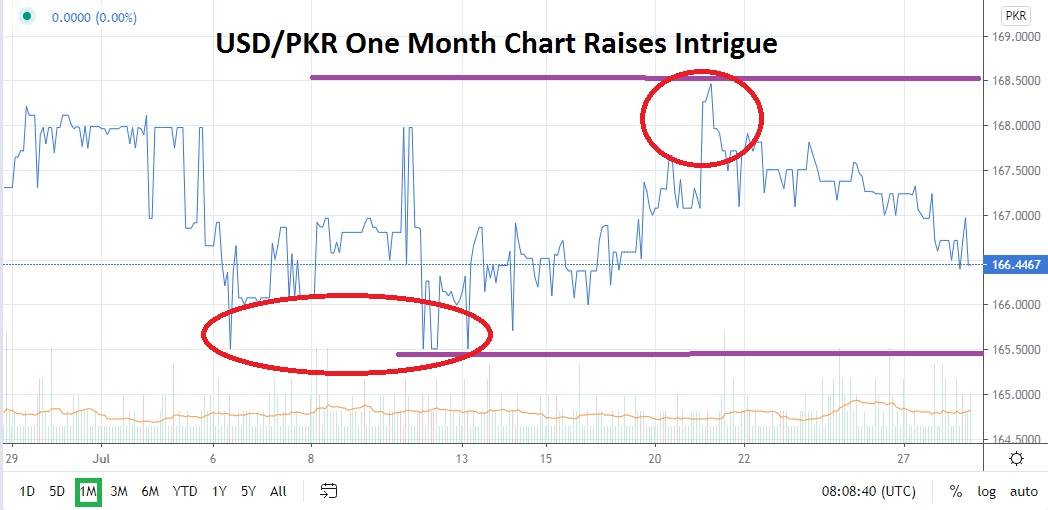

Coronavirus certainly has impacted the Pakistan. A perceived lack of transparency, and concerns about the potential for undercounting real infection rates lingers among critics too. So why do I need to make sure my bias is examined? Because I may be wrong and Pakistan may have the capabilities to pull itself out of its economic tailspin better than I imagined. Resistance near the 168.0000 level has proven durable the past month, yes the USD/PKR did trade above this juncture late last week, but since then a bearish reversal has taken place.

This is a speculative forex pair, the USD/PKR should only be traded by experienced folks who understand the profound risks which shadow. Trading volumes are not high, sudden violent spikes are plentiful and if solid risk management is not used to enter and exit a trading position of the USD/PKR a speculator can suffer monetary losses quite easily.

However, if you are an experienced trader and seek adventure the USD/PKR may be the forex pair you want to entertain yourself. This a speculative position that many in the investment world would define as a gamble. The one month chart of the USD/PKR shows the forex pair is within the middle of its range and tests early in July near the 165.5000 level produced sudden reversals upward. However, is it possible the short term trend of the Pakistani Rupee coupled with the notion the US Dollar is weaker in the forex market will create a slight bearish trend for this pair? Is it a possibility that selling the USD/PKR could produce a worthwhile trade?

Limit orders should be used when trading the USD/PKR. Speculators who enter trades with market positions and do not protect their entry points with limits should expect to be burned. Stop losses are vital too. If a trader has enough courage to sell the USD/PKR they may want to wait for the forex pair to trend higher before entering a selling position. The million dollar question is if resistance near the 168.0000 level will continue to work and stop a sudden bullish surge upwards which seems possible too.

If you are stuck at home and cannot get to the casino of your choice, trading the USD/PKR on your chosen forex platform could be the next best thing. This is a speculative trade and the notion that the USD/PKR bullish trend which has been in effect for a long time is going to start reversing with a significant bearish movement may be hoping for too much. However, if you like casinos, you may be willing to make a speculative selling position of the USD/PKR part of your day.

Pakistani Rupee Outlook for August:

Speculative price range for USD/PKR is 165.0000 to 169.0000.

Support at 166.0000 is important and if broken the USD/PKR may test additional support lower at 165.0000.

Resistance at 167.8000 is important, if broken a move to 169.0000 could be possible.