Pakistan has signed $11 billion worth of projects signed with China, as part of the China-Pakistan Economic Corridor (CPEC). Many have labeled it a debt-trap, while it remains a flagship project of Chinese President Xi Jinping and his ambitious Belt and Road Initiative (BRI). Renegotiation over the stalled Diamer Bhasha Dam (DBD) was part of the deals. Upon completion, it will generate 18.10 billion units of electricity annually, and irrigate over 1.23 million acres of arable land. Other hydropower projects include Kohala and Azad Pattan. After the USD/PKR recorded an all-time high yesterday, a new breakdown sequence is likely.

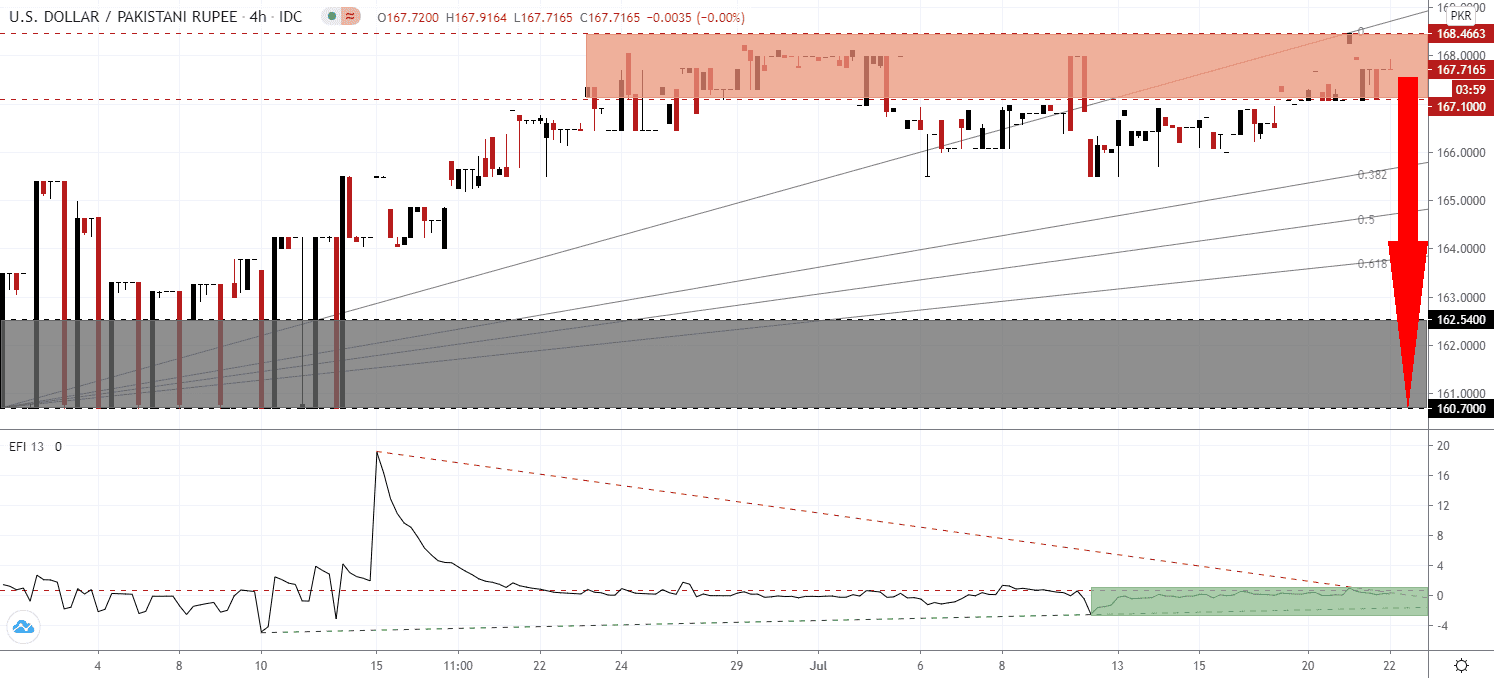

The Force Index, a next-generation technical indicator, points towards the presence of a negative divergence, suggesting a price action reversal is imminent. With the descending resistance level applying downside pressure on the Force Index below its horizontal resistance level, as marked by the green rectangle, a further collapse below its ascending support level is expected. Bears wait for this technical indicator to slide into negative territory to regain complete control over the USD/PKR.

Rising attacks by Baloch separatists, targeting projects related to CPEC, add costs to the projects amid a rise in security expenditures. Since May, three deadly attacks were carried out. CPEC projects and Chinese personnel are well-protected, since 2017, by a 13,700-strong Special Security Division, which is commanded by a two-star Pakistani army general. With Covid-19 crippling economic output, Pakistani Prime Minister Imran Khan seeks to revive stalled projects while he ordered a review to increase exports of technology-related products and services. The USD/PKR awaits its next catalysts inside of its resistance zone located between 167.1000 and 168.4663, as identified by the red rectangle.

Foreign exchange reserves, per data from the State Bank of Pakistan, totaled $18.952 billion as of July 10th. They have steadily increased despite the downside pressure on the Pakistani Rupee and are likely to exceed the $20 billion target for 2020 set by the government. Another area of focus for Pakistan is the Blue Economy, referencing ocean-related activities. With a coastline spanning over 1,000 km and the Exclusive Economic Zone (EEZ) covering about 240,000 square kilometers, Pakistan has plenty of untapped economic potential. The Blue Economy is valued at $24 trillion globally. A breakdown in the USD/PKR below its ascending 38.2 Fibonacci Retracement Fan Support Level is favored to drive price action into its support zone located between 160.7000 and 162.5400, as marked by the grey rectangle.

USD/PKR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 167.7000

Take Profit @ 160.7000

Stop Loss @ 168.7000

Downside Potential: 70,000 pips

Upside Risk: 10,000 pips

Risk/Reward Ratio: 7.00

A spike in the Force Index above its descending resistance level may inspire the USD/PKR to seek more upside. Due to the worsening Covid-19 pandemic in the US, which is presently out-of-control, and Congress stalled in a fifth debt-funded stimulus package, the breakout potential remains reduced to the 170.0000 psychological resistance level. Forex traders should take advantage of any breakout with new short-positions, amid US Dollar weakness.

USD/PKR Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 169.2000

Take Profit @ 170.0000

Stop Loss @ 168.7000

Upside Potential: 8,000 pips

Downside Risk: 5,000 pips

Risk/Reward Ratio: 1.60