Sweden faced severe criticism for not imposing a strict nationwide lockdown, arguing it is not necessary. While most of the world remained at home, images of Swedes enjoying life circulated. Ignoring warnings, the government maintained its course until infection surged and deaths mounted. It has acknowledged it made a mistake but is now locked out of special travel zones by its neighbors. Despite Sweden’s significant mismanagement of the Covid-19 pandemic, the USD/SEK was able to enter a massive corrective phase. While it paused, the absence of bullish momentum is likely to restart it with a new breakdown sequence.

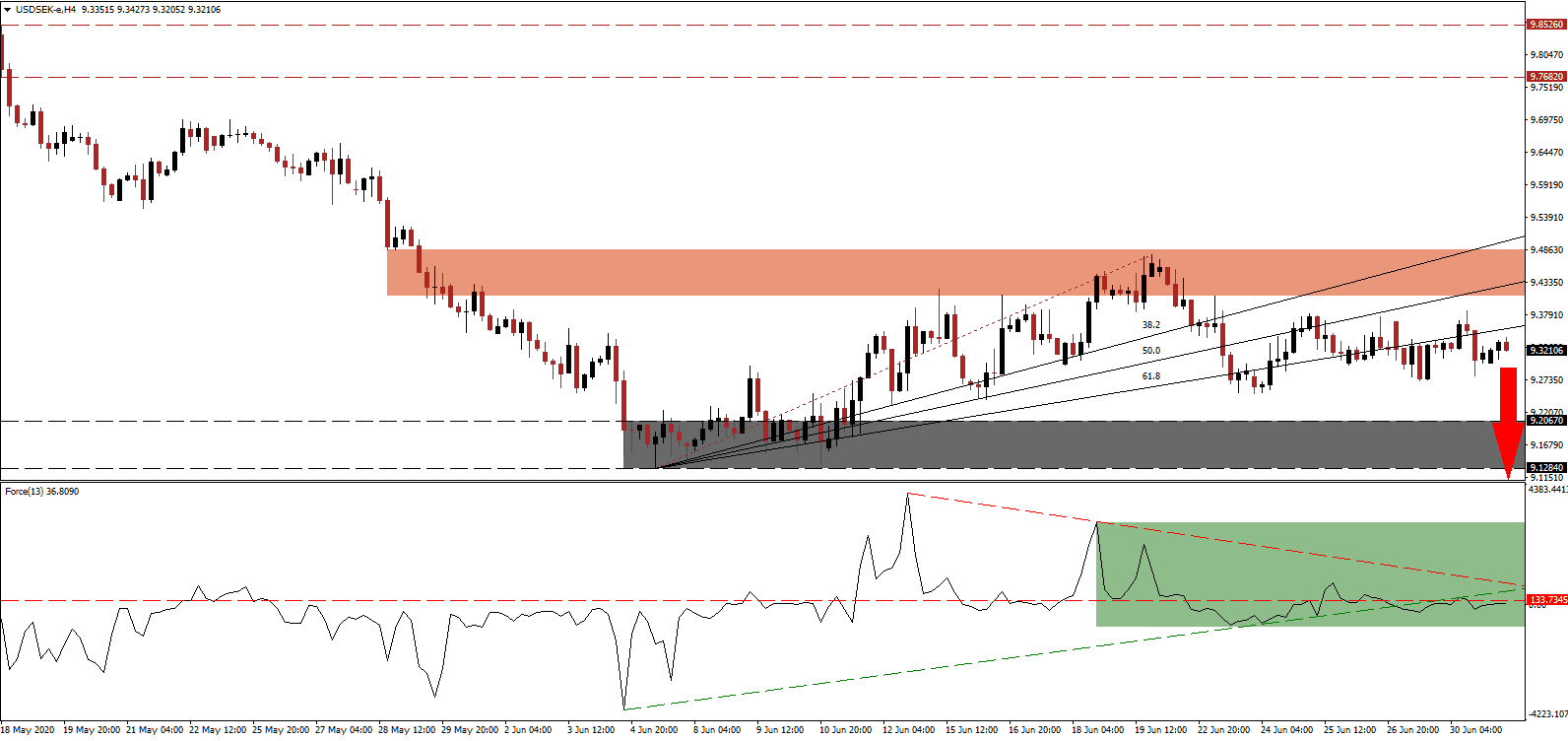

The Force Index, a next-generation technical indicator, flatlined, after a temporary spike above its horizontal resistance level, was swiftly reversed. Bearish pressures expanded following the breakdown below its ascending support level, as marked by the green rectangle. The descending resistance level is adding to downside pressure, expected to push this technical indicator below the 0 center-line, granting bears control of the USD/SEK.

On the economic front, Sweden was unable to benefit and mirrors the performance of Denmark, which implemented one of the strictest lockdowns globally. The unemployment rate rose by 2.0%, and it recorded a more severe plunge in its service sector than Denmark and the EU in total. It did cost Sweden a significantly more massive death rate per 100,000. While consumer and business confidence is recovering off their lows, it is an unreliable forward-looking indicator for activity. Following a healthy counter-trend advance in the USD/SEK into its short-term resistance zone located between 9.4106 and 9.4857, as marked by the red rectangle, and subsequent breakdown, the long-term bearish trend is intact.

Adding to breakdown pressure on price action is the dire state of the US labor market. With many focused on the headline unemployment rate, it represents an inaccurate assessment of the health of it, due to the way it is calculated. The employment-to-population ratio, which dropped to 52.8% in May, is a superior metric. It shows that nearly half of the US population is without employment. After the USD/SEK plunged below its ascending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance, the path is clear for an acceleration into its support zone located between 9.1284 and 9.2067, as identified by the grey rectangle. An extension into its support zone between 8.9539 and 9.0392 is likely.

USD/SEK Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 9.3200

Take Profit @ 8.9700

Stop Loss @ 9.3900

Downside Potential: 3,500 pips

Upside Risk: 700 pips

Risk/Reward Ratio: 5.00

In case the Force Index moves above its descending resistance level, the USD/SEK may advance. The upside is limited to its 38.2 Fibonacci Retracement Fan Resistance Level, just above the top range of its short-term resistance zone. Negative progress across the US economy due to the uncontrollable spread of the Covid-19 pandemic enhances bearish pressures on this currency pair. Forex traders should sell any rallies moving forward.

USD/SEK Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 9.4300

Take Profit @ 9.5100

Stop Loss @ 9.3900

Upside Potential: 800 pips

Downside Risk: 400 pips

Risk/Reward Ratio: 2.00