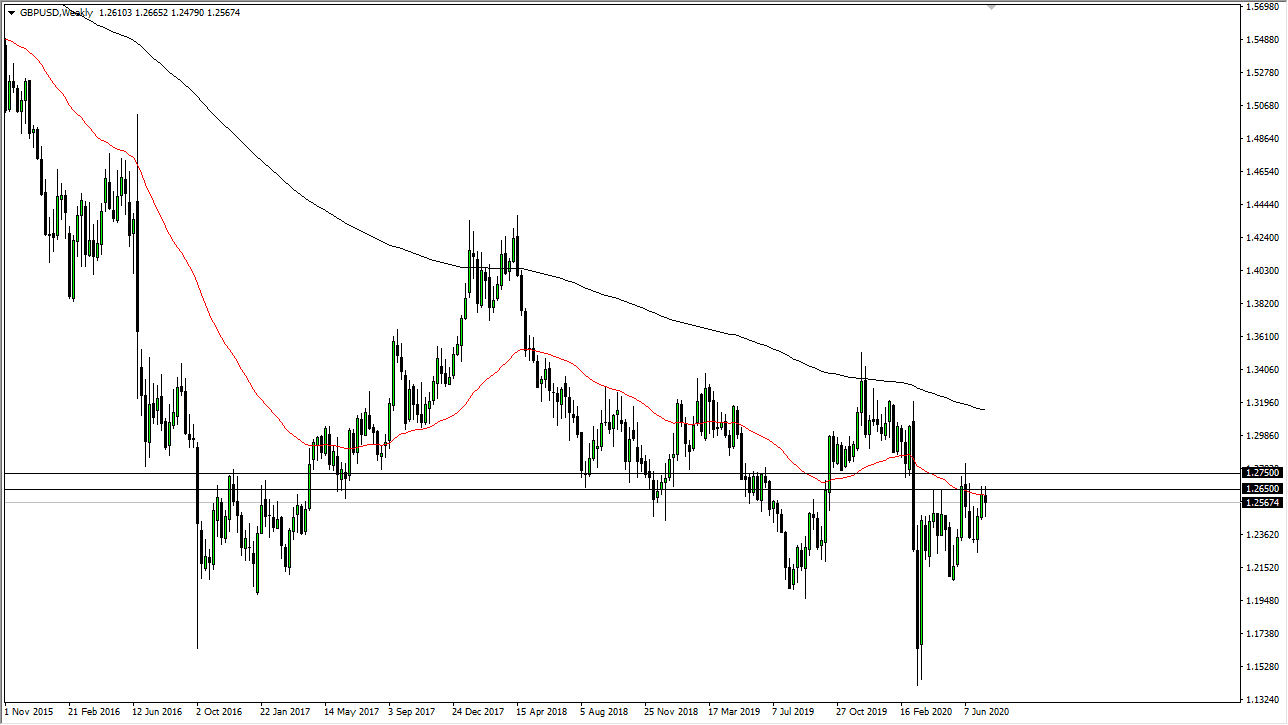

GBP/USD

The British pound initially spent most of the week following, but as you can see, we have recovered quite nicely. By doing so we have formed a bit of a hammer as we press up against the major resistance barrier at the 1.2650 level. That resistance barrier extends 100 pips so it takes a certain amount of resiliency to finally break above there. I think that we will continue to see a “buy on the dips" mentality for the week but you need to be looking for value instead of paying for the British pound randomly.

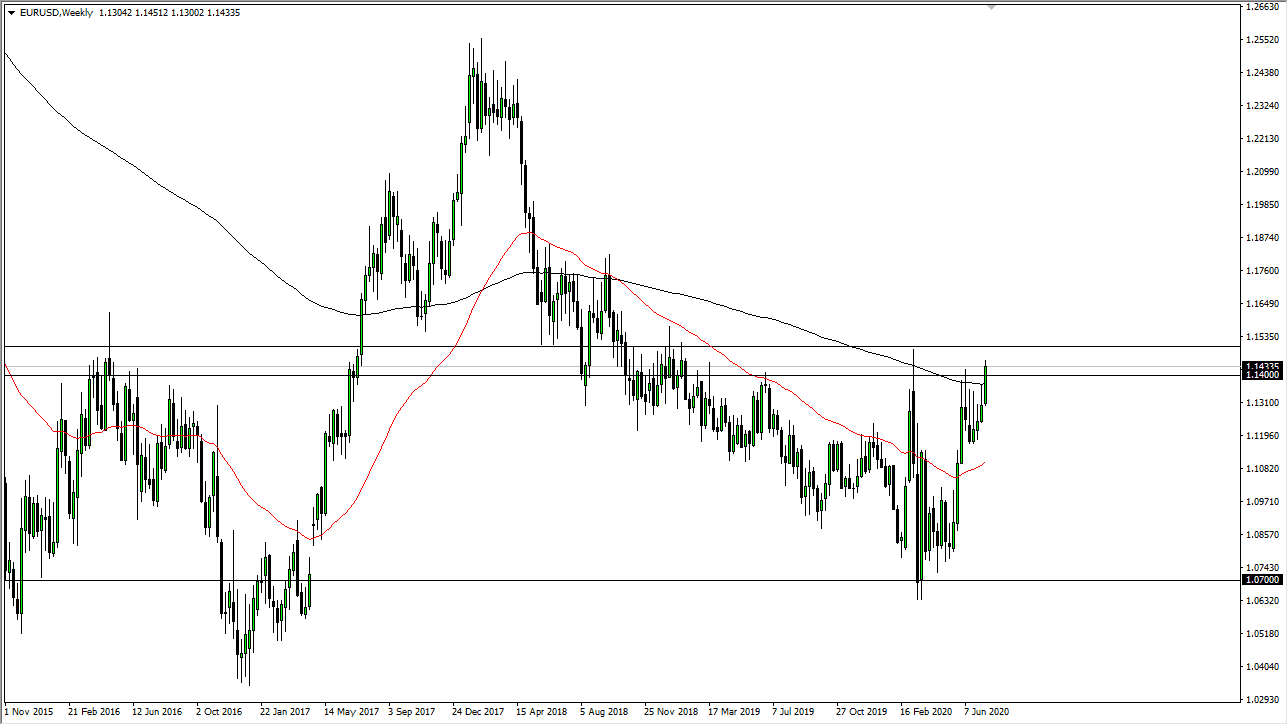

EUR/USD

The Euro has broken higher during the week, and unlike the several previous weeks, managed to stay somewhat elevated. By closing above the 1.14 level it shows that we are making significant headway into chipping away at the massive resistance. At this point, if we break above the 1.15 handle, it is likely that we will go much higher given enough time. We may get a pullback in the short term but simply be bought into as it is obvious that the US dollar is in serious trouble right now, and the Euro is one of the first places that traders will go looking to in order to get away from the greenback.

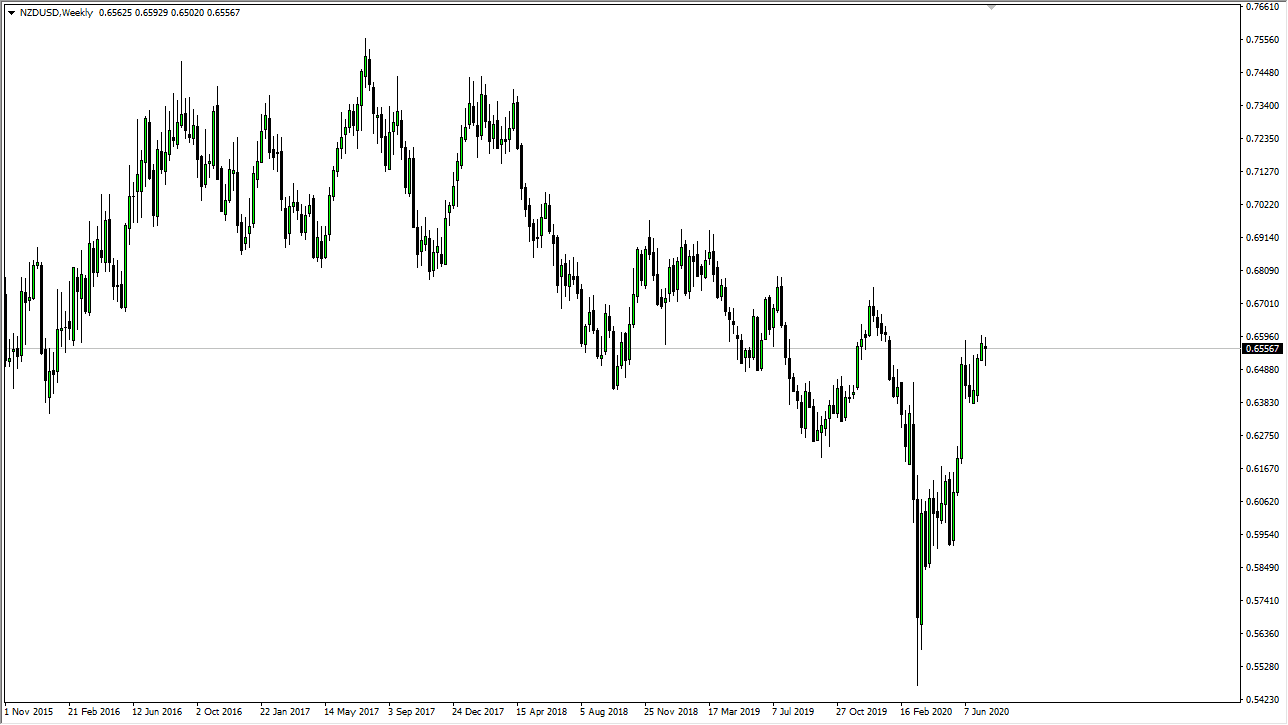

NZD/USD

The New Zealand dollar initially pulled back during the week as well, but at this point, it is only a matter of time before we break out to the upside. We are starting to see the same story everywhere; the US dollar is on its back foot and the New Zealand dollar is ready to try to continue going higher. Do not get me wrong, we have probably a few pullbacks here and there between now and the actual breakout, but I do anticipate that we do pull back you can pick up bits and pieces of value on those dips. To the upside, we could go as high as 0.67 if we get a little bit of momentum going.

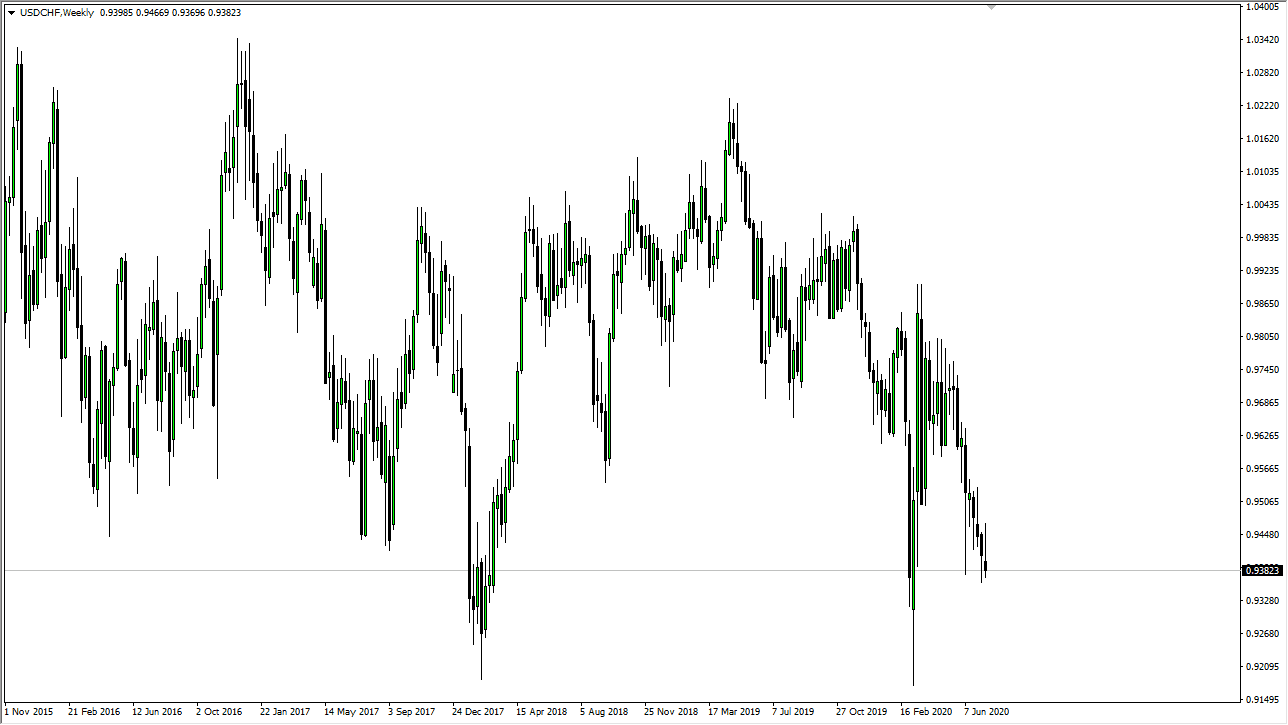

USD/CHF

The US dollar initially rose quite drastically against the Swiss franc, but on Friday collapsed. At this point, it is likely that we could go much lower, and on a break below the lows of the previous week, I think that opens up a move down to the 0.9250 level rather quickly. Rallies at this point in time will continue to be sold into as this market looks negative when it comes to the greenback, not just in this pair, but in just about anyone I look at.