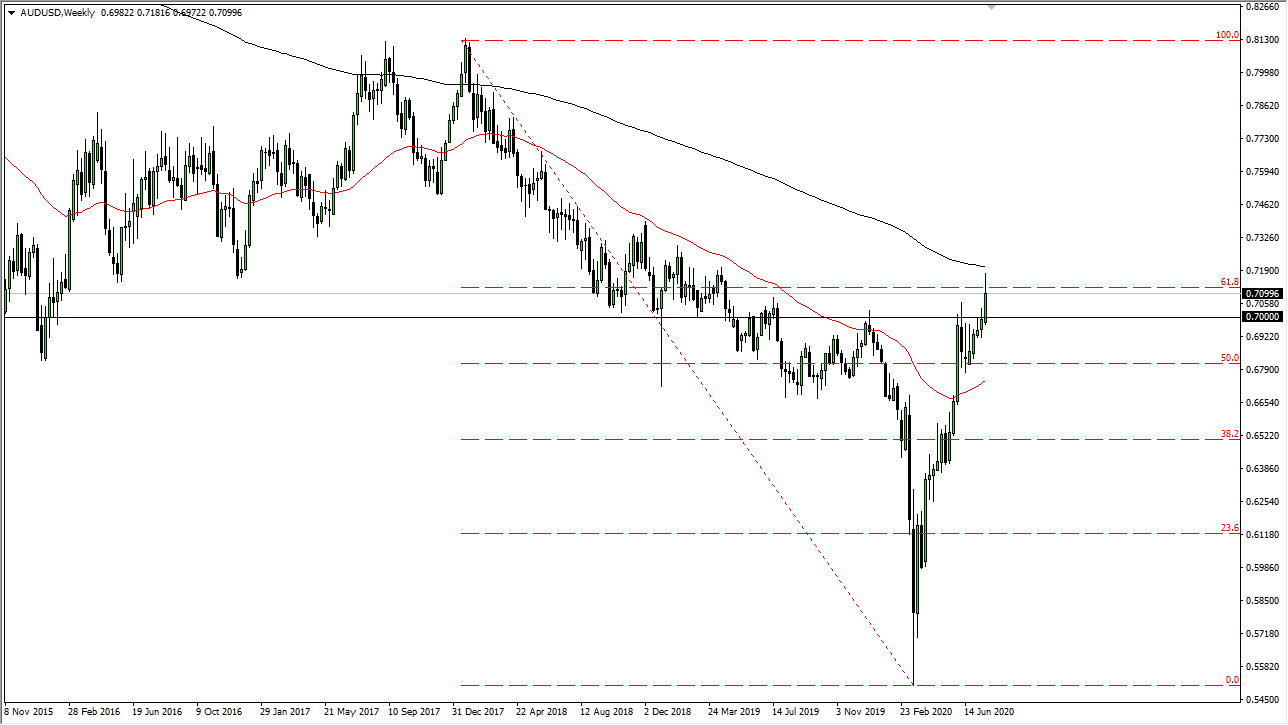

AUD/USD

The Australian dollar has rallied significantly during the week, reaching towards the 0.71 level. Ultimately, we broke above there, and then we have pulled back to show signs of exhaustion. However, we have broken out now and I think that short-term pullbacks will continue to be thought of as buying opportunities as the Federal Reserve continues to work against the value of the US dollar. The 0.70 level is what I consider to be the floor at this point, so I am a buyer and I have no interest whatsoever in shorting.

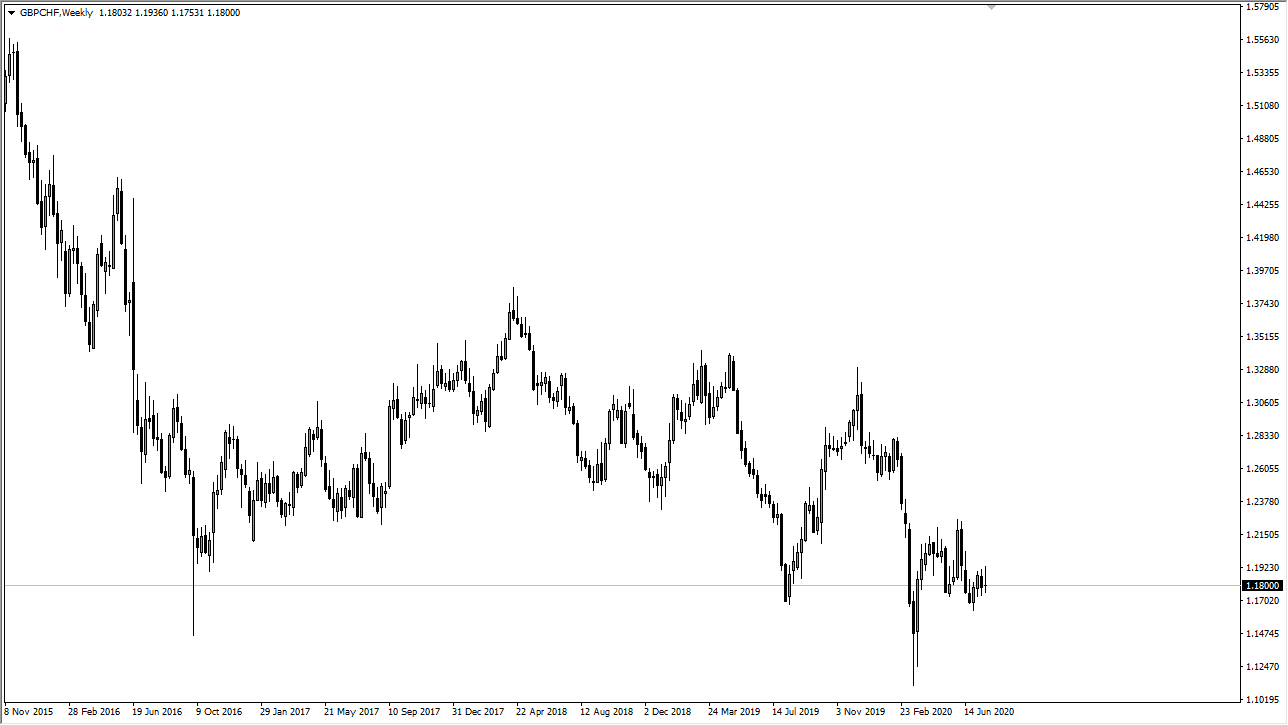

GBP/CHF

The British pound tried to rally during the week but found enough resistance to turn around and form a bit of a shooting star. Ultimately, I think that the market will continue to be very choppy, but I think at this point if we can break above the top of the week, then the market could pick up quite a bit of momentum towards the 1.2150 level. Ultimately, if we break down below the 1.17 level, then this pair probably drops down to the 1.15 handle. This could be an interesting play considering that it is very risk-sensitive.

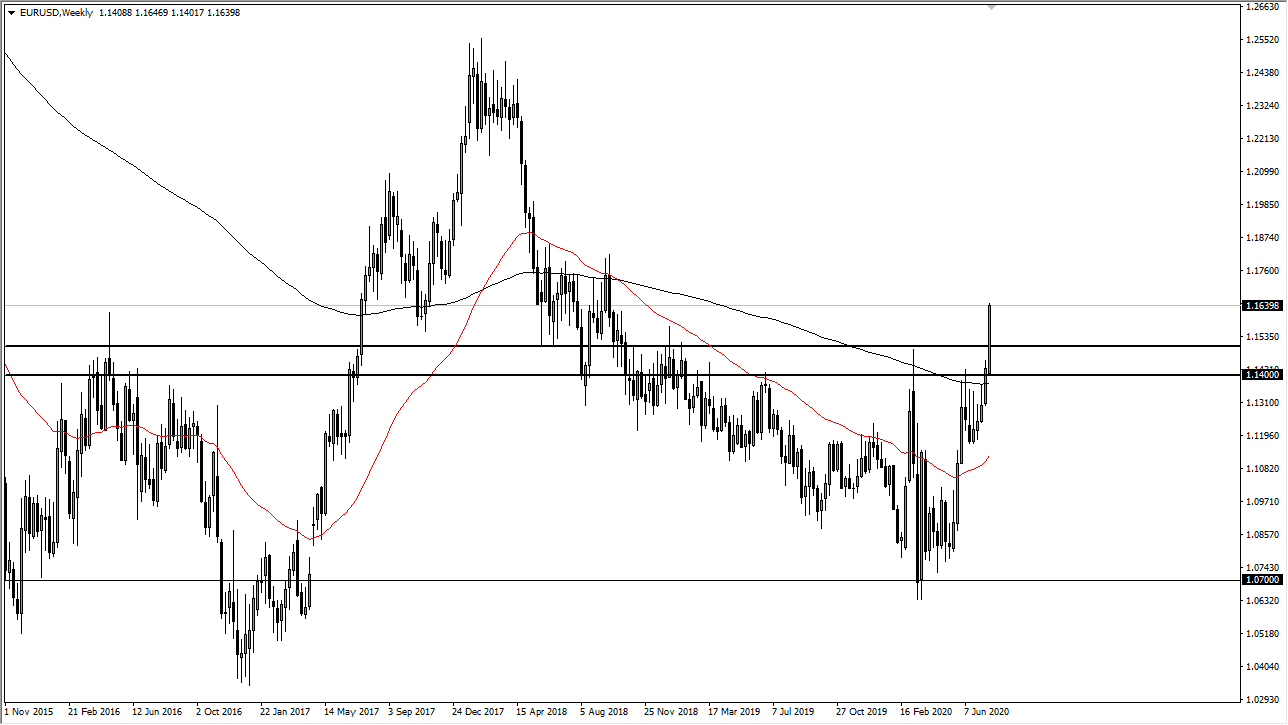

EUR/USD

The Euro has exploded to the upside during the trading week, breaking above the 1.15 handle rather handily. At this point, I think that buyers will continue to jump into this market on any type of dip as we have clearly changed the overall attitude of the US dollar. As the Euro has been the main beneficiary, I believe that this market will continue to go towards the 1.20 level longer-term. In the short term, I would not only expect some type of pullback, but I would welcome it. With this, I like the idea of finding value at lower levels, especially the closer we get to the 1.15 handle.

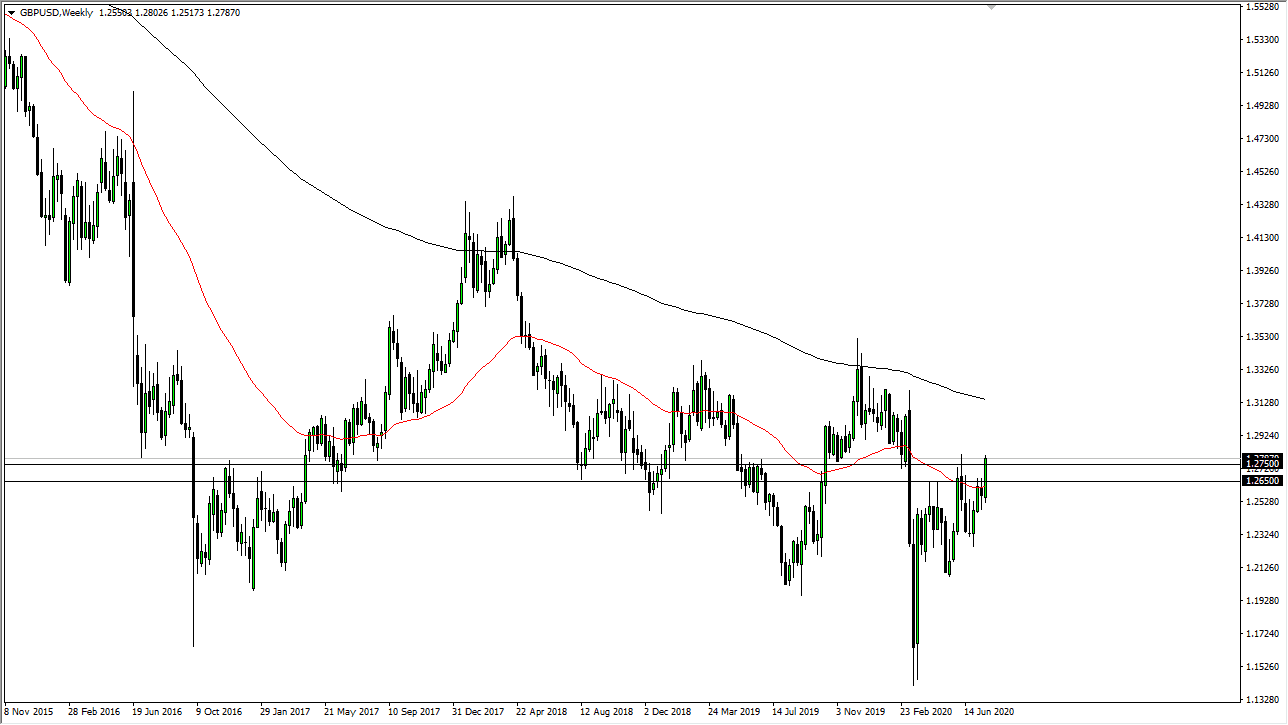

GBP/USD

The British pound has broken higher during the week, clearing the 1.2750 level, and even closed above there. If we can break above the 1.2811 handle, we will have cleared that most recent high and I think that we are looking to go to the 1.30 level at that point, and perhaps even the 1.31 level. Ultimately, I think that pullbacks should be bought as well, with the 1.2650 level offering significant support. The British pound has been a major winner over the last couple of weeks and it looks like we are primed for more next week.