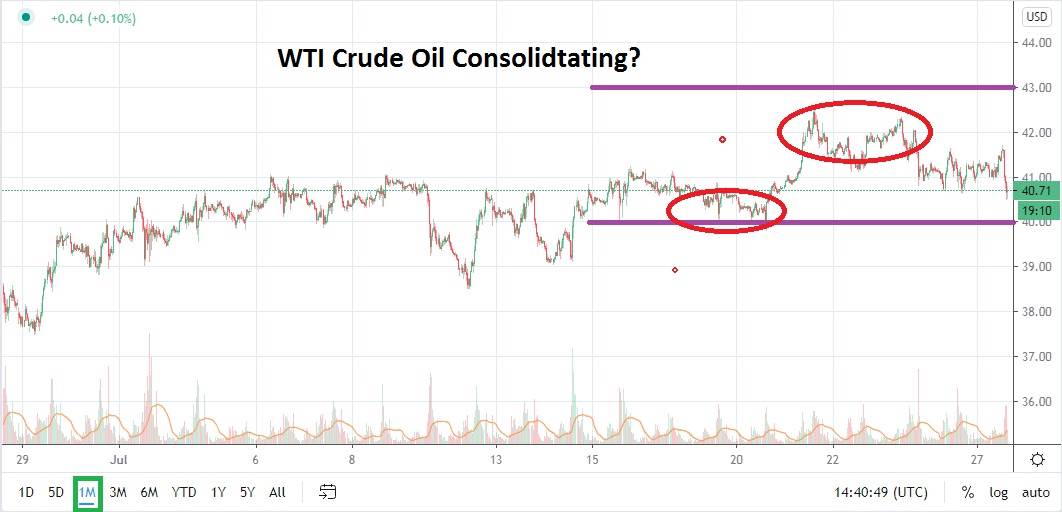

West Texas Intermediate Crude Oil has enjoyed a solid stretch of trading and has stopped turning the hair of traders prematurely grey. A range of 38.00 to 42.00 USD per barrel for WTI has been seen in large measures during the month of July. Support levels have incrementally risen and the juncture of 40.00 USD per barrel appears like it will be an important inflection point if comes into focus with sustained trading below. However, the violent gyrations within the commodity apparently have disappeared, although storm clouds do remain on the horizon and should be checked on every so often.

Tensions between China and the United States have risen in the past couple of weeks, but it is hoped the nations have enough maturity to know when to simmer down their accusations. As the November election for President in the US approaches, China may decide to take a wait and see approach to US policy and hope for a change in the White House administration.

From the US, the question about China’s long term intent and potential influence remain tactical challenges which must be considered carefully. While political considerations because of the US election are certainly a focus, economic interests globally are vital and an important aspect to the puzzle. Demand for Crude Oil internationally has increased the past couple of months as global economies reopen and manufacturers source the commodity, China and the US are key players in the consumption of Crude Oil.

However, questions about the emergence of new coronavirus outbreaks concern the global markets and this will have an effect on outlook long term which traders need to take into consideration. While OPEC, Russia and other major oil producers seemingly cooperate and follow production guidelines to insure the world market is not swimming in an oversupply of Crude Oil, United States producers have also limited their production and have brokered a few business deals among oil corporations which have helped consolidate tactical concerns.

Where is WTI Crude Oil going to trade the next month? Sentiment remains a vital part of the equation, but the fact that volatility has decreased in the market the past two months allows the notion that there will not be violent speculative moves short term. Support within the 39.00 to 40.00 USD will be important, if these junctures fail to hold there could be retests of the 38.50 USD mark rapidly. Since the middle of July a range between 40.00 to 42.00 USD has been witnessed.

If there is an underlying sentiment WTI Crude Oil is overvalued and traders have limit positions to sell the 38.50 juncture, the commodity could develop quick and vulnerable downward pricing again.

Even though WTI Crude Oil has taken on the appearance of normality, traders should remain skeptical about its relative safety as a speculative asset, meaning risk management should be firmly in place when trading the commodity. If WTI Crude Oil tests the 42.25 level and breaks above this juncture it could serve as a catalyst to test higher marks near the 43.00 to 44.00 USD levels.

However, traders should proceed carefully within the commodity and follow its technical trends. The 43.00 mark could prove important if WTI Crude Oil can sustain its price above this level and cause speculators to believe the commodity wants to test March values near 45.00 USD.

WTI Crude Oil Outlook for August:

Speculative price range for WTI Crude Oil is 36.00 to 45.00 USD.

Support at 38.50 USD may prove strong and an opportunity to seek reversals upwards, but if broken lower the commodity could test the 36.00 to 37.00 USD levels.

Resistance at around 43.00 USD is important, but if broken higher could mean 45.00 USD will be tested.