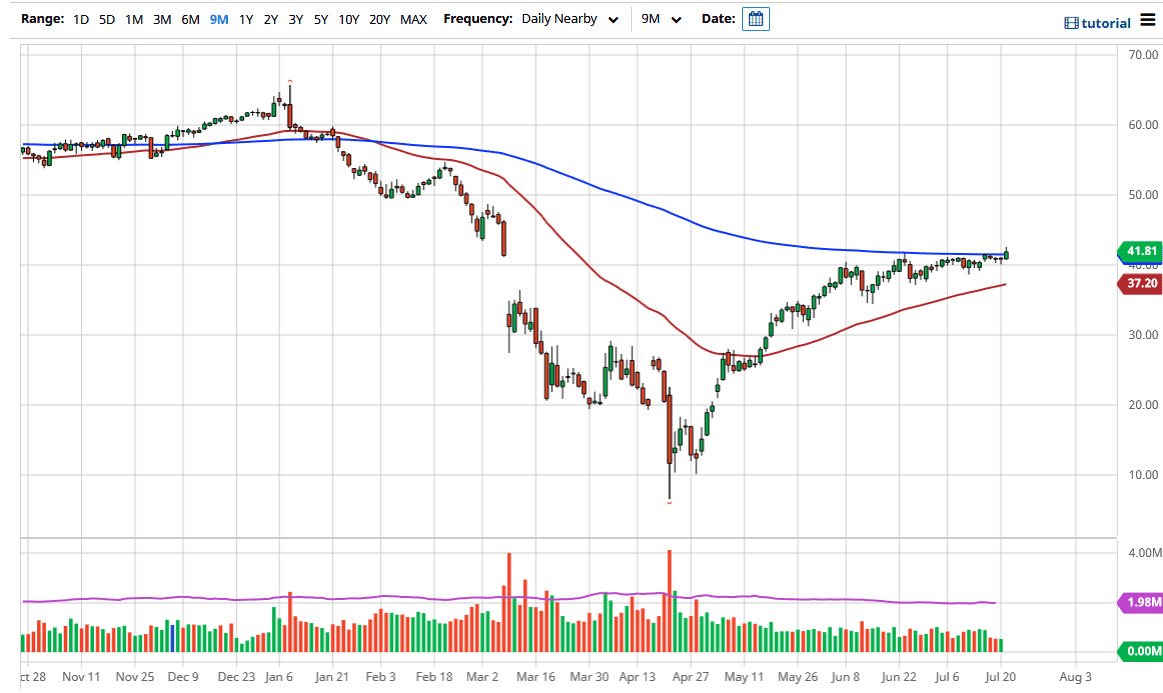

The West Texas Intermediate Crude Oil market has broken above the 200 day EMA during the trading session on Tuesday, as it looks like we are ready to break through the $42 level. This is a market that has been squeezing in general, and therefore think it is likely that we will continue to find value hunters every time we dip, as the market has been in a slow grind to the upside.

However, you should keep in mind that the oil markets have been rallying for some time, and the fact that the US dollar has been absolutely crushed helped the market break above the 200 day EMA. At this point in time, the market is likely to look towards higher levels, perhaps even as high as the $49 level. At this point, I think that you are looking for short-term pullbacks in order to pick up bits and pieces of value, as this market has clearly decided which direction it wants to go. The 50 day EMA underneath should offer plenty of support, so at this point, the volatility in choppiness of this market continues, and I think that is exactly what you will be seeing. Short-term volatility continues to offer opportunities to pick up markets every time they dip.

I have no interest in shorting this market until we break down below the 50 day EMA at the very least, perhaps sending this market down to the $35 level, maybe even the $30 level underneath. Ultimately, this is a market that I think will continue to look for value and should offer trades to the upside on breakouts. I think that even though it is difficult to imagine that demand is suddenly going to take off to the upside, the reality is that the US dollar is probably trumping everything else right now. All things being equal, this is going to continue to be a short-term trading type of environment, so if you are a day trader or a scalper, looking for buying opportunities repeatedly will probably be the best way forward. The candlestick was the biggest one we have had in the last couple of weeks, so that is something to pay attention to as well, as the market has been so quiet until Tuesday. Typically, when you break above the 200 day EMA it will attract more buyers.