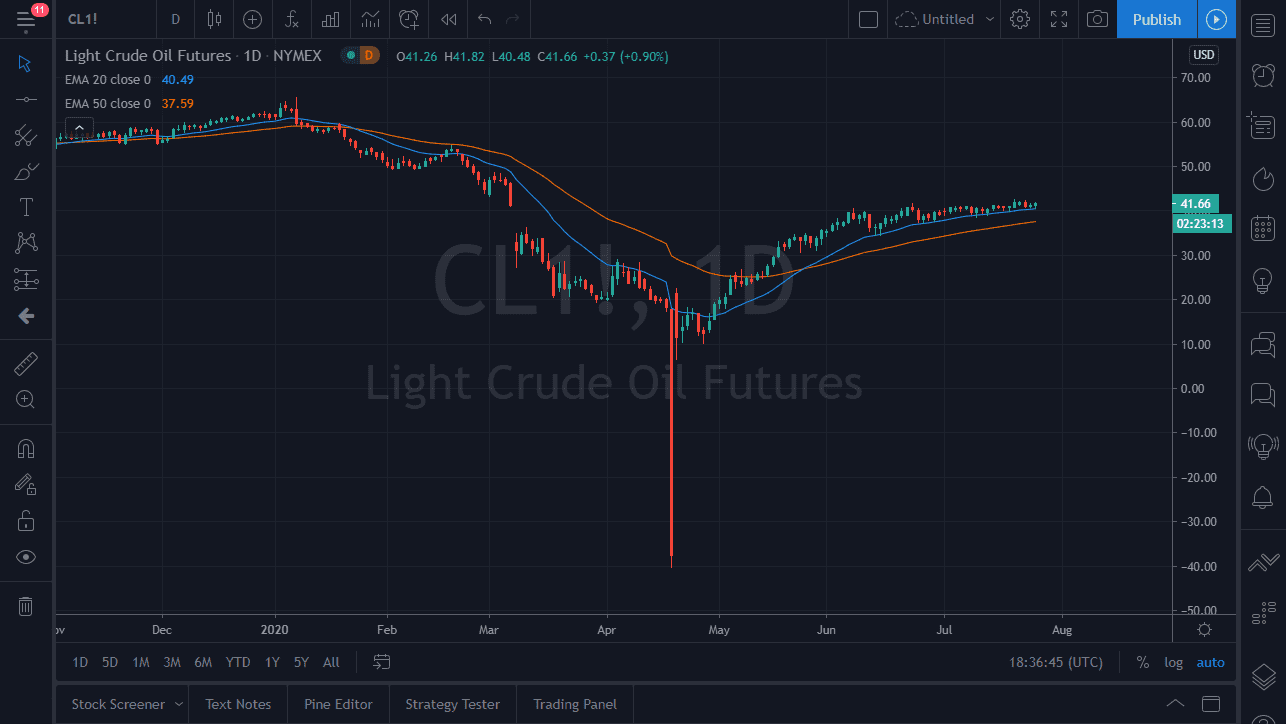

The West Texas Intermediate Crude Oil market continues to grind sideways during the trading session on Monday as it simply has nowhere to be. Quite frankly, this is a difficult market to trade, unless you have the ability to sit and go back and forth on five-minute charts. Unless you are scalping, there is not much going on here that will benefit traders. I think if you are looking for a longer-term move, then it is almost impossible to do so at this point in time.

Just below current trading conditions, we see the 20 day EMA and the 50 day EMA in orange. This suggests that there is support underneath, as the $40 level is also in that same general vicinity. At this point in time, it is obvious that short-term pullbacks offer buying opportunities, but that does not necessarily mean that we are going to go a lot higher anytime soon. That being said though, it does look like the market is trying to get towards the $49 level given enough time. The $50 level is just above there and will cause a certain amount of psychological resistance as well.

One of the biggest contributors to the crude oil market rallying the way it has, is the falling US dollar, which is crucial when it comes to the measurement of price, as a weakening US dollar will simply purchase less “things”, including a barrel of crude oil. That is essentially what I think is happening here because the outlook for crude oil demand is not exactly that strong right now. Furthermore, if we are starting to see tensions build between the Americans and the Chinese, which was horrible for crude oil prices before the pandemic, it cannot be any good right now. As the economy shuts down, which it certainly looks like we may see more of, the demand for crude oil will be driven lower. Beyond all of that, the demand for crude oil from airlines has been minuscule, and probably will be for the foreseeable future. It is in that light that I think moves higher will probably be somewhat muted, but it does seem like we are favoring that overall direction. Little back and forth short-term opportunities continue to present themselves, with an emphasis on buying and not selling per se, unless something drastic changes.