After a wild couple of months of trading, WTI Crude Oil actually produced a calm range during June allowing speculators to actually relax and seemingly not worry that the sky was literally falling. It is still easy to make jokes about trading conditions which developed in late April in the energy sector. This is partly due to the reason that for many people it is better to laugh than cry. WTI Crude Oil still has shadows looming over its future regarding its value, but June certainly produced a range that offered traders an opportunity to test normal ranges and generate perceptions about trends.

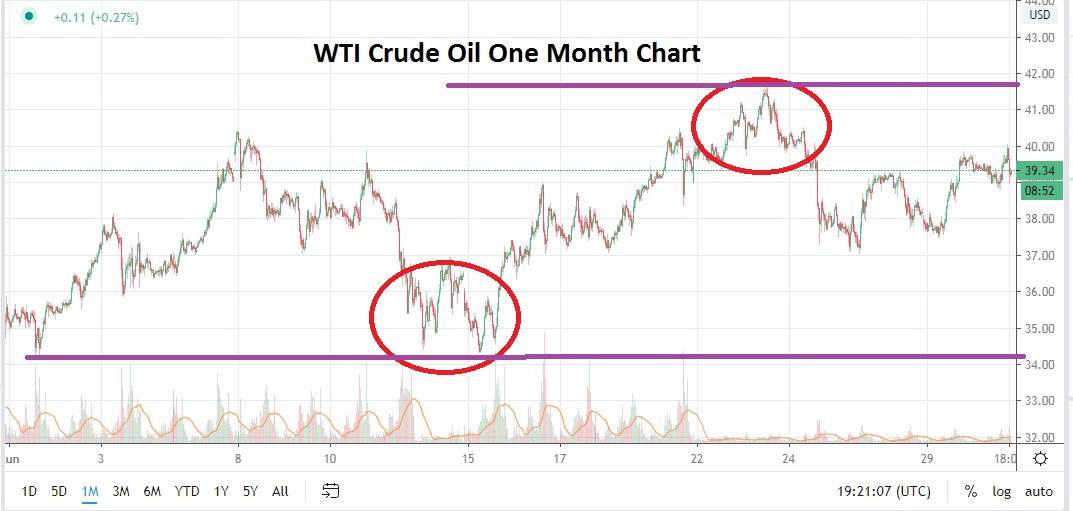

June produced a price range mostly between 34.00 and 40.00 US Dollars a barrel. The commodity appears to be heading into July with enough backers to support a normal trading range too. Questions of supply and demand remain troubling aspects within WTI Crude Oil. However, a foundation has been established which allows speculators to take positions in a manner that allows them to breathe and not worry about a repeat of the death spiral which developed in April, causing professional and retail traders to shake their heads in disbelief.

Since the middle of June a relatively strong level of support has been established near 37.00 USD, but will it hold? Taking into consideration the wild fluctuations from the past couple of months, it seems unlikely traders can buy WTI Crude Oil and feel comfortable with 37.00 as a support ratio. However traders need to use risk management, the rules of trading have not disappeared and the question is if there is enough room to speculate on added value higher for the commodity as summer develops.

WTI Crude Oil remains a key barometer of risk appetite in the global marketplace. Oil companies in the US are under pressure economically and there are rumors and developing news regarding bankruptcies coming from the energy sector on a fairly regular basis. However, even as demand for the commodity remains questionable and its higher values of early this year look unattainable, WTI Crude Oil actually managed to test a gap higher in late June which was created when the energy sector started to show signs of distress in early March.

WTI Crude Oil remains a highly speculative trade and upwards value needs to be justified. Although the commodity has certainly produced a dynamic shift upwards the past couple of months with higher prices, problems still lurk on the horizon. Technically, resistance around 42.00 USD appears an inflection point, if this value can be broken upwards and WTI Crude Oil can sustain prices above this mark it would be rather surprising.

However, the commodity was able to prove me wrong in June and it was able to break resistance and maintain higher values. Again, it is important to note that the price of an asset in the market is the correct price no matter what your technical or fundamental information is telling you. Betting against an asset because you ‘know’ it is not valued correctly often leads to fatal mistakes by traders as they let their emotions and logic get in the way of the marketplace which does not care what you think.

Speculators will want to take the current values of WTI Crude Oil into consideration via technical charts and ask themselves if they want to participate in the market. If the answer is yes, speculators should practice their risk management skills with a tinge of paranoia considering what took place within the commodity the past few months. Selling WTI Crude Oil seems to be the logical choice if the price hits resistance around the 40.00 to 41.00 USD levels, but logic may not mean that much within this commodity presently.

WTI Crude Oil Outlook for July:

Speculative price range for WTI Crude Oil is 33.00 to 43.00 USD

Support at 34.00 USD may prove strong and an opportunity to seek reversals upwards

Resistance at 41.00 to 42.00 USD could mean WTI Crude Oil is overvalued