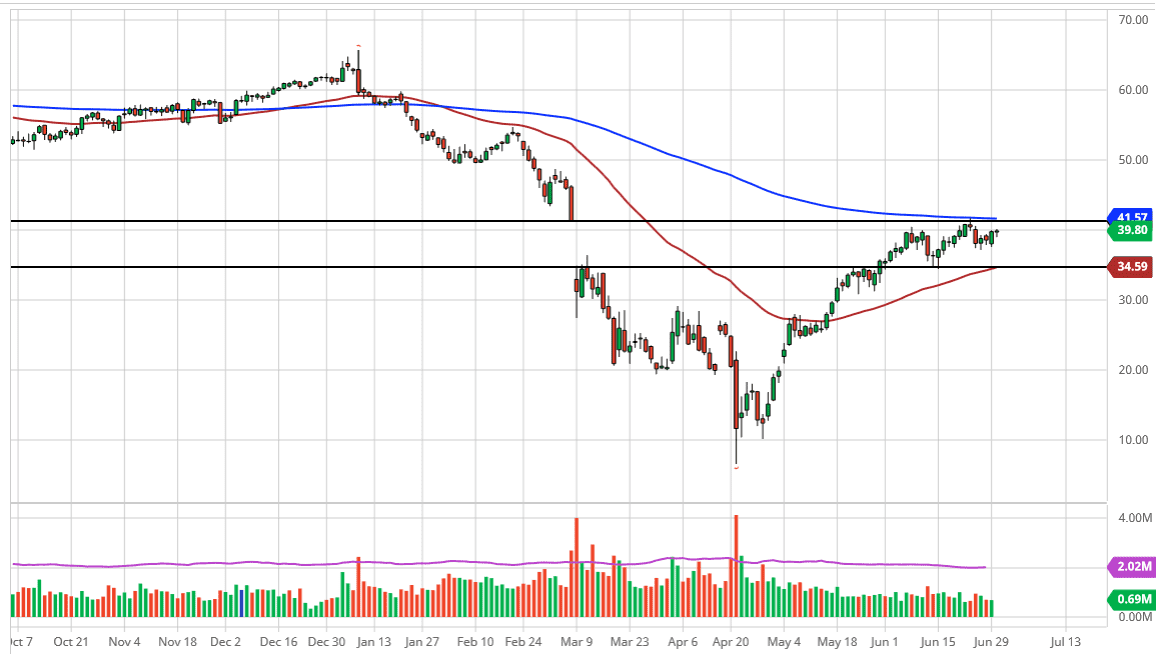

The West Texas Intermediate Crude Oil market rallied slightly during the trading session on Tuesday as we continue to grind towards the $40 level. This is a market that has recently filled a gap and now looks as if it is ready to go up there and test it again. The $41.50 level is sitting just above, and that is an area that has been resistive previously. After all, we had filled the gap in that area but also had the 200 day EMA sitting in the same area. That does tend to cause some issues, so do not be surprised at all to see that if we get there, we will find sellers again.

If we can break above the 200 day EMA, then it is likely that we go looking towards the $49 level above. It is likely that we will continue to see resistance there as well, and I think it is going to take several attempts to break out to the upside. To the downside, the market clearly has a lot of support based upon the 50 day EMA, closer to the $34.50 level. We are in the middle of the gap from the previous trading, so now the market needs to decide whether or not it can blow through that gap or if it is going to find quite a bit of resistance. If we were to turn around a break down below the 50 day EMA, then the market is more than likely to go looking towards the $30 level.

Typically, this is a market that likes to find a $10 range, and now I think we are trying to figure out where that is. The $40 area is roughly where I think the top will be, just as the $30 level underneath will probably be supportive. Ultimately, this is a market that I think continues to go sideways in the short term in order to find some type of range and footing for the market. On the other hand, if we do break out then we could shift into a range between $40 and $50. I think at this point we are simply trying to figure out what to do next so the next several days will probably be a lot of back and forth sideways trading. In general, this is a market that is going to be noticeably short term and tight.