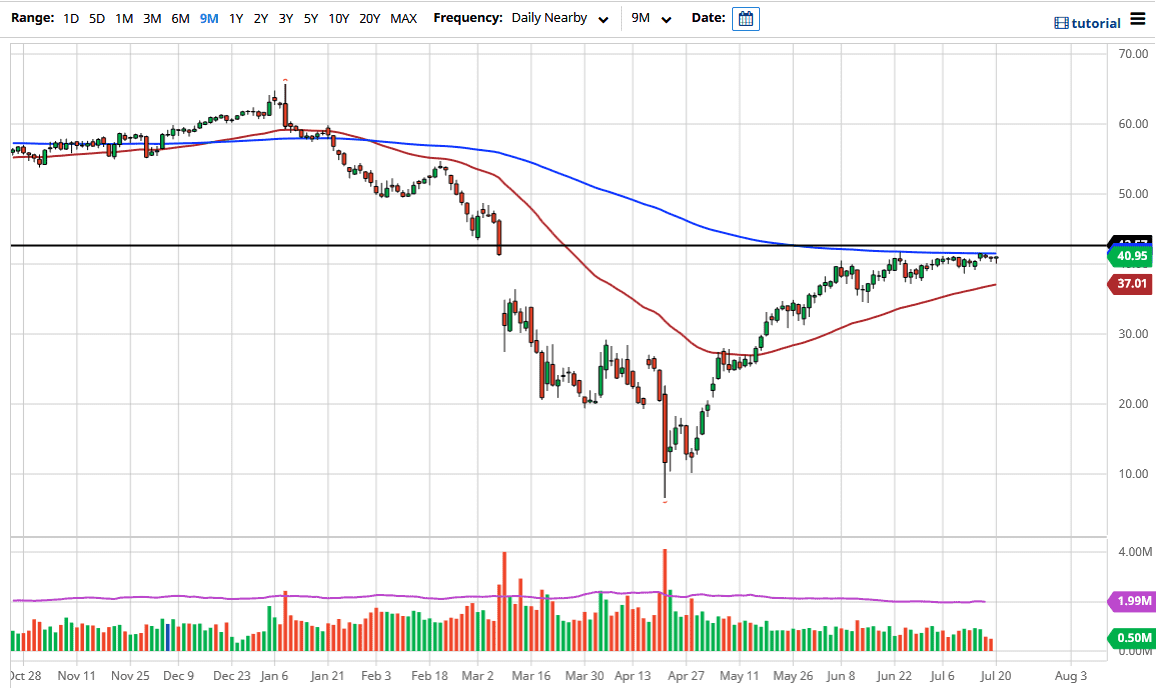

The West Texas Intermediate Crude Oil market initially dropped during the trading session on Monday to kick off the week but has found plenty of support near the $40 level yet again. This is a market that has been very noisy and choppy, but at this point in time, it looks as if we just do not have enough momentum to break out. The 200 day EMA sits just above, and it is likely that we are going to continue to see that technical indicator causes some issues. Having said that, this is a market that continues to see a lot of buyers underneath, and the 50 day EMA at the $37 level also offers a bit of a “floor” in the market as we have had a lot of interest in the 50 day EMA previously.

The biggest problem with this market is that it simply cannot decide what it wants to do for a longer-term move at the moment. Ultimately, I think that pulling back is simply going to offer a lot of buying opportunities as the crude oil markets have been focusing on the fact that OPEC has been very stringent when it comes to the idea of production cuts, so that has helped support this market. However, the demand for crude oil seems to be a bit soft still, and therefore I think that a lot of people are going to look at this is a market that is not quite ready to take off yet.

This is a great place to put money if you are looking for it to do nothing. However, if you are a short-term trader then it is likely that we will find scalping opportunities, perhaps on dips. I have no interest in shorting this market at the moment because it has been relatively resilient in hanging out in this area, so the question is now whether or not momentum will reenter the marketplace so that traders can take this pair higher. The candlestick for the Monday session is a bit of a hammer so it does suggest that we could go higher eventually but there is just no real momentum to get things moving. The 50 day EMA underneath being broken to the downside would be extremely negative, but at this point in time, it does not look like it is being threatened.