The pace of sharp and continuous gains in the price of gold has stopped at the end of last week’s trading, amid profit-taking sales in light of the USD strength and technical indicators reaching overbought areas. Therefore, the price of gold fell to the $2015 an ounce after a new record in the same session, reaching a $2073 an ounce, the highest price in the history of the yellow metal, and closed the week's trading around the $2033 an ounce. The strength of the US dollar was only driven by the data results which showed a larger than expected growth in US job growth in July. Gold retreated today, despite increasing tensions between the United States and China and reports that there are signs of a strong second wave of Coronavirus infections in Europe.

The failure of American Democratic leaders and White House officials to make any meaningful progress in a new bill to help combat the consequences of the Coronavirus contributed to a slight decline in gold.

Gold futures posted a gain of 2.2% last week. Silver futures closed lower at $27,540 an ounce after a record high, reaching $29.83 an ounce, and copper futures settled at $2.7925 a pound.

Data from the US Labour Department showed that employment increased by 1.763 million jobs in July after rising by 4.791 million jobs revised downward in June. Economists had expected an increase in employment of 1.6 million jobs compared to the 4.8 million jobs originally reported in the previous month. Therefore, the US unemployment rate decreased to 10.2% in July from 11.1% in June. The rate was expected to decline to 10.5%.

Going back to US economy stimulation in the face of the Coronavirus effects, US President Donald Trump, bypassing lawmakers in the country, requested a payroll tax delay and replace the expired unemployment benefit with a smaller amount after negotiations with Congress on a new coronavirus rescue package collapsed. Therefore, Trump signed executive orders at his own country club in Bedminster, New Jersey, to act on measures that Congress had not taken. Not only has the pandemic undermined the economy and lives of Americans, but it has also jeopardized the re-election of the US president in November.

Perhaps most importantly, Trump moved to continue to pay federal unemployment benefit supplementation to millions of unemployed Americans during the outbreak. Yet his orders called for up to $400 per week, one-third less than what an adult would receive, which was $600. Congress authorized the end of these high payments on August 1, and negotiations plunged into a dead end.

Trump's decisions caused sharp criticism from Democratic congressional leaders as they insulted Trump with shameful titles in statements before signing the orders, and House Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer dismissed Trump's actions as "lean" in the face of the economic and health crises facing Americans. The executive orders may face legal challenges that call into question the authority of the US president to spend taxpayer money without explicit consent from Congress. Trump has remained largely on the side-lines during the administration's negotiations with congressional leaders, leaving the talks at his side to his Chief of Staff, Mark Meadows, and Treasury Secretary Steve Mnuchin.

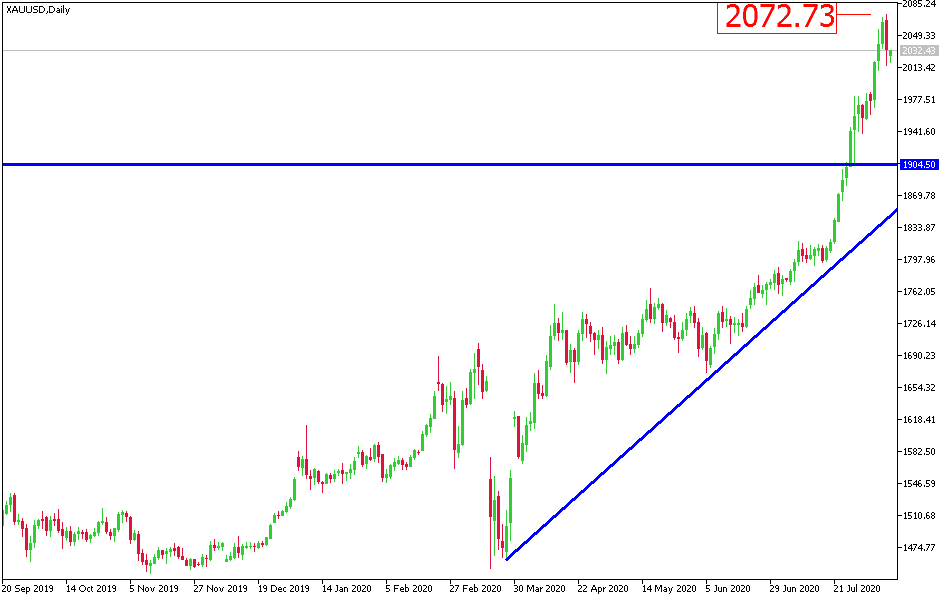

According to the technical analysis of gold: The recent move did not exit the price of gold from its historical ascending channel, as it is still moving above the $2000 historical psychological resistance. The recent move was widely expected, and what is even expected more in the event of a downward correction with profit taking selloffs by gold investors. This will not happen without a final vaccine that ends the COVID-19 epidemic is found, the glory of US dollar gains returns, and tensions between the two largest economies in the world eases. The recent decline, even if increased, may lead the market to new purchases to launch towards new record and historical levels, the closest of which are currently at $2,100 and $2,300, according to the closest global expectations. The closest support levels for gold are currently at 2010, 1985 and 1970, respectively. I still prefer to buy gold from every lower level.