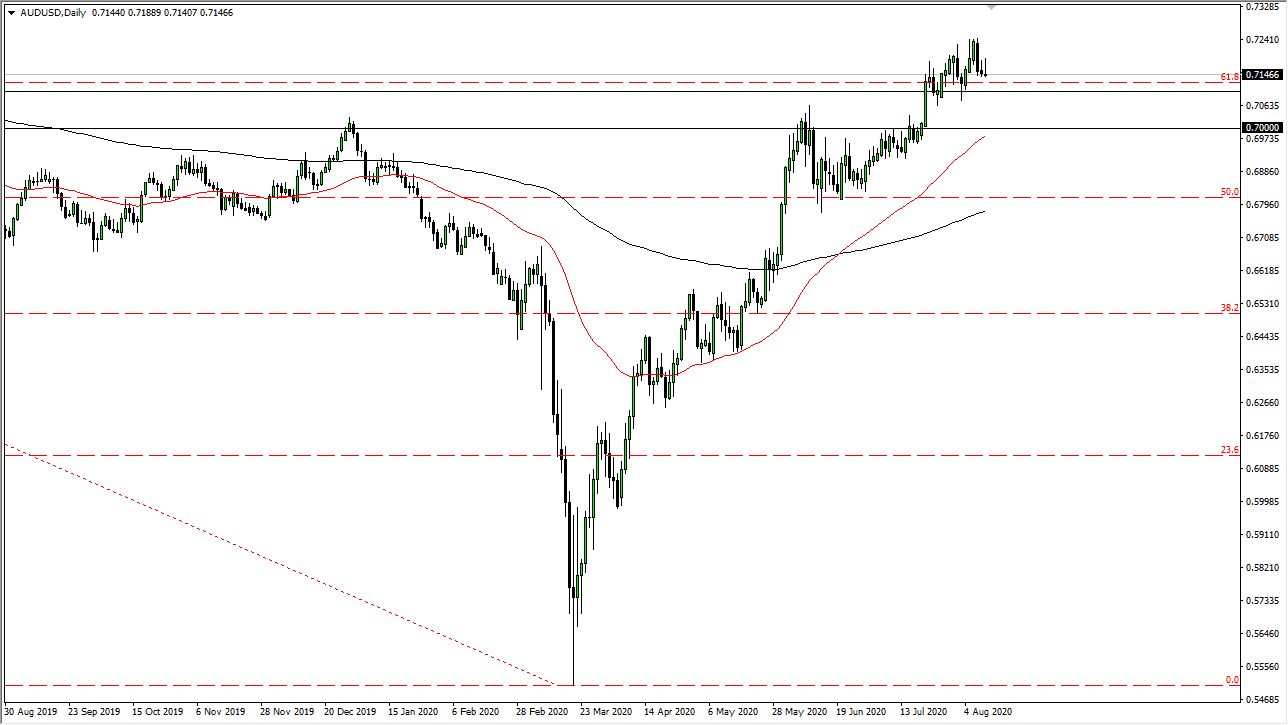

The Australian dollar has initially tried to rally during the trading session on Tuesday but gave back the gains to form a bit of a shooting star-shaped candlestick. This was preceded by the exact same type of candlestick on Monday, so this tells me that we are likely to see a lot of noise and resistance just above, but ultimately it is likely that there are buyers underneath. The 0.71 level should offer plenty of buying pressure, as there should be plenty of traders in that area looking to pick up the momentum. The area just below there and extending down to the 0.70 should see plenty of support coming into play, so I think that looking for an opportunity in that area is probably best that this point.

The US dollar is a bit oversold so do not be surprised to see this pullback, but ultimately the Federal Reserve will continue to work against the value of the US currency, as they flood the market with greenbacks. As long as they do that, the Australian dollar will more than likely continue to go higher. This is an area that was important on longer-term charts though, so it is going to take a significant amount of momentum to break out to the upside for a sustained move. This could be something that takes several weeks, so do not be surprised to see the occasional pullback but I certainly think we are trying to build up the momentum to make that breakout.

Gold got absolutely hammered during the trading session and the Australian dollar is a bit of a proxy for that so do not be overly surprised that the Aussie has taken it on the chin. The shape of the candlestick is somewhat ugly, so that tells me that we are likely to see a lot of volatility, but I still believe in the upside until we break down below the 200 day EMA which is currently sitting at the 0.68 level. That is an area that I think if it gets broken to the downside could send this pair much lower. Obviously, it is can it take some type of catalyst to move this market in one direction or the other, but I think move that we have seen over the last couple of days has been a simple matter of exhaustion more than anything else.