AUD/USD: Uptrend supported by commodity prices

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

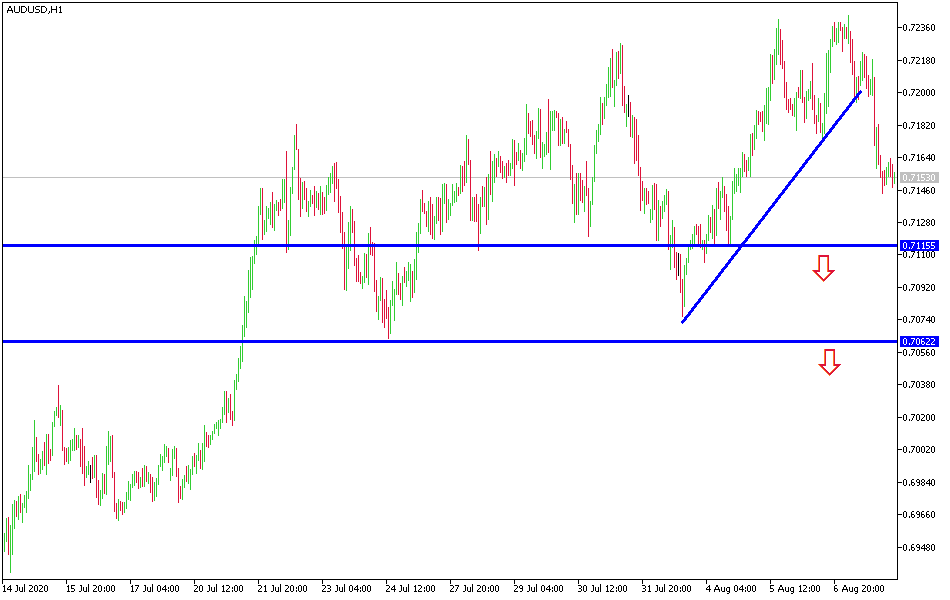

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7090 or 0.7000.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7245 or 0.7300.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I also mentioned in the latest AUD/USD technical analysis that gains pushed it towards strong overbought areas, and a downward correction is awaited at any time. This happened during last Friday's trading, as it retreated to the 0.7144 support after its recent gains reached the 0.7242 resistance, its level highest since February 2019. The recent gains of the Australian dollar were supported by the continuous rise in commodity prices to record and historical highs, the most prominent of which was the rise in the price of gold to its highest level in history at $2073 an ounce. The momentum was stronger than the concern about tensions between the United States and China, which usually hurt the Australian economy. But there is something important, the new outbreak of the Coronavirus in both the United States and Australia threatens the future of reopening economic activity and may affect the balance to some extent of the pair’s performance.

Several Chinese companies have been listed in the US over the past two months, and it appears that Chinese trade data is not disturbed by hostile measures and rhetoric between the two largest economies in the world. And that is in defiance of economists' expectations for lower Chinese exports, as they rose 7.2% (year over year) after June's 0.5% gain. Imports decreased 1.4%. Economists had expected a slight increase. The net result is a striking trade surplus of $62.33 billion ($46.4 billion in June).

Of particular interest, exports to the United States rose 12.5% (year over year), the strongest increase in two years. Imports from the United States increased 3.6% (11.3% in June), dropping 3.5% year-on-year, while the Phase 1 trade agreement, of course, called for an increase not only during 2019 but also during 2018 as well. China's trade surplus of $32.46 billion with the United States was slightly less than the trade surplus in March and April combined ($38 billion). Separately, China's oil imports declined 3.6% during the month, while imports of industrial minerals (iron ore + 11% month-over-month) and copper ore (+ 13%), and China's steel exports rose 13%.

It appears that the sharp fluctuations in the foreign exchange market last month helped boost the dollar's value as global central bank reserves. South Korea recently announced an increase of 4 billion dollars to 416 billion dollars. Japan said its reserves rose by $19.3 billion, the largest increase in six years, to $1.402 trillion. China's reserves rose by $42 billion to $3.154 trillion, the largest increase in six years.

I am still sticking to selling the AUD/USD as it crossed the 0.7255 resistance level.

Regarding the Australian dollar, no economic releases are expected from Australia today. For the US dollar JOLTZ numbers will be announced.