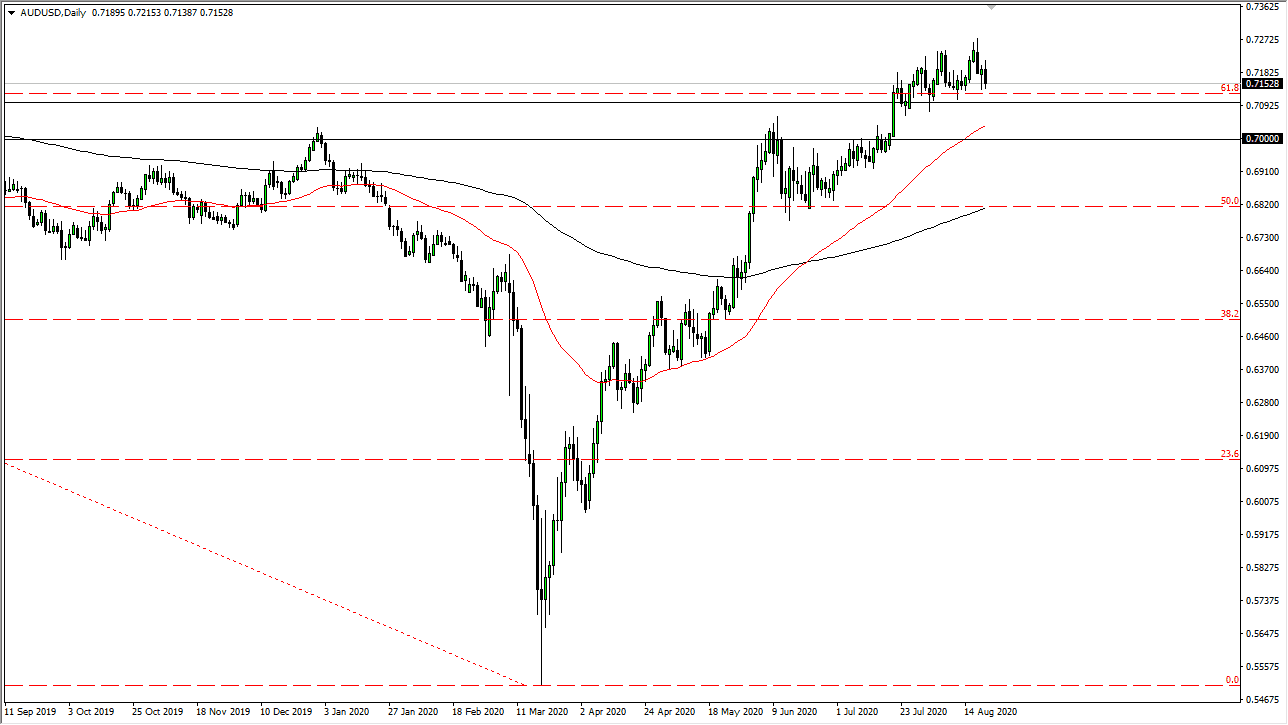

The Australian dollar has initially tried to rally during the trading session on Friday, but the US dollar got a bit of a boost against most currencies, including the Aussie. Looking at the chart, the 0.71 level offers a certain amount of support extending down to the 0.70 level, which is a range of buyers just waiting to happen. If the market sees above the 0.70 level, then we should continue to see more of a grind sideways to the upside, perhaps sending the Australian dollar higher.

If we break down below the 0.70 level, the market likely goes looking towards the 0.68 level underneath which also features the 200 day EMA. There is a massive amount of noise between the 0.70 level and the 0.68 level. All things being equal, I think that the Australian dollar has a good shot of going higher over the longer term, but it is worth noting that the US dollar is oversold, so a pullback would make a certain amount of sense. That being said, I do not like the idea of buying the US dollar as long as the Federal Reserve is so aggressively easy with its monetary policy. Having said that, a lot of other central banks are as well so it becomes a “beggar thy neighbor” type of monetary situation.

If we were to break down below the 0.68 level, then I would be a bit more concerned about the Aussie. For what it is worth, the weekly candlestick is a shooting star so that does suggest some problems. However, markets cannot go straight up in the air forever so again, I believe that a pullback would make a certain amount of sense. If we turn around a break above the highs of the week, it is likely that we go looking towards the 0.75 handle. That is an area that will attract a certain amount of attention as well, and eventually, the market goes looking towards the 0.80 level. All things being equal, this is a market that I think will be volatile and will pay close attention to the strength of the US dollar in general and gold. After all, the Australian dollar is back and forth with the gold markets as well so that is worth paying attention to.