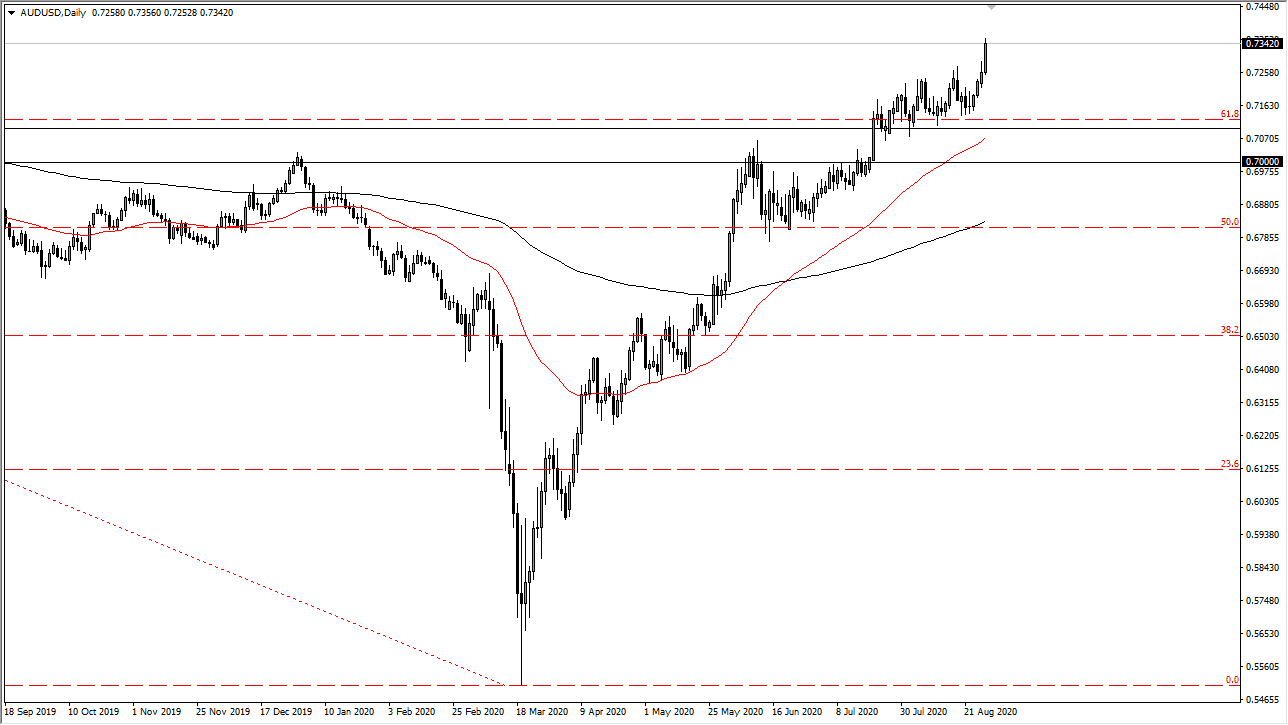

The Aussie dollar has broken out during the trading session on Friday as we continue to see a lot of anti-US dollar negativity out there. Ultimately, breaking through the top of the candlestick on Thursday was a good sign and it looks likely that we are going to continue going higher. I like buying the Aussie dollar on pullbacks as has been the case for some time. I believe that the 0.71 level underneath is going to be a massive “floor” in the market. Looking that the fact that the market closed towards the top of the candlestick does suggest that perhaps we are going to continue to see a lot of bullish pressure, and therefore I think that it is only a matter of time before we take off to the upside.

I look at pullbacks as value and an opportunity to take advantage of what has been a very strong trend. Ultimately, I think that we go looking towards the 0.75 level and the 0.80 level over the longer term. This is a market that I think continues to see a lot of volatility due to the fact that people are worried about the coronavirus and global growth, but at the end of the day this is all about the Federal Reserve and its lack of interest rates. As we are going to stay very low in the United States for a very long time, it makes sense that the greenback gets torched.

The Australian dollar is highly levered to the gold market, and it makes sense that we will continue to see the two move higher as the US dollar loses value, making it more expensive to buy “things”. The 50 day EMA is racing towards the 0.71 level underneath, which is a major indicator of support, so I like the idea of taking advantage of any opportunities that come away. In fact, I do not even have a scenario where I start shorting the Aussie, and I look at any time that we pullback as an opportunity and I have no scenario in which I’m willing to short this market as long as we are above the 0.68 level. That is where the 200 day EMA said, and therefore a lot of people will be paying close attention to that if we do get down to that area.