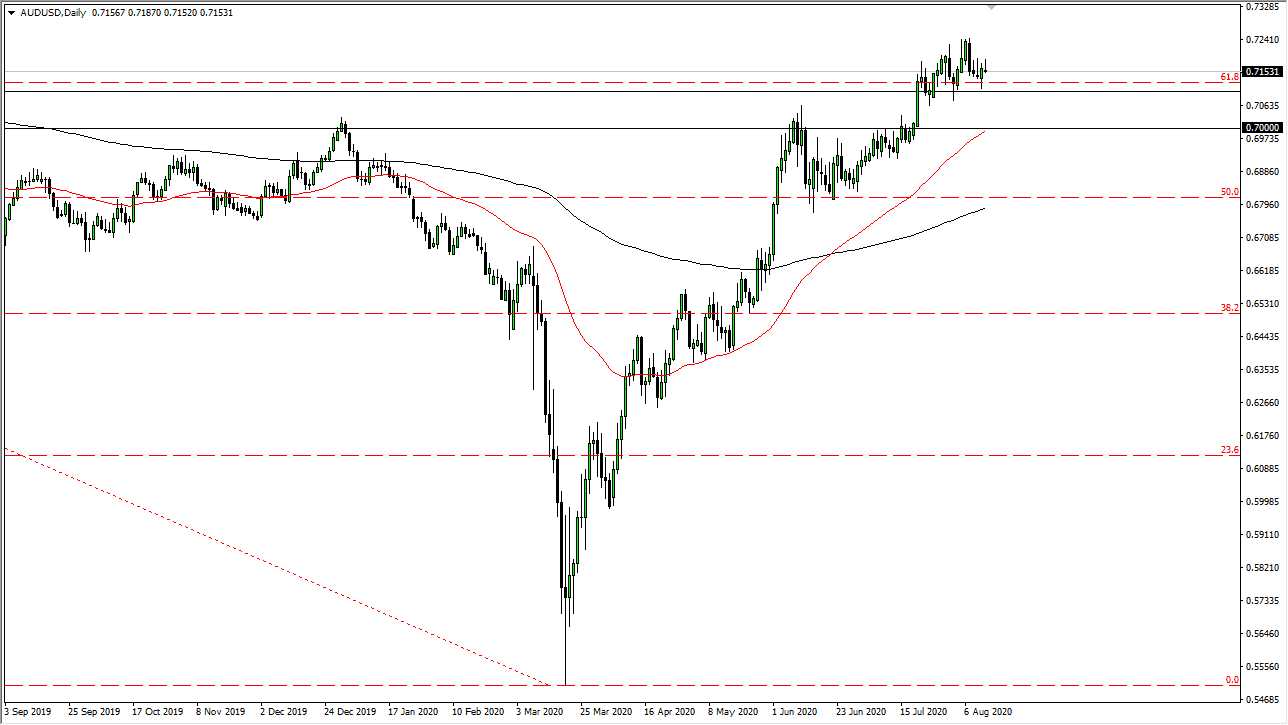

The Australian dollar continues to “chop word” heading into the weekend, which is an expression for going back and forth or simply killing time.The market looks like it is very comfortable in this general vicinity, so I do not necessarily think that we are going to see a big move anytime soon. After all, we have been very positive for some time, and the market needs to digest the massive gains that we had just seen. Beyond that, traders are worried about vacation more than anything else this time a year so I think a serious lack of interest may take over the market for the next couple of sessions and weeks.

Looking at this pair, I think there is a significant amount of support at the 0.71 handle that extends down to the 0.70 level. That region should be massive support, but we could break down below there and go looking towards the 0.68 level before I would be concerned. I like the idea of picking up the Aussie dollar “on the cheap”, because it is so highly correlated gold which of course has been lying straight up in the air with the exception of a massive selloff on Tuesday. Speaking of which, the Australian dollar barely bunched during that massive selloff, which tells me that it is indeed fundamentally strong at this point.

I still look at pullbacks as short-term buying opportunities and I suspect that Friday will probably be more of the same type of trading. I do not have any interest in shorting this market until we break down below the 0.68 handle, and even then, I would have to evaluate the overall situation. To the upside, if we can break out then I think we will go looking towards the 0.73 level, followed by the 0.75 handle, and then eventually go looking towards the 0.80 level after that. Ultimately, that is my plan, buying the Aussie dollar on dips and holding on to bigger positions but right now we just do not have the necessary momentum to send this market towards that target. Overall, I do believe that the Aussie dollar continues to be a positive market, but this time year is just going to be very brutal when it comes to the lack of volatility.