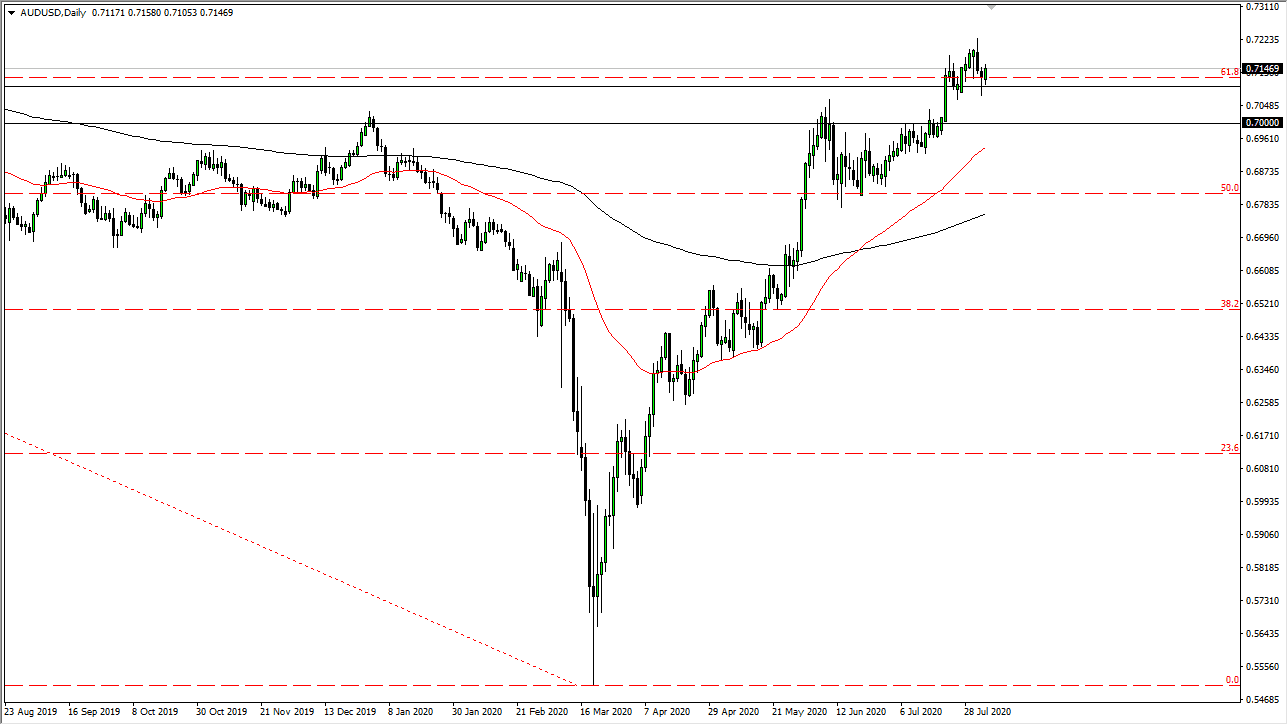

The Australian dollar has rallied a bit during the trading session on Tuesday as we continue to grind higher. In fact, the candlestick broke above the hammer from the previous session, which in and of itself is a very bullish sign. I think it is only a matter of time before this market goes to the upside, perhaps reaching towards the 0.73 level. Pullbacks at this point should be thought of as value, and therefore I will be a buyer of the Australian dollar on short-term charts. In fact, I believe that we have much further to go to the upside as the Federal Reserve continues to flood the markets with US dollars.

The 0.71 level is massive support and I think it extends down to the 0.70 level. If we were to break through all that, then things could change, and we will more than likely go looking towards the 0.68 level. That is an area where I think a lot of buyers would be waiting as well. Breaking down below there will perhaps change the trend to the downside. On the other hand, the market is in an uptrend in general, and therefore I do not think there is any point in fighting it. The Australian dollar is a proxy for risk appetite, but it is also a proxy for the gold market. With that being the case, it is likely that we will continue to see buyers in this market given enough time.

Longer-term, I believe that the Australian dollar should go looking towards the 0.80 level. Overall, this is a market that I think will remain quite noisy, but clearly there is a multitude of things out there that are working for it. I have no interest in shorting anytime soon, not at least until the Federal Reserve changes its tune war and lesser some type of catastrophic event out there that has people running towards the US dollar. In fact, while the US dollar gets hammered the Treasury market continues to attract a lot of attention. That normally is very bullish for the US dollar, but in this present situation there has been a bit of divergence between the normal correlations, but at this point, it is a one direction trade and therefore I look for value to take advantage of and continue to go much higher.