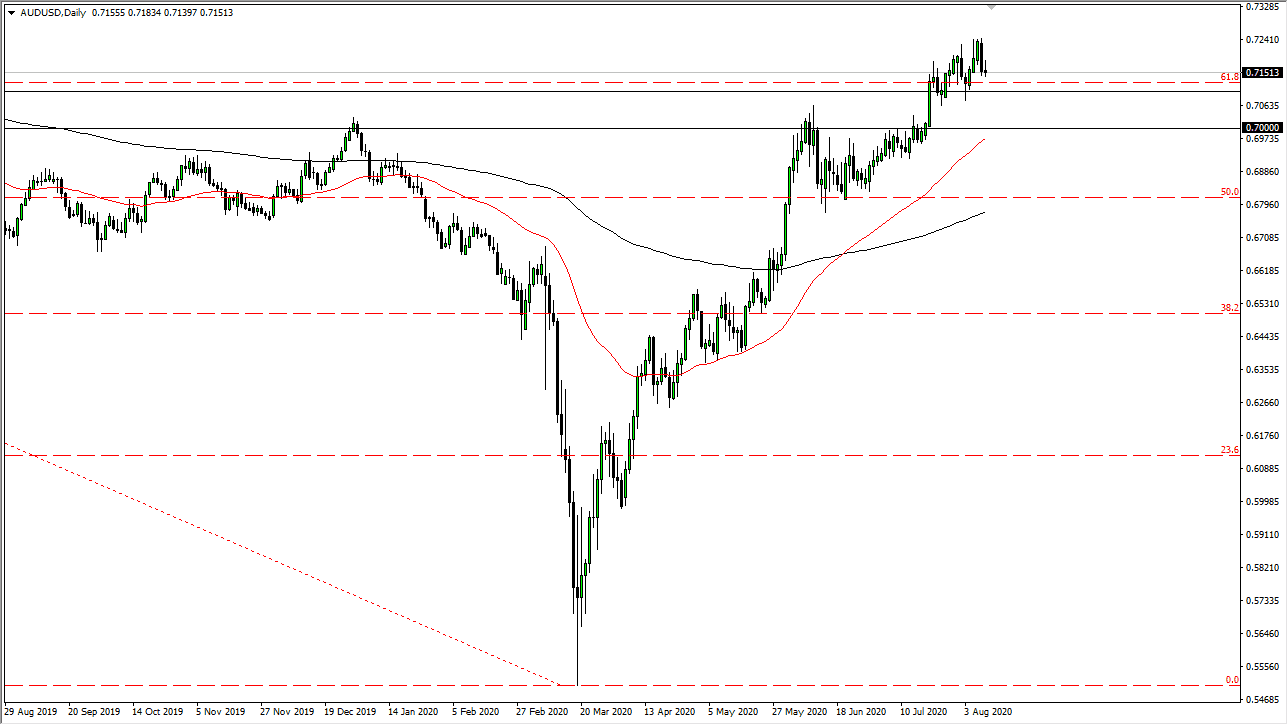

The Australian dollar has gone back and forth during the trading session on Monday, as we continue to look bullish. Although, it may have needed to take a little bit of a break over the last couple of trading sessions. That being said, there is a lot of support just below, starting at the 0.71 handle and extending all the way down to the 0.70 level. Ultimately, I think that will win the day and we will continue to find buyers on dips. In fact, that offers a bit of value that I think a lot of traders are out there looking for right now.

The Federal Reserve continues to flood the markets with currency, and that is working against the value of the greenback overall and I think that is what we are seen played out here. Clearly, we have formed a new uptrend over the longer term, and it looks like we are going to continue to go much higher. As long as we stay above the 0.70 level, it is likely that the market is going to continue to find plenty of buyers. Ultimately, the candlestick from the trading session on Monday suggests that there is a lot of uncertainty, meaning that I do not know that we can continue to go much lower with any type of ease. After all, this has been a relentless drive higher so unless we see some type of massive switch in the overall attitude, it is very unlikely that we will break down below the previously mentioned 0.70 level.

The 50 day EMA is sitting just below the 0.70 level, so it does make sense that we would find buyers in that general vicinity. Ultimately, this is a market that has been rising due to not only the Federal Reserve but the fact that gold has been rising so pay attention to that as well. After all, the Aussie dollar is highly correlated to gold so it does make a certain amount of sense that the currency pair would continue to rally. Selling is not even a thought at this point in time and I think it is only a matter of time before we get plenty of value the people will be willing to take advantage of. It has been the way to trade this pair for some time and I do not see it happening to change in the short term.