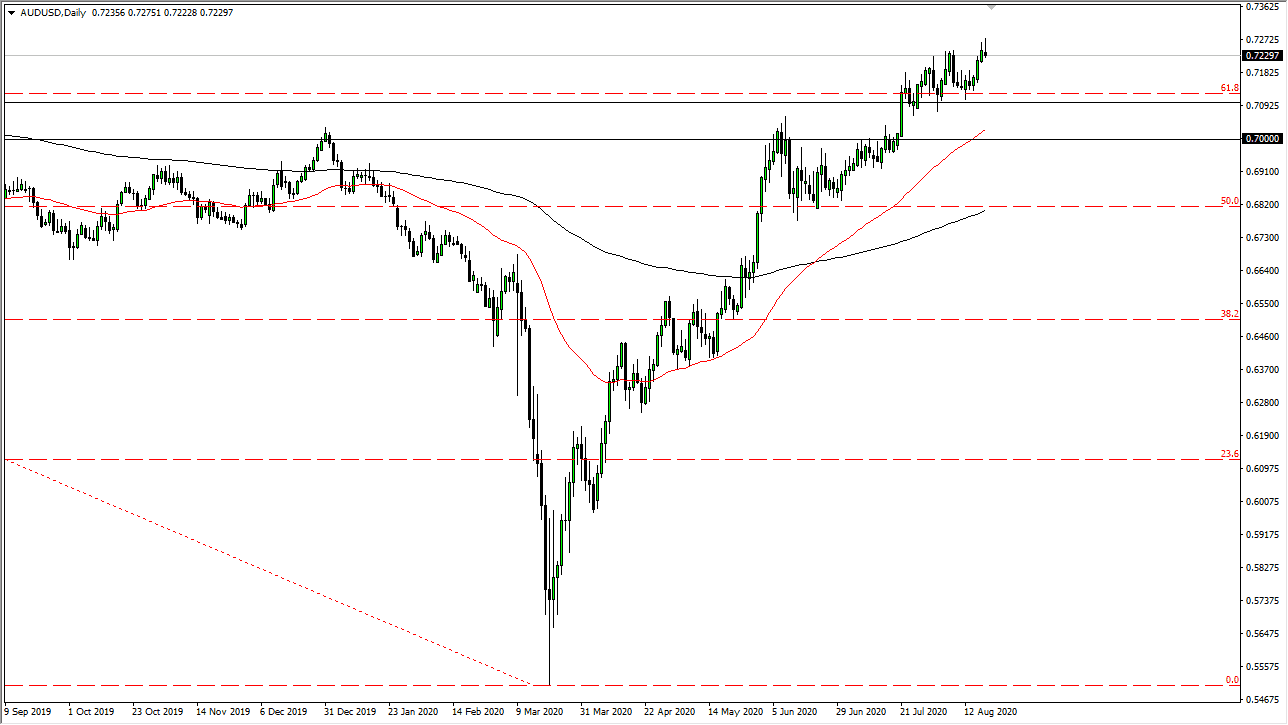

The Aussie dollar initially rallied again during the trading session on Wednesday but gave back the gains in order to form a less than desirable candle. However, the thing that you need to pay attention to most here is the fact that we have been rallying for some time. When you look at longer-term charts, we are most certainly near an area that could cause a significant amount of resistance, so it should not be a surprise at all that the market has decided to take a bit of a break in this vicinity.

Underneath, I see the 0.71 level as massive support that extends down to the 0.70 level. That is an area of buying pressure that should come into the fray and offer a lot of support. I would be more than willing to buy this pair on a pullback in that general vicinity and a short-term bounce. At that point, we could see the market goes looking towards the highs again, followed perhaps by the 0.75 handle. Longer-term, I anticipate that this market is going to go towards the 0.80 level above, which has been my longer-term target for quite some time.

As the Federal Reserve continues to pump the market full of liquidity, this has been driving down the value of the US dollar from a supply/demand perspective. Furthermore, traders are trying to find yield wherever they can get it, and that most certainly is not in the US Treasury markets. In other words, there are plenty of reasons to not like the greenback right now. On the other side of the coin, you have the Australian dollar which represents Asia, which is a growing part of the world obviously. The Aussie dollar represents an economy that supplies Asia with a lot of its hard commodities, so therefore it is quite often tied to what is going on in China. Beyond all of that, the Australian dollar is also the currency of one of the world’s largest gold producers, so it is quite often used as a proxy for gold. In other words, there are plenty of reasons to think that this pair goes higher over the longer term, but we may need to build up a little bit of momentum. We are in the midst of the vacation season for a lot of big traders, so we may have some sideways action in the short term to work through.