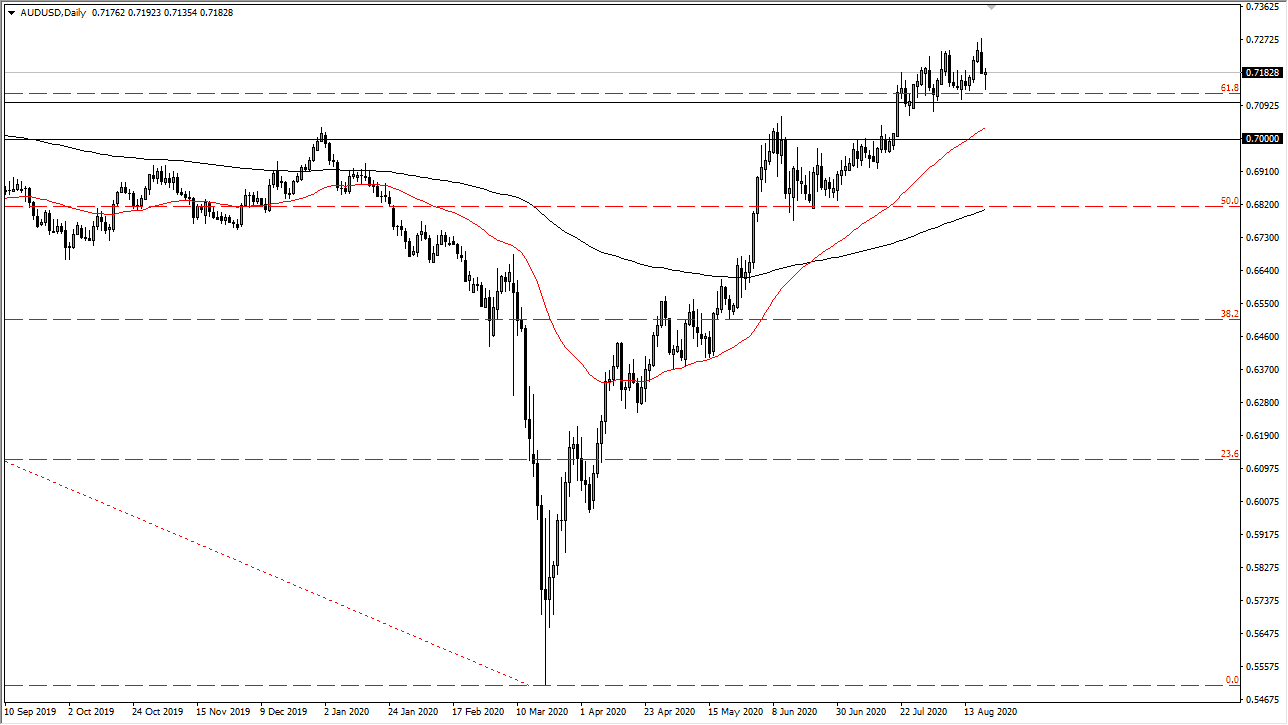

The Australian dollar has initially fallen during the trading session on Thursday but looks as if it is ready to continue grinding higher based upon the nice bounce that we have seen, and the fact that at the end of the trading session we are seeing the Aussie break back above the 0.72 level. The Aussie is clearly benefiting from the Federal Reserve flooding the market with greenbacks, and I think that will continue to be the case. Furthermore, the Australian dollar is highly levered to the gold market, so it makes sense that it rallies in this type of environment as well. As long as the Federal Reserve remains as loose as they are, it is likely that gold will continue to go higher.

To the downside, I see a massive amount of support near the 0.71 level that extends down to the 0.70 level. If we were to break down below there, I think there is even more support in the form of the 0.68 level which is where the 200 day EMA currently sits. I do not expect that to happen, but it is a possibility that we always need to keep in mind.

To the upside, I believe that the market probably goes looking towards the 0.73 handle, and then possibly even the 0.75 handle given enough time. Longer-term, I think that we could even go as high as the 0.80 level as we have clearly trying to turn things around with a longer-term trend change. As long as the Federal Reserve is out there trying to work against the value of the greenback, I think that short-term dips should continue to offer nice buying opportunities. Do not get me wrong, we will get the occasional big pullback but so far it has been pretty reliable bullish pressure that we have seen.

The fact that the weekend is coming could keep a little bit of a dampening on the pair, but I think longer term we must certainly be going to see value hunters come out when we dip. That being said, I think you are looking to build a larger core position because this becomes more of an investment as the Federal Reserve is working so feverishly to flood markets with liquidity, although in all fairness most central banks are. That being said, the Federal Reserve is the only one anybody cares about, so as long as that is the case you have to be a buyer.