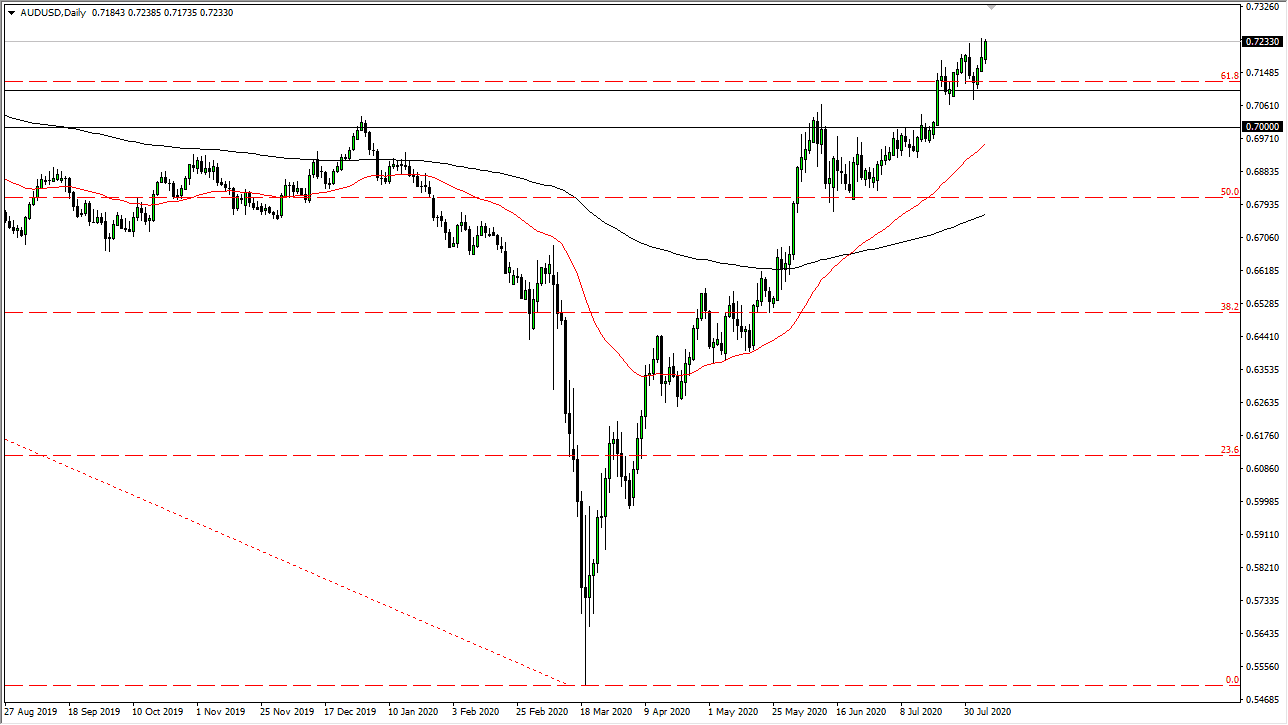

The Australian dollar has continued to push to the upside overall, reaching towards the highs from the previous session on Thursday, so at this point it looks like we are more than likely going to find buyers on dips still. This is obviously being fueled by the US dollar losing strength in general, and I think that pullbacks closer to the 0.71 level will offer plenty of support, extending down to the 0.70 level. Otherwise, we will simply take off towards the 0.73 level. I have no interest in shorting this market, the US dollar has far too much weakness attached to it in order to go the other way.

In fact, it is not until we break down below the 0.68 level that I would consider shorting this market, as it would be a massive area of interest and breaking down below there would of course be a very negative move overall. At this point in time, it certainly looks as if we are looking for any reason whatsoever to short the US dollar, so I do like the idea of buying dips going forward as the trend has clearly changed.

The Australian dollar could go all the way to the 0.80 level given enough time, but that does not mean that we get there overnight. It could take some time to get there, but I do think that eventually where we go. With that being said, short-term pullbacks offer value that you should be willing to take advantage of. I expect that we may get a bit of a reaction heading into the Non-Farm Payroll numbers, but eventually we will find a certain amount of value hunters coming back into the market to take advantage of any dip. In fact, I think that we have just started a longer-term trend to the upside, and therefore I think it takes a bit of patience in order to take advantage of value. In fact, I believe that the US dollar will continue to fall against most currencies, but the Australian dollar is a play on China and of course the global growth situation. With that being the case, the market should continue to favor the Aussie dollar due to the commodity play that continues to be such a bullish place to put your money. After all, anything to run away from the greenback seems to be the best way to trade this market.