AUD/USD: Benefitting from weaker USD

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

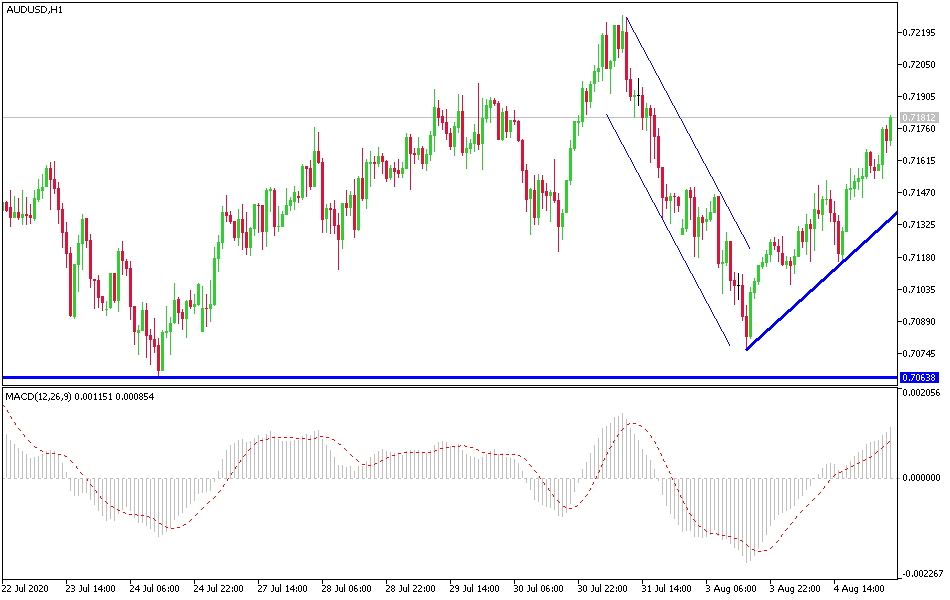

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7120 or 0.7055.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7290 or 0.7220.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

Political and trade tensions around the world did not prevent the AUD/USD from completing the bullish correction. As I mentioned yesterday, the weakening of the US dollar is important for bulls' control. The outlook for the possibility of a rate cut by the Reserve Bank of Australia was more likely, from a consensus view than expectations for maintaining the bank's policy. Nevertheless, the Reserve Bank of Australia did not provide any indication of a rate cut, but it has resumed bond purchases, and their three-year yield is limited to 25 basis points, and is less than a narrow range around it, to the point that the Reserve Bank of Australia has not felt obligated to buy any bonds since May 6.

After the decision, Reserve Bank of Australia Governor Philip Lowe said that the economic slowdown was less severe than expected and that the recovery is now continuing across the country despite renewed restrictions on activity in some of the largest Australian states. The bank acknowledged that the recovery would be uneven and very weak, justifying its decision to leave the monetary interest rate and bond yield for three years unchanged at 0.25% in line with market expectations.

On another front, Australia announced its trade surplus in June at A$ 8.2 billion, after an A$ 7.3 billion in May. Exports increased by 3% during the month after the revised slide by 7% in May (initially -4%), while imports increased by 1%, recovering from the revised decline of 7% (initially -6%). Meanwhile, retail sales slowed to a solid gain of 2.7% in June after a 16.9% rise in May.

China has expressed its objection to the forced sale of TikTok to an American company. While US President Trump has indicated that Microsoft can do this, Trump has asked his government to monitor negotiations for attractive US Treasury fees in exchange for approval of the acquisition.

I am still sticking to selling the AUD/USD as it crossed the 0.7200 resistance level.

Regarding the Australian dollar, no economic releases are expected from Australia today. For the US dollar, ISM services PMI, ADP survey numbers for nonfarm sector jobs and trade balance will be announced.