AUD/USD: Australian employment numbers.

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

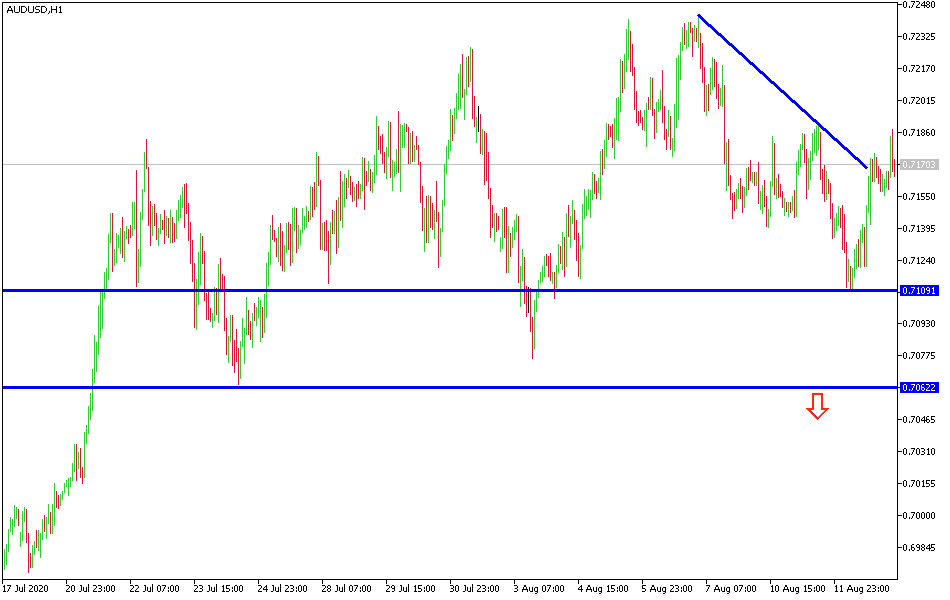

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7185 or 0.7220.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.7120 or 0.7060.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

As I mentioned yesterday, the 0.7000 resistance will continue to support the bulls' control over the AUD/USD performance. The pair will react strongly today to the release of Australian employment numbers amid expectations of a sharp improvement in this important sector as the country's economic activity reopens. The pair is stable around the 0.7188 resistance at the time of writing. US-Chinese tensions continue to negatively affect the Australian dollar against the rest of other major currencies. Besides, the sharp correction in metal prices also brought losses to the Australian dollar.

The recently announced US sanctions on 11 Hong Kong officials have put Chinese banks in an awkward position. They must respect US procedures by not dealing with the aforementioned officials or risking access to US dollar funding. According to press reports, Chinese banks are in compliance. At the end of last year, the four largest Chinese banks had about $1.1 trillion in financing. Of course, Chinese officials hate compliance, but the adoption of dollar financing drives the United States and the dollar’s long-term role in the global economy. In response, Beijing sanctioned eleven American officials, but with less severe measures compared to the United States.

No date has been set for senior US and Chinese officials to review the Phase 1 trade agreement, as it is still expected in the coming days. By most accounts, China's purchases of U.S. goods are lagging far behind where they should have been if they were on track to comply with the $200 billion increase from 2017 levels by the end of next year.

Reports suggest Beijing wants to talk about US measures to ban TikTok and WeChat next month if they are still under Chinese ownership. It may not be the first, but the latter is underway. China does not allow US giants, such as Google and Facebook, although the US actions were not retaliatory, and have been cited for national security reasons.

Also from Asia, The Reserve Bank of New Zealand left its interest rate target unchanged at 25 basis points but announced an NZ $100 billion expansion on its long-term asset purchase program. Unlike other major countries, New Zealand's financial initiatives remain aggressive, larger, and more loaded than the RBNZ anticipated. However, with Auckland back under lockdown, the central bank kept its options open going forward.

I recommend selling the AUD/USD currency pair if it returns to the 0.7265 resistance.

Regarding the Australian dollar, Australian employment change and unemployment rate will be released. For the US dollar, weekly unemployment claims will be announced.