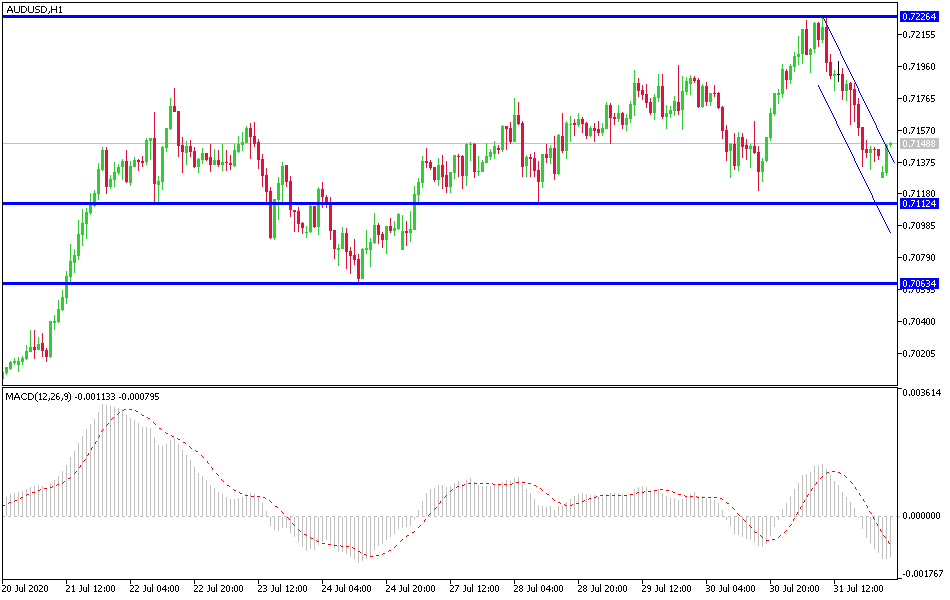

AUD/USD: Gains will continue to be threatened

Today’s AUD/USD Signals

- Risk 0.75%.

- Trades must be entered from 8 am New York time to 5 pm Tokyo time today.

Long Trade Ideas

- Long entry following bullish price action on the H1 time frame immediately upon the next touch of 0.7090 or 0.7020.

- Place the stop loss 1 pip below the lowest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade Ideas

- Short entry following bearish price action on the H1 time frame immediately upon the next touch of 0.285 or 0.7200.

- Place the stop loss 1 pip above the highest recent price.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

Correcting last Friday's trading session, the pair did not exit the range of its bullish channel, and this may only happen if the AUD/USD pair moves steadily below the 0.7000 support. Forex traders, especially those interested in this pair, are monitoring the level of tensions between the United States of America and China because the latter is Australia's largest trading partner.

Bulls targets, especially the move towards the 0.7200 resistance, which was ideal to activate the profit-taking sales, as the technical indicators reached strong overbought areas and the bears were waiting for the moment to activate the selling operations. The Coronavirus, along with US-China relations and commodity prices, will remain the most important influencers on the future performance of the pair.

I still hold on to my technical view of selling the Australian dollar from every higher level above the 0.7200 0 resistance.

Regarding the AUD, the MI Inflation Outlook and ANZ Australian jobs data will be released. As for the US dollar, the ISM Manufacturing PMI and construction spending data will be announced.