The bitcoin markets fell a bit during the trading session on Thursday as most traders have been paying attention to Jerome Powell and his speech for the Jackson Hole Symposium. Ultimately, he did not say too much in the way of change as the market may have been looking for some more stimulus. This has made a little bit of recovery in the US dollar possible, and this of course has put a little bit of negativity into the Bitcoin market. That being said, the longer-term outlook has not changed much, and Jerome Powell even suggested that the new way that they will trying to meet their obligations will be more of a “average of inflation” instead of a hard target. In other words, inflation is probably coming.

If that is going to be the case, dollar-denominated assets, which of course this currency pair is, will rise over time. In other words, it will take more of those US dollars to buy “things”, in this case Bitcoin. It is the same with the gold market, it is the same with the silver market. Those markets also pulled back a bit during the trading session as there may have been a little bit of front running the conversation, he had today in order to take advantage of a potential big move. However, traders quickly covered their positions and therefore we are essentially where we were 48 hours ago.

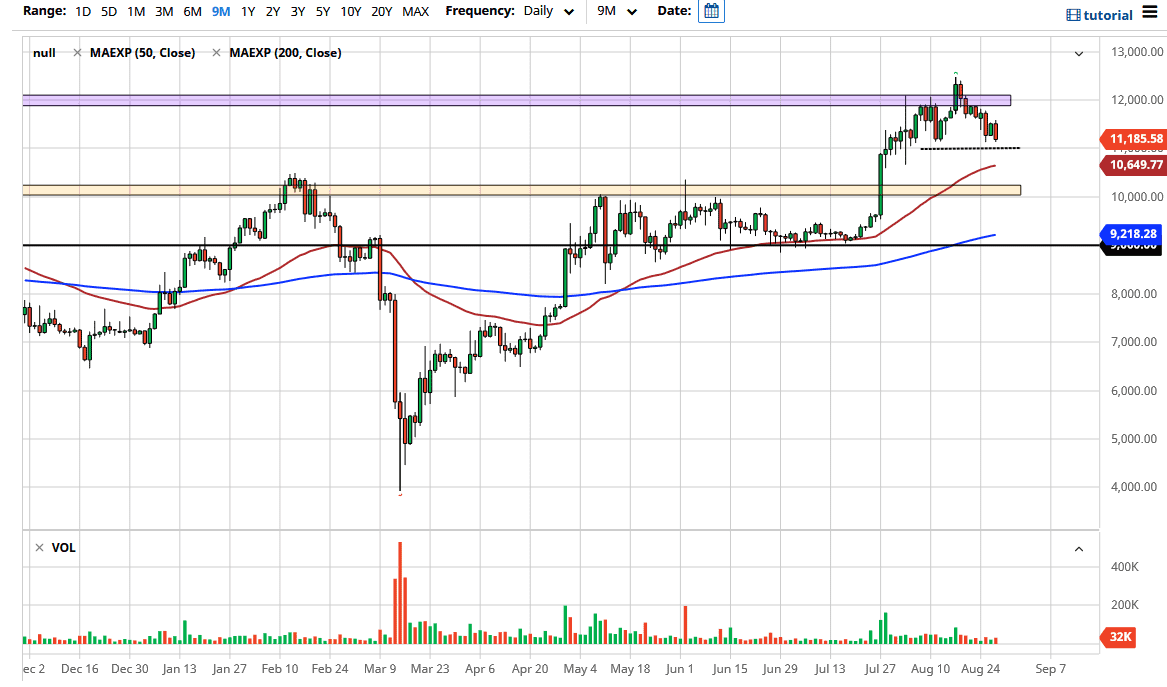

Looking at this chart, the $11,000 level underneath should be significant support, as it has been more than once. Ultimately, I think that there will be buyers jumping into this market on signs of bullishness, and I do believe it is only a matter of time before we recover. However, from a structural standpoint it will be interesting to see whether or not $11,000 holds as support. If it does not, then the 50 day EMA comes into play near the $10,650 level, and then possibly towards the $10,000 level after that. I do believe that the buyers return, but the question is which one of these three levels underneath will hold? Because of this, you will need to scale into a position slowly, trying to take advantage of a potential continuation of the overall uptrend. I have no interest in selling, I do believe that this market eventually reaches the highs again, just as I would say the same thing about precious metals.