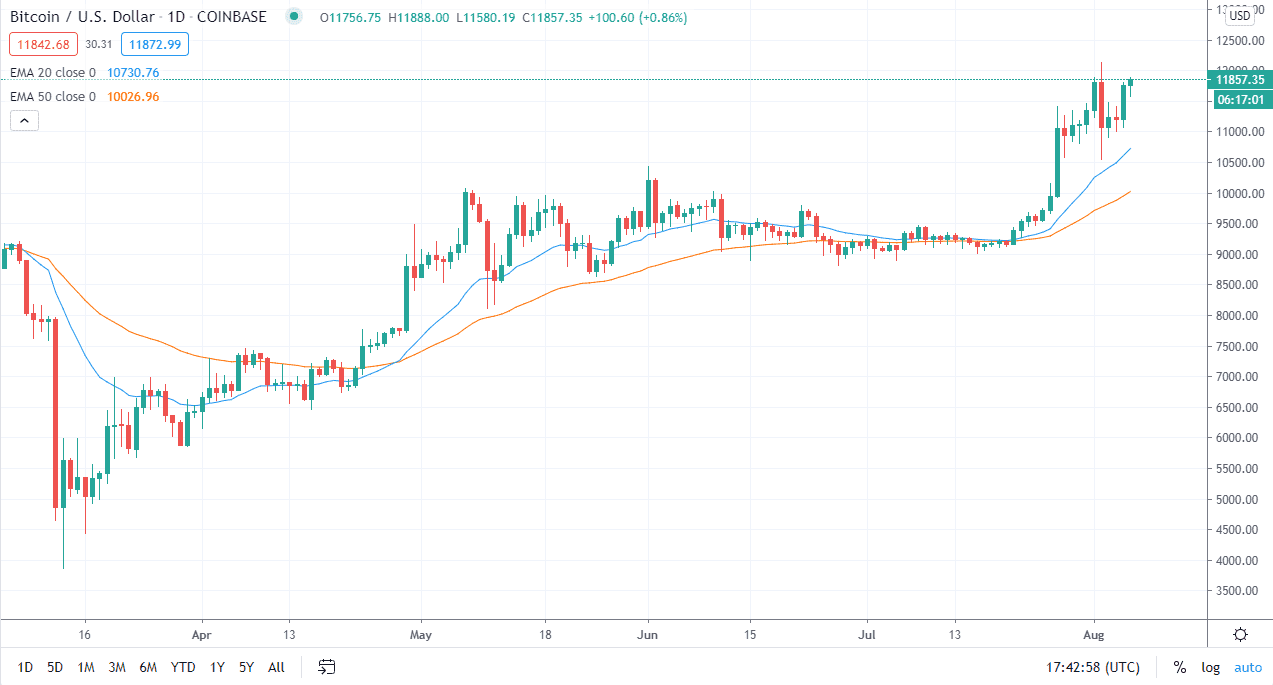

Bitcoin pulled back a bit during the trading session on Thursday but found buyers yet again on that dip. The Bitcoin market looks like it is poised to go much higher although we are seeing a little bit of resistance at the psychologically and structurally important $12,000 level. If we can break above, there then we will more than likely go much higher. At that point, we would be looking at the $12,500 level, and possibly beyond.

In the short term, I think there is plenty of support near the $11,000 level, so pullbacks towards that area will be buying opportunities from what I can see. Furthermore, the 20 day EMA sits just below there and is sloping up into that direction. I think that the Bitcoin market is getting quite a bit of a boost from the central banks out there crushing fiat currency, including the US dollar as the Federal Reserve is doing. As the value of the US dollar drops, it makes sense that assets that are priced in that currency will continue to see appreciation as far as price is concerned. I know people do not like to hear this, but Bitcoin is essentially a commodity, or at least it trades like it. If that is going to be the case, then it makes quite a bit of sense that the market continues to go higher.

When I look at the candlestick, it does suggest that we are going higher due to the fact that we have formed a bit of a hammer. Granted, if we break down below that hammer then it technically becomes a “hanging man”, but I only read a potential pullback to that $11,000 level if that happens. If we break above the top of the candlestick however, it shows that they simply could not sell off Bitcoin, and it continues its relentless march higher. I do believe that it is only a matter of time before we break out to the upside regardless, so if you choose to take a small position and build upon it that makes quite a bit of sense. In fact, I suspect that there is an absolute “floor” in the market currently at the $10,000 level. If we were to break down below there then things could change, but right now it does not look to be very likely as Bitcoin is very bullish.