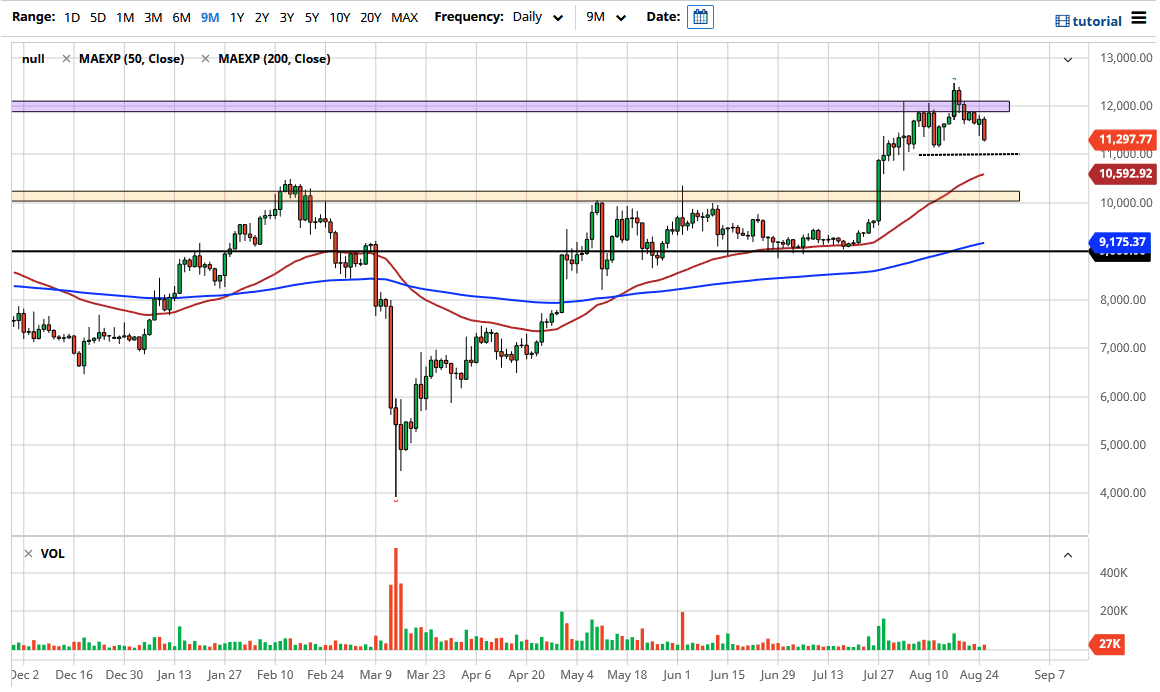

The bitcoin markets have fallen during the trading session on Tuesday, reaching towards the $11,300 level. Underneath there, I think there is a certain amount of support to be found at the $11,000 level, which I have mentioned previously. At this point, there should be a certain amount of buying pressure, but even below there I think there is significant support down at the $10,000 level as well. I do think that Bitcoin does continue to go higher, but the US dollar has enjoyed a little bit of a reprieve as of late and therefore you are not getting the tailwinds that we had seen previously.

The 50 day EMA is at the $10,600 level, and that of course should show a lot of support as well. It is not a huge surprise to see that we have pulled back a bit from the $12,000 level, as it has been important a couple of times, and of course is a large, round, psychologically significant figure. With this being the case, it is not a huge surprise that we have a bit of trouble in this area but given enough time I do anticipate that we will smash through there. Ironically, even though most Bitcoin believers are totally against gold, the reality is that gold will be a great secondary signal. If it starts to rise, then Bitcoin should go right along with it. Currently, the gold market is pulling back toward support, which is exactly what we are seen over here.

If we do break out to a fresh, new high, then it is likely that we are going to go towards the $13,000 level, possibly even the $15,000 level given enough time. All things being equal, I do think that is what happens, but I also recognize that the market still has to digest the massive gains that had been seen during the back half of the month of July. Currently, I have no interest in shorting bitcoin, at least not until the market breaks down below the $9000 level. If it did, that would be a major breakdown, but we are light years away from that currently, so it is not a concern of mine at the moment. Looking for dips to buy will be the best way going forward, assuming you can be patient enough to wait for the opportunity.