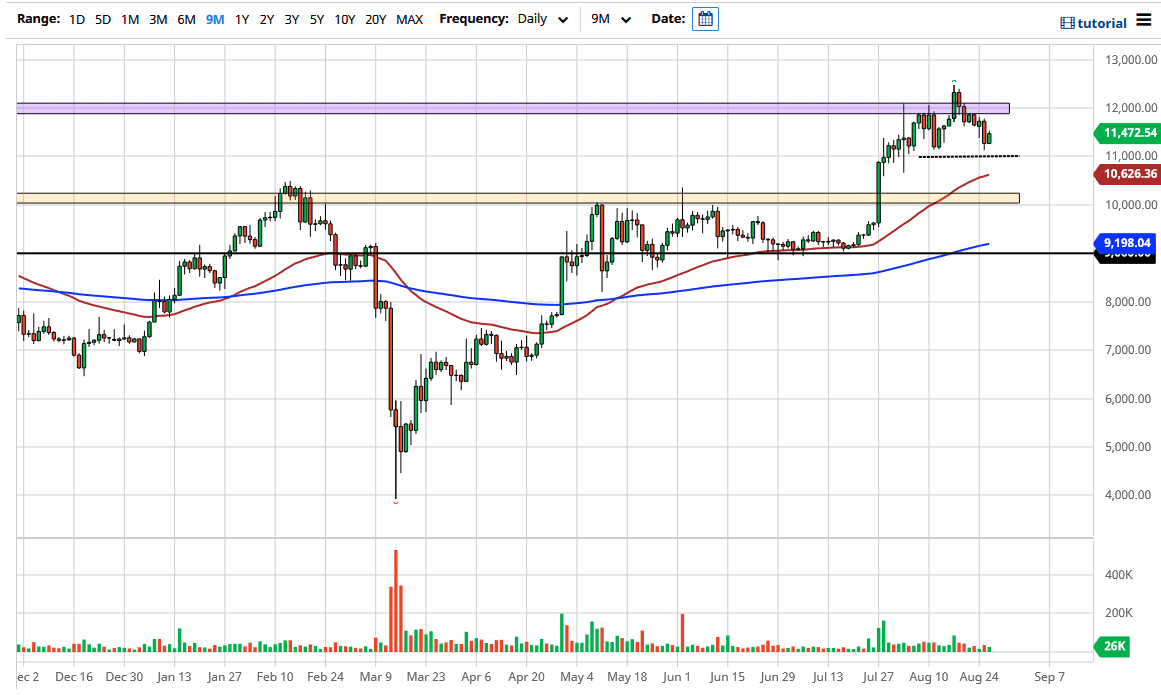

The bitcoin market has rallied just a bit during the trading session on Wednesday as we look likely to find the $11,000 level as somewhat supportive. Underneath there, we also have the $10,000 level in the $10,600 level which features the 50 day EMA. In other words, I think we are simply “killing time” in this market to build up enough pressure to finally break out to a fresh, new high again. After all, the Bitcoin market rallied rather significantly, breaking above the $11,000 level, and then the $12,000 level recently. However, we need to consolidate gains before going higher, because this is not like the Bitcoin market of a few years ago and that is a good thing.

Gold markets also rallied a bit off the bottom, and the two markets are starting to trade very similarly, which is a bit ironic considering how most Bitcoin traders consider themselves above gold traders. That being said, it is about the US dollar and nothing else. It is not about adoption, it is not about usage, it is not even about hash rates or happenings or anything else, it is about the value of the US dollar. It trades like a commodity, and that is what you need to be the most aware of. Currently, commodities are very desirable, and therefore used as a way to get away from the US dollar, which was one of the biggest arguments for Bitcoin in the first place. However, the US dollar is falling a bit, so it is not going to be a path straight up in the air.

Ironically, the catalyst for Bitcoin to go higher may come from the Federal Reserve tomorrow. Chairman Jerome Powell has a speech from the Jackson Hole Symposium that could outline further quantitative easing or the like coming out of the United States. The very central bank that a lot of Bitcoin traders are trying to get away from will dictate what happens with Bitcoin next. In a strange sense, that has always been the case here. If we can continue to rally and make a fresh, new high it is likely the Bitcoin goes looking towards 13,000. If we pull back from here, there are those multiple support levels on the chart underneath that will continue to come into play.