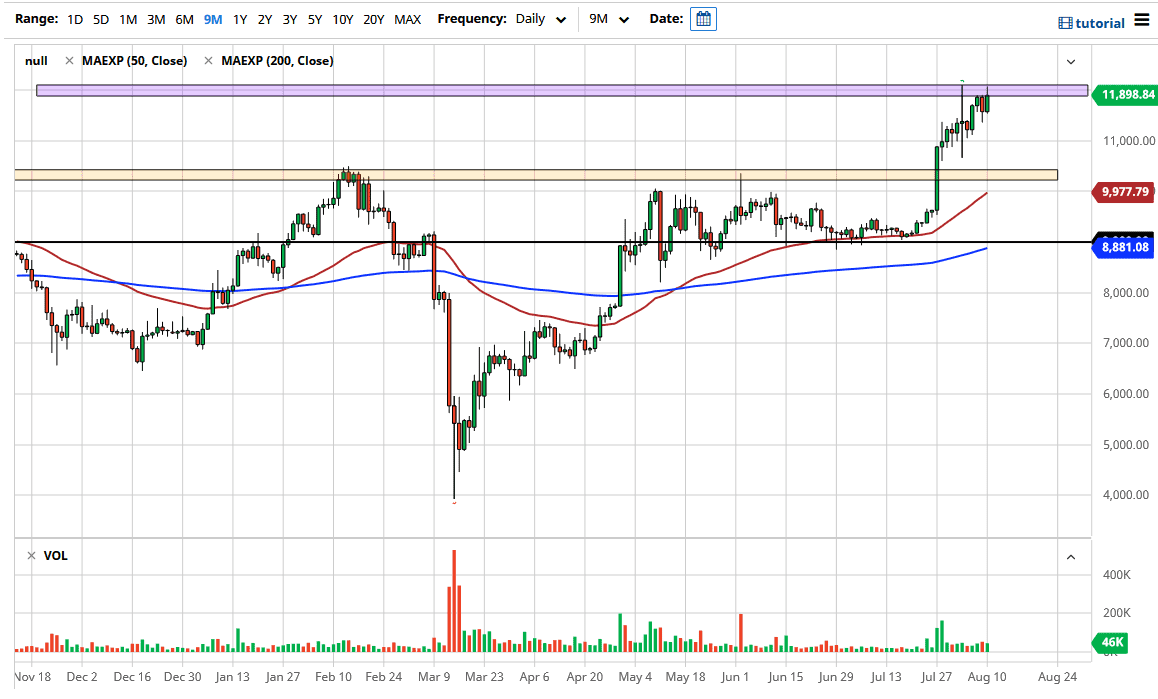

The bitcoin market has rallied a bit during the trading session on Monday again, testing the crucial $12,000 level. It now looks as if we are going to try to break above there, and if and when we do, it is likely that we could go towards the $12,500 level. We have seen a bit of a pullback late in the day, but it is not enough to change the overall attitude of this market and I believe we will eventually see this market find plenty of buyers based upon value. After all, Bitcoin is starting to make headlines again, so that will cause quite a bit of attention.

The US dollar has been getting hammered due to the fact that the Federal Reserve is out there printing greenbacks as fast as they can, which is without a doubt one of the biggest drivers for Bitcoin to gain. After all, Bitcoin does tend to move right along with gold overall, as Bitcoin is trading more like a commodity these days than anything else. That being said, I think it is only a matter of time before we see buyers jump in due to the fact that commodity inflation is a reoccurring theme out there. With that being said, I like the idea of buying on dips especially when we get close to the $11,000 level, assuming that we can even get there. I do like the $12,500 level was the next target, simply because it has been an important number for quite some time.

Underneath, I recognize the $10,000 level has been crucial, as it is a large, round, psychologically significant figure that has caused major resistance in the past. In fact, I believe that will serve as a marker for this pair going much higher over the longer term if we can stay above there. If we cannot, then the next major support level is at the $9000 level and that will be trend determining. A break down below there changes everything. Until then, I believe that buying dips will continue to cause buyers the look for buying opportunities, just as a breakout above the $12,000 level will. As long as the Federal Reserve continues to flood the market with currency, it is going to make quite a bit of sense that Bitcoin will eventually rise over the longer term. This does not mean we will get the occasional pullback, but you need to look at it as potential buying opportunities.