Bitcoin/USD: Benefiting greatly from decline of USD

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo today.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $10170 or $9700.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $14,500.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

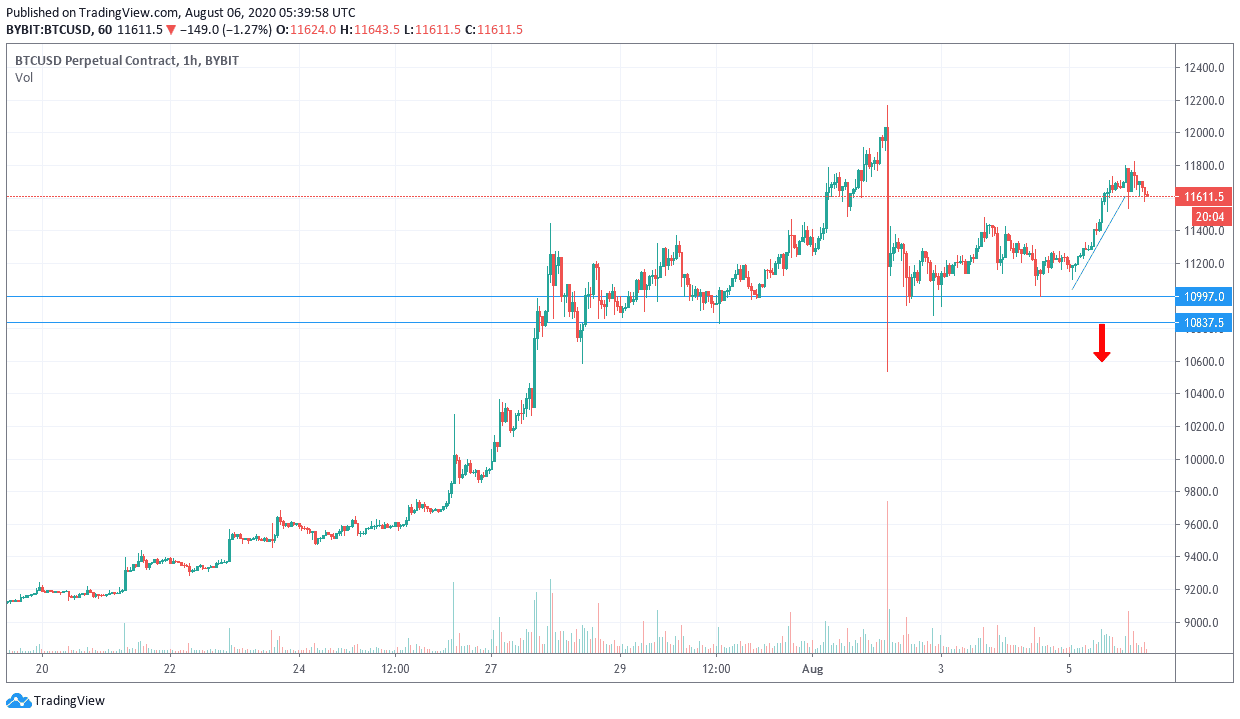

Bitcoin/USD Analysis

As I mentioned yesterday, the BTC/USD pair is still benefiting greatly from the decline of the US dollar, the pair is consolidating above the $10,000 psychological resistance and is ready to test higher levels. The pair is stabilizing around $11,635 and at a Bitcoin market value of $215 billion. Bitcoin prices recently rose more than 5% in less than 24 hours and broke through $11,500 earlier today. Cryptocurrency analysts believe that this level is very important because it will support the move towards stronger bullish levels. Expectations indicate that breaking the resistance levels at $12,000 and $13,000, the world's first cryptocurrency will move towards its highest levels since 2019.

There are three developments to note in China; First, Caixin Services PMI fell to a reading of 54.1 from a reading of 58.4. This was enough to raise the composite index reading to 54.5 from 55.7. This report notes that despite the recovery of the world's second-largest economy, the pace has slowed. Secondly, as competition expanded into the technology field, Beijing unveiled new efforts to help the semiconductor and software industry. While this is in line with the import substitution strategy, it is likely to raise concerns about the country's approach. Third, Chinese and US officials will conduct a formal review of the progress of the first-stage trade deal on (or around) August 15, the anniversary for the end of the Bretton Woods.

Meanwhile, the US Secretary of Health and Human Services will visit Taiwan soon. As the highest-ranking US official to visit Taiwan since they cut US ties in 1979, this is likely to be hostile to Beijing and thus a new concern arises in the financial markets. Taiwan is one of the potential hot spots, as the status quo appears to be increasingly unstable. The United States does not have a joint defense treaty with Taiwan.

Regarding the US dollar, unemployed claims will be announced.