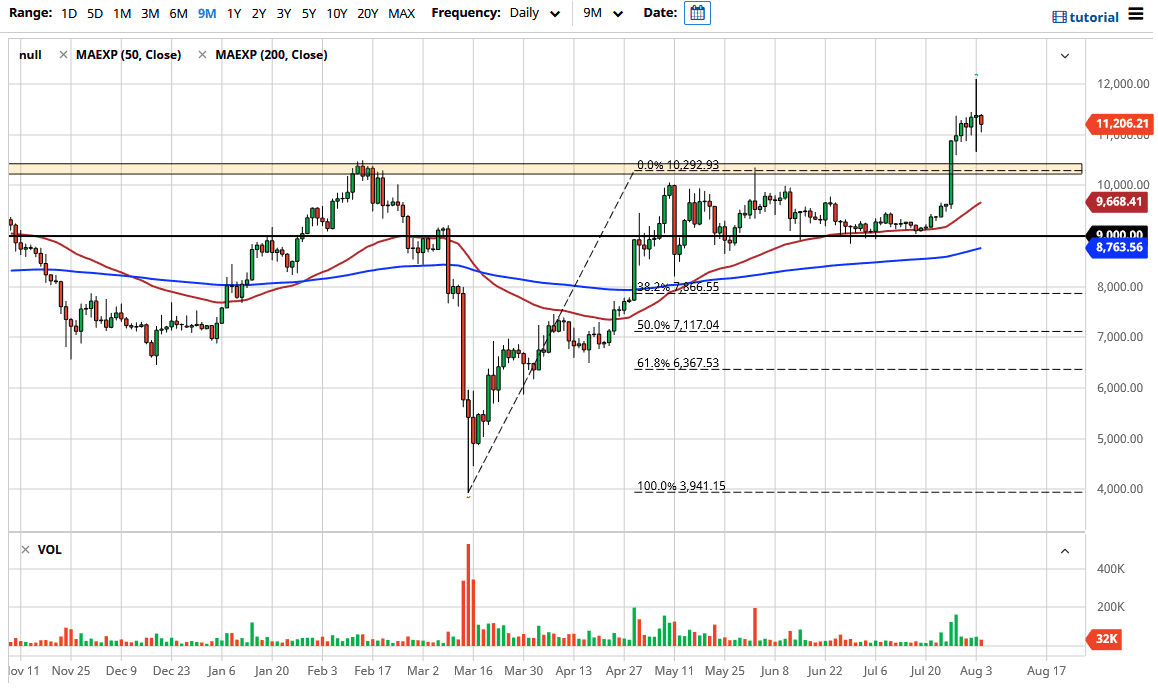

The bitcoin market has fallen a bit during the trading session on Tuesday, perhaps taking a bit of a breather after the volatile action that we have seen over the last week or so. Looking at the candlestick from the Monday session, I think that we are going to see similar action to what we are seeing in the silver markets. At this point in time, it is likely that we will continue to see choppiness and volatility, as the market looks to be carving out some type of short-term range. The $12,000 level on the top and the $10,500 level underneath being support.

Bitcoin has reacted positively to the massive selloff in the US dollar, just as the precious metals market has. This is a bit ironic, considering that most Bitcoin believers talk about the futility of precious metals, but at the end of the day these are a couple of markets that are behaving the same. We are more than likely going to have to digest the gains that we have seen so quickly. Ultimately, this is a market that I think has more of an upward bias than anything else, and as the US dollar continues to struggle, I think that is going to further propel Bitcoin higher.

To the downside, the 10,500 level is the top of the previous resistance area that started at the 10,000 handle. If we break down below there, then the market is likely to find plenty of support between 9000 and 10,000. Ultimately, this is a market that has far too much in the way of support underneath to simply crumble, unless of course something drastic happens like we see extreme US dollar strength. Regardless, I think that this represents a nice “buy on the dips” opportunity going forward, and I think that a lot of traders are more than willing to take advantage of that. If things change, I will obviously tell you but right now it looks like you could probably build up little bits and pieces of a longer-term position as the Federal Reserve is looking to flood the market with US dollars. As those US dollars continue to get flooded into the market, that will drive down the value of these US dollars, which is when Bitcoin is bought.