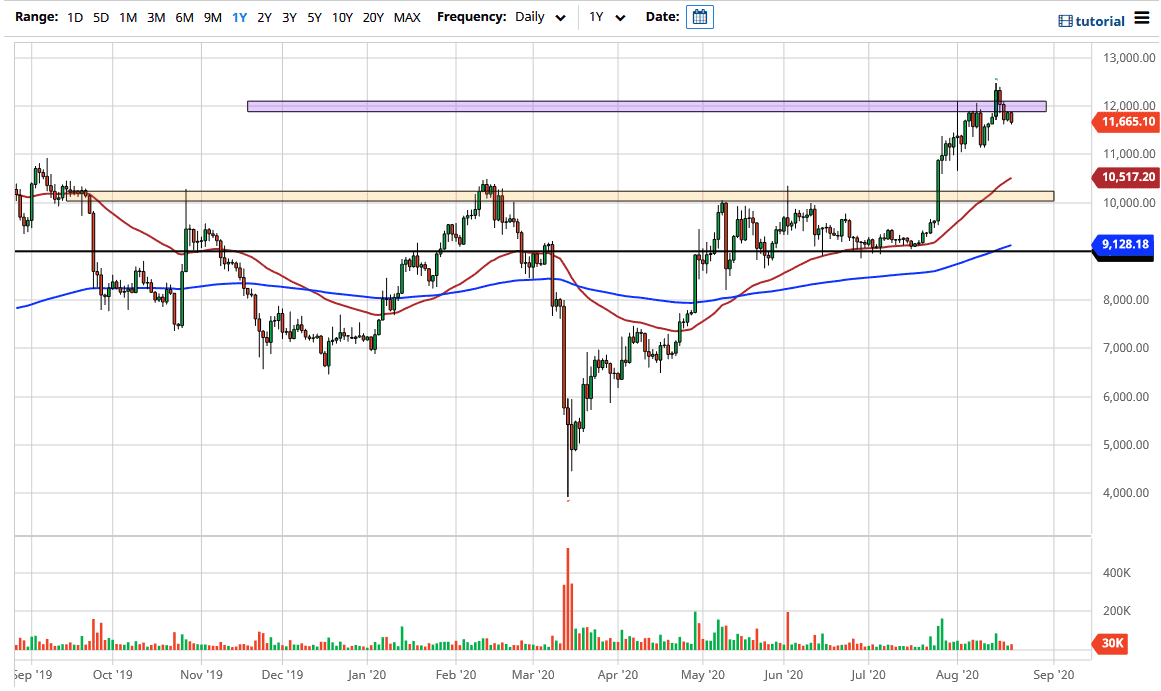

The Bitcoin market has pulled back just a bit during the trading session on Friday as we go into the weekend and face a significant amount of resistance in the form of the $12,000 level. Ultimately, this is a market that is reacting to the US dollar more than anything else, and as the US dollar got a bit of a lift. Ultimately, the Bitcoin market is likely to continue to keep trading right along with gold and other “anti-dollar” markets.

If we break down below the bottom of the candlestick from Friday, it is very likely that the market will continue to go lower, perhaps reaching down towards the 11,000 level which has offer short-term support. Ultimately, the US Dollar Index is testing a major uptrend line and has bounced a bit so that suggests that we could see a little bit more in the way of negative action in Bitcoin, but I think that there is enough support underneath that eventually we will find buyers to lift this market again. After all, the Federal Reserve continues to pump the markets full of liquidity, as do other central banks like the European Central Bank and the Bank of Japan.

The $10,000 level underneath is massive support and therefore is a scene of “market memory” as we had seen such a hard push to break out of there. It has not been tested again, and typically that happens at least once given enough time. I think that looking for value underneath is probably the best way to continue trading, but if we were to turn around and break higher that may make a fresh new high, and then it is likely that we could go looking towards the $13,000 level. That being said, you need to be cautious about new highs being made over the weekend because the liquidity is rather thin. I think at this point in time it is likely that the 50 day EMA will also offer a lot of support. Ultimately, I think that Bitcoin still has further to go, despite the fact that we have struggled over the last several sessions. I can say the same thing about most precious metals markets, as they tend to be moving in the same direction over the longer term. This is all about the US dollar, so pay attention to how it is behaving against other currencies.