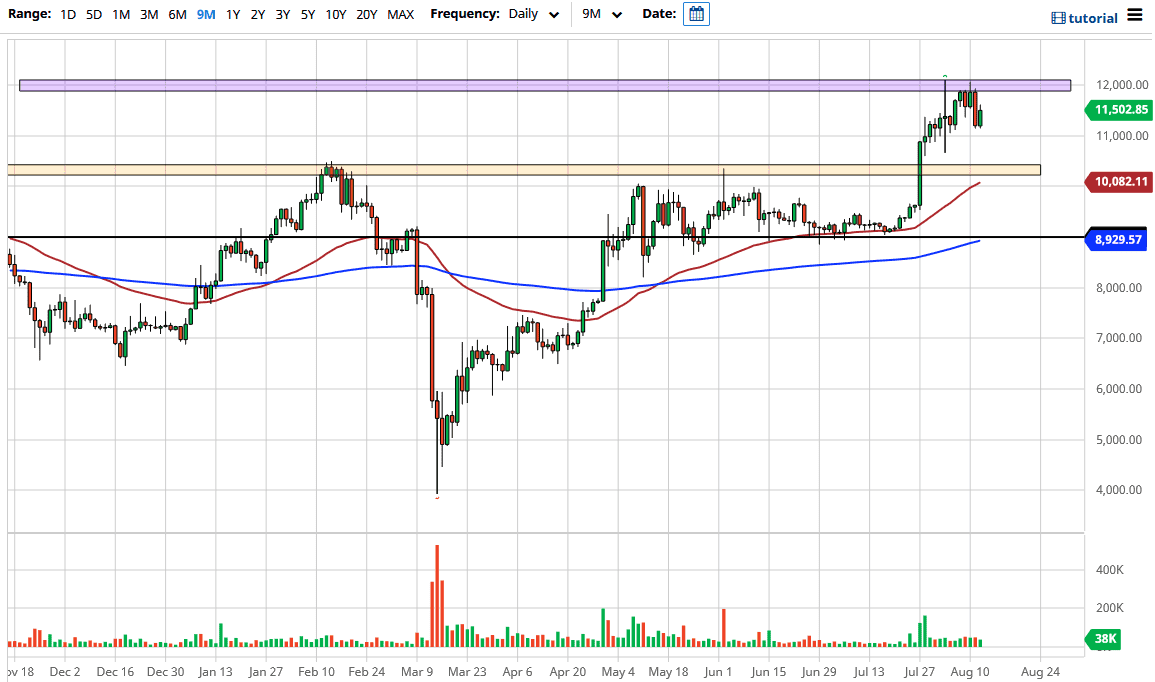

Bitcoin rallied a bit during the trading session on Wednesday as we recovered a bit from the massive selloff on Tuesday. After all, we had seen the US dollar surge much higher during the Tuesday session which brought down the value of anything that was measured in US dollars, including Bitcoin. At this point in time, it looks as if the market is ready to recover the losses and go looking towards the $12,000 handle.

The $12,000 level has been significantly resistant over the last couple of weeks, but at this point in time, I think it is only a matter of a catalyst before we break above there. That catalyst will more than likely be the US dollar falling again. Quite frankly, you need to look to the FX markets to see what is going to happen with Bitcoin, because of the US dollar itself. As long as the US dollar is under pressure, the Bitcoin market will do fairly well. This does not mean that we will slice through the $12,000 level easily, just that the market eventually should do that.

Underneath, I would anticipate that the $11,000 level should offer some support, but there is probably more substantial support near the $10,000 level and the 50 day EMA. As long as we can stay above there, I believe that the uptrend still is relatively healthy. Once we do break above the $12,000 level, I would anticipate another $500 to be aimed for rather quickly. That being said, keep in mind that Bitcoin is susceptible to sudden moves in both directions, so you need to be willing to ride out massive amounts of volatility. After all, that is more the norm than the exception in many of the world’s markets today, not just this one.

The best way to attack this market is to look for little bits and pieces of value as they come, and scale in your position, not simply jumping in with both feet. After all, you can find that Bitcoin is down $2000 rather suddenly due to the massive volatility that becomes an issue. The biggest problem is that this market will run into eventually is that there will be a lot of people looking to get out of it that bought Bitcoin at extreme highs. After all, if you have been losing for three years or so, you are more than willing to get out at breakeven under normal circumstances.