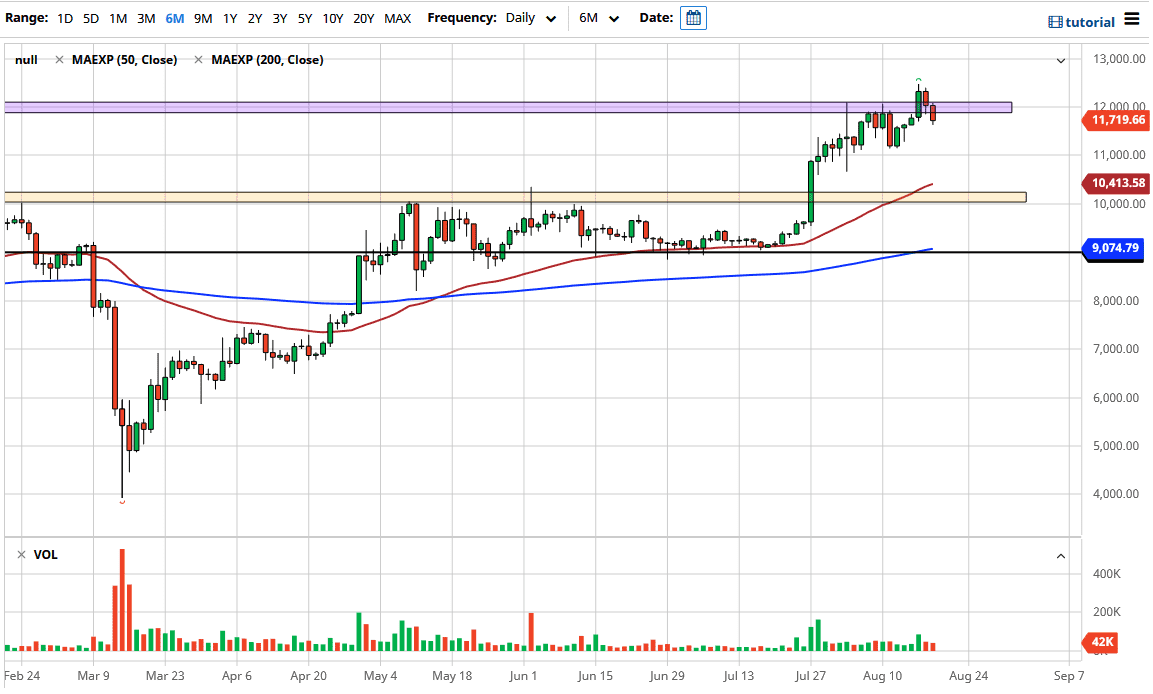

Bitcoin markets have pulled back again during the trading session on Wednesday, as we have seen a continuation of selling on Tuesday. This is an interesting development because it mirrors what we are seeing in the EUR/USD pair and the AUD/USD pair. In other words, we have seen a bit of a “false break out”, as the market broke above the $12,000 level and then gave it up again. That being said, I think it is only a matter of time before we go higher but we may need to pull back a bit as the US dollar strengthens slightly. After all, the US dollar had been oversold and therefore it will translate into assets and commodities falling as it recovers. I know people who trade Bitcoin hate that I call it a commodity, but it certainly trades as one.

Underneath, I believe that the $11,000 level should be supportive, as the 50 day EMA is starting to race in that general direction. It is also an area where we have seen support in the recent past so I think it would make sense that the buyers would come back into the market somewhere in that general vicinity. At that point, then we can make a serious attempt at the $12,000 level again.

Underneath, the $10,000 level is even more supportable because it is a large, round, psychologically significant figure and it is an area that had been difficult to break above previously. The candlestick is closing towards the bottom of the range, so that suggests that there could be a little bit of follow-through to the downside as well. With all this, it is a simple matter of waiting to see some type of supportive daily candlestick that you can start buying, so between now and then there will not be much to do. I certainly would be a seller, because of the solid uptrend that we have been in recently. In fact, it is not until we break below the $9000 level that I would be concerned about Bitcoin and its recent uptrend. If we can break above the recent highs, then we could go looking towards the $13,000 level initially, but I prefer the pullback because it allows the market to build up the necessary momentum to have a sustainable rally.