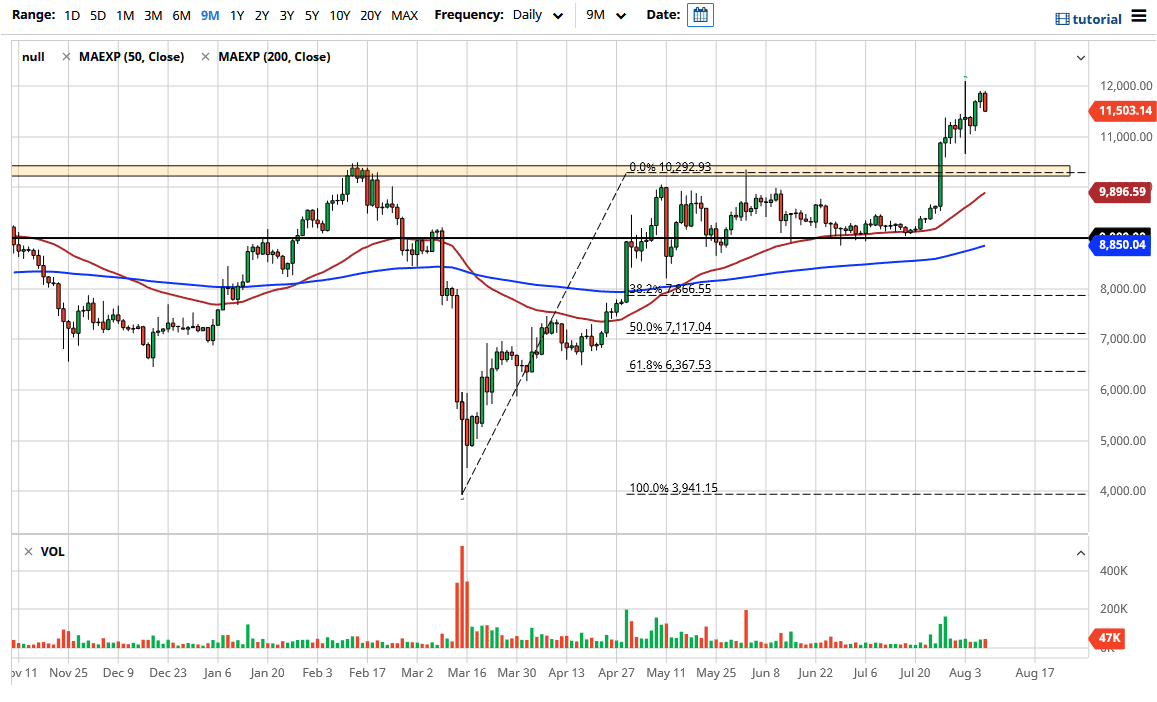

The Bitcoin market fell significantly during the Friday session, pulling back from just below the $1200 level. That is a significantly large, round, psychologically significant figure, and it will attract a certain amount of attention anytime you get near it. The $12,000 level has been important in the past, so it makes sense that this previous support level should be massive resistance.

Looking at this candlestick, we are closing towards the bottom of that range and it is a very negative sign as we are closing so low. I think at this point the market is likely to go down towards the $11,000 level, possibly even the $10,000 level after that. I like the idea of finding value on dips in Bitcoin as it moves counter to the US dollar which has been getting hammered as of late. With the Federal Reserve out there printing greenbacks as fast as they can, it makes quite a bit of sense that assets will continue to go higher. It is hard for a lot of Bitcoin believers to understand, but it trades a lot like a commodity. In other words, the commodity markets and Bitcoin tend to move in the same direction because of the US dollar part of the factor.

Having said that, the US dollar is oversold so I think it is about time we see Bitcoin give back some of the gains. There are plenty of support levels underneath that should continue to come into play, so I would be more than willing to buy that pullback. We may have a day or two of negativity but longer-term it still looks as if the Federal Reserve is going to kill the US dollar, and Bitcoin is in play on getting away from that same greenback. With all that being said, it is likely that we will continue to see noisy trading, but I certainly have no interest in shorting, at least not until we break well below the 50 day EMA which is currently at the 9895 level. I believe it is only a matter of time before value hunters will come back into this market as Bitcoin does tend to be rather impulsive for the longer term. Keep in mind that the weekend is coming up and we may get a sudden doubt, a lot of people will use that thin liquidity to manipulate the market.