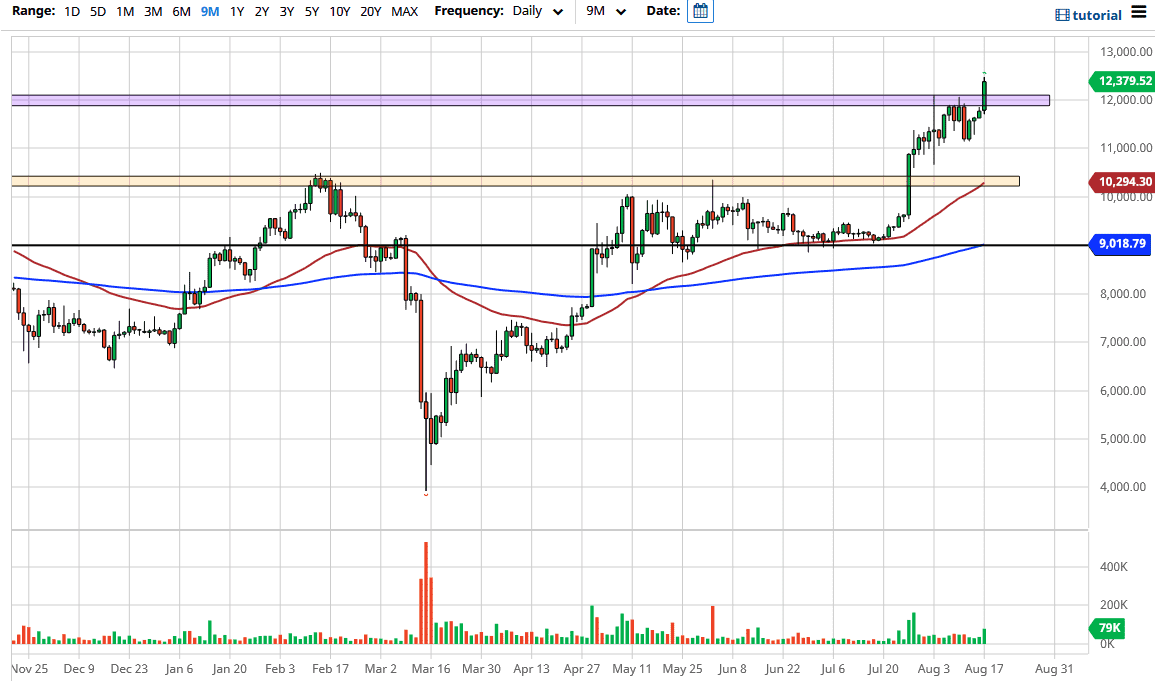

Bitcoin markets have had an explosive day on Monday, breaking through the crucial $12,000 level quite handily and is higher than the recent volume that we have seen in the market. The market is likely to continue to go higher, as we have cleared the major barrier in the form of the $12,000 handle. That is a large, round, psychologically significant figure, and an area that we have seen a lot of pressure recently. That being said, the market breaking out is simply a function of the fact that the Federal Reserve is flooding the markets with US dollars still, and that does not look like it is going to end anytime soon. The Fed is not only loosening monetary policy, but it is buying everything it can. Do not be shocked if they go into the business of buying stocks soon.

Looking at the chart, the bullish momentum still remains, and it is likely that we will continue to climb much higher as the US dollar seems to be in serious trouble. Pullbacks at this point should find plenty of buying opportunities near the $12,000 level initially, as it was previously resistant and it should now be supportive. Underneath there, I would anticipate that the market probably finds support at the $11,000 level as well as the $10,000 level underneath there. The 50 day EMA is currently sitting at roughly $10,300, so I would anticipate that there should be plenty of support in that area as well. Quite frankly, Bitcoin should not be sold anytime soon, as the US dollar itself is in trouble.

Beyond even the US dollar, central banks around the world continue to loosen monetary policy so it should not be a huge surprise that Bitcoin gets a bit in general. This is exactly what Bitcoin is designed for, to get away from fiat currency. Having said that, it trades a lot like a commodity and commodity markets are essentially “on fire” at the moment. With that being the case, I buy dips and recognize that this market could very easily be at $13,000 rather soon. I have no interest in shorting, mainly because there is no reason to suspect that the overall attitude is going to change anytime soon, and the technical analysis is starting to line up with the fundamental analysis. That is a very good sign for the buyers.