Bitcoin markets have pulled back a bit during the trading session on Tuesday, as we had seen the gold market meltdown during the day as well. In fact, both markets lost about the same percentage which lends even more credence to the idea that Bitcoin is becoming a commodity before our very eyes. I know that some people will reach out to me to argue the fact of whether or not Bitcoin is a commodity or exactly what it is, but the reality is that it is moving right along with gold, whether you like it or not.

This is because people are focusing on the Federal Reserve and its loosening the monetary policy, so that is the reason for Bitcoin to go higher or lower right now. It certainly is not adoption; nobody uses it for anything other than speculation 99% of the time. It attracts speculative trading more than anything else, with the exception of those who are “true believers” looking for a longer-term run higher. That being said, the biggest problem that Bitcoin will have is going to be the fact that it is only a matter of time before central banks release crypto on the world, and it is very likely that the general public will flow towards that version of crypto rather than Bitcoin. However, in the meantime, we definitely have a market that is available to be traded.

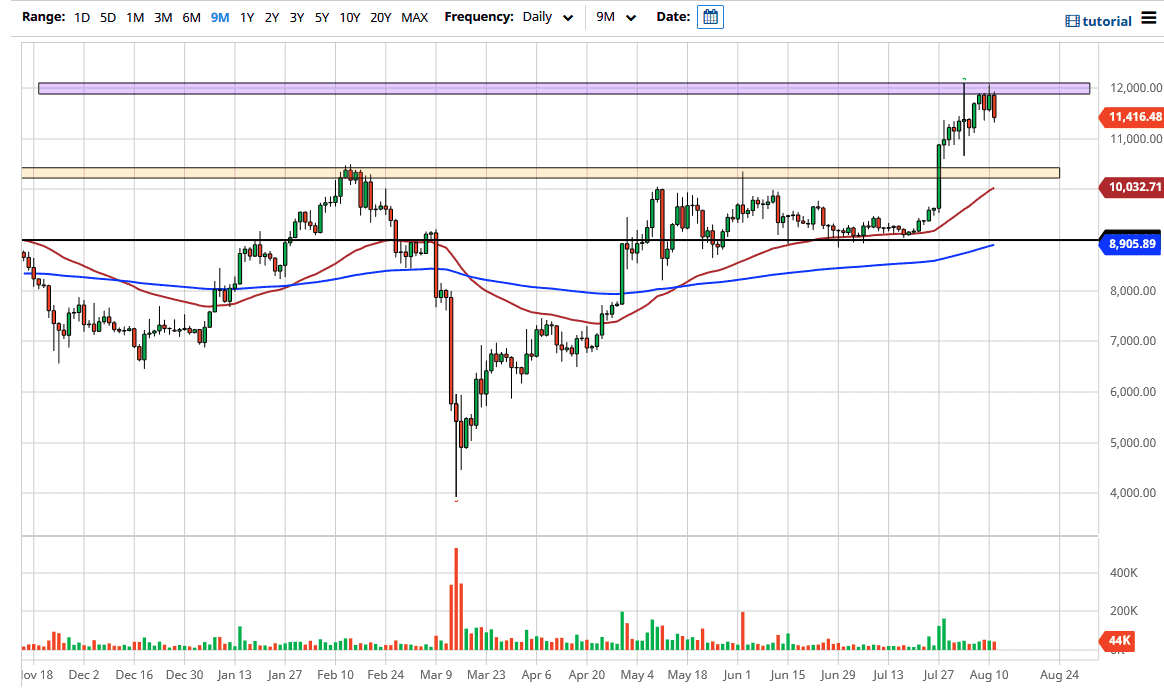

To the downside, the market is very likely to go down to the $11,000 level, perhaps even down to the $10,000 region. In that area, we should find ourselves. I think that there will be plenty of buyers to get involved. After all, we are most decidedly in an uptrend and the 50 day EMA sits just below that level. With all of that technical support underneath I do believe that it is only a matter of time before the buyers will get involved. Alternatively, if the market were to break above the $12,000 level, it will more than likely gain another $500 rather quickly, perhaps even go looking towards the $15,000 level. The biggest problem the market will have after that breakout is the fact that there are so many retail traders that are still waiting to get back to breakeven that there will naturally be some resistance above. However, the Federal Reserve continues to flood the markets with greenbacks, and as gold rises, and with that, silver and Bitcoin will also rise.