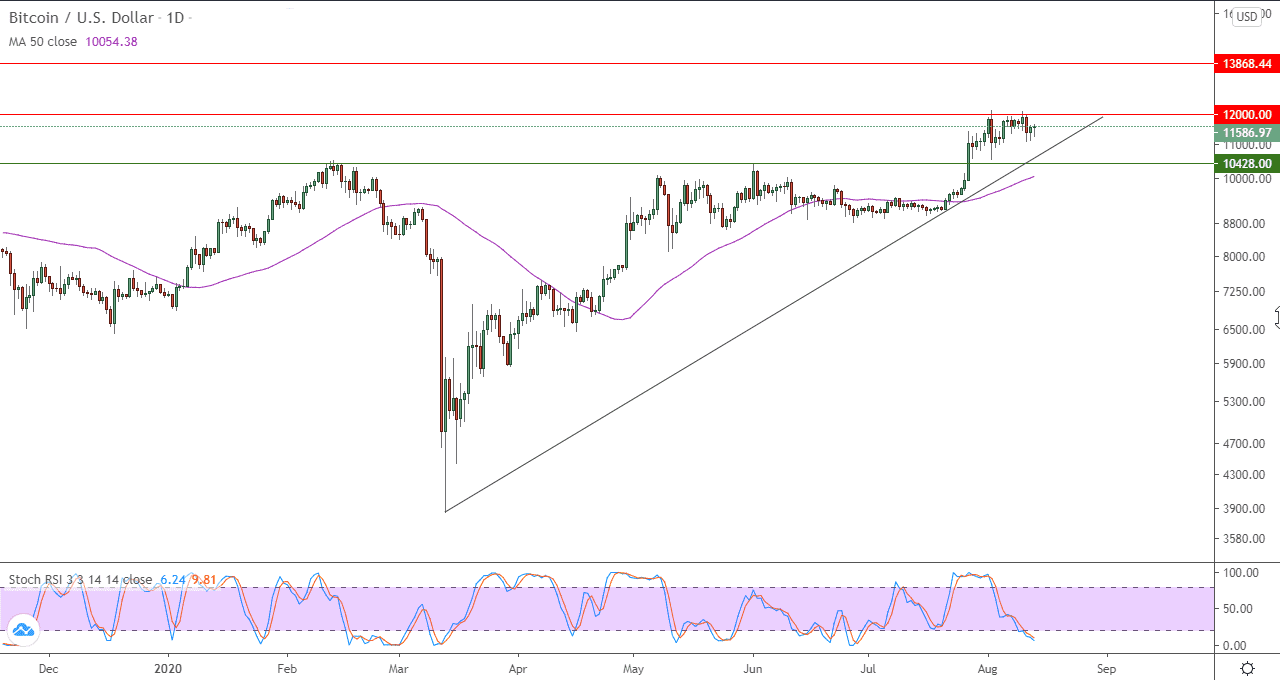

Bitcoin/USD: Will it reach $10500?

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo today.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $11850 or $12000.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $11,300.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside, or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

As I mentioned yesterday, the BTC/USD pair is facing downward pressures, after failing to move above the $12,000 resistance and stabilize around $11625 at the time of writing, with a market value of $215 billion. Bitcoin, the world's first cryptocurrency, has tried several times to overcome a decisive resistance during the past few days, which was the only obstacle before heading towards the $14,000 peak. Now, several technical indicators are indicating that a sharp correction is imminent, and participants in the crypto market became "very greedy."

Nearly 47,000 BTC were sent to various cryptocurrency exchanges while the upside was reaching exhaustion. The sudden spike in selling pressure, combined with a massive number of margin calls on over-indebted long positions, triggered a nearly 7% correction that sent Bitcoin down to $11,127.

Although Bitcoin was able to recover and return above the $11,400 support, the uptrend that started in early July has been jeopardized by the recent price action.

A robust risk management strategy is recommended when trading Bitcoin, despite all the previously mentioned bearish signals. A sudden spike in buy orders allowing BTC to cross the $11,640 resistance could trigger a jump towards the $12,000 resistance barrier. If this happens, traders should pay attention to the daily candlestick closing above this price barrier as it is likely to jeopardize bearish expectations and lead to a rally towards the $14,000 top.

On Tuesday, the price of gold and silver showed some corrective moves, and the same was seen in the cryptocurrency market. Accordingly, the BTC/USD pair fell by $700 from $11,800 to $11,100 in one day, indicating a short-term correction. Once the bitcoin price loses the support level at $11.100 - $11300, expectations indicate that the price may drop significantly towards the $10,000 region.

The uptrend in BTC/USD is now in danger of facing further challenges if the US dollar shows signs of further strength. Meanwhile, investors are also focused on the release of the next US stimulus package. This could lead to uncertainty in the dollar market, which has historically driven the price of bitcoin up.

Regarding the USD, weekly unemployed claims will be announced.