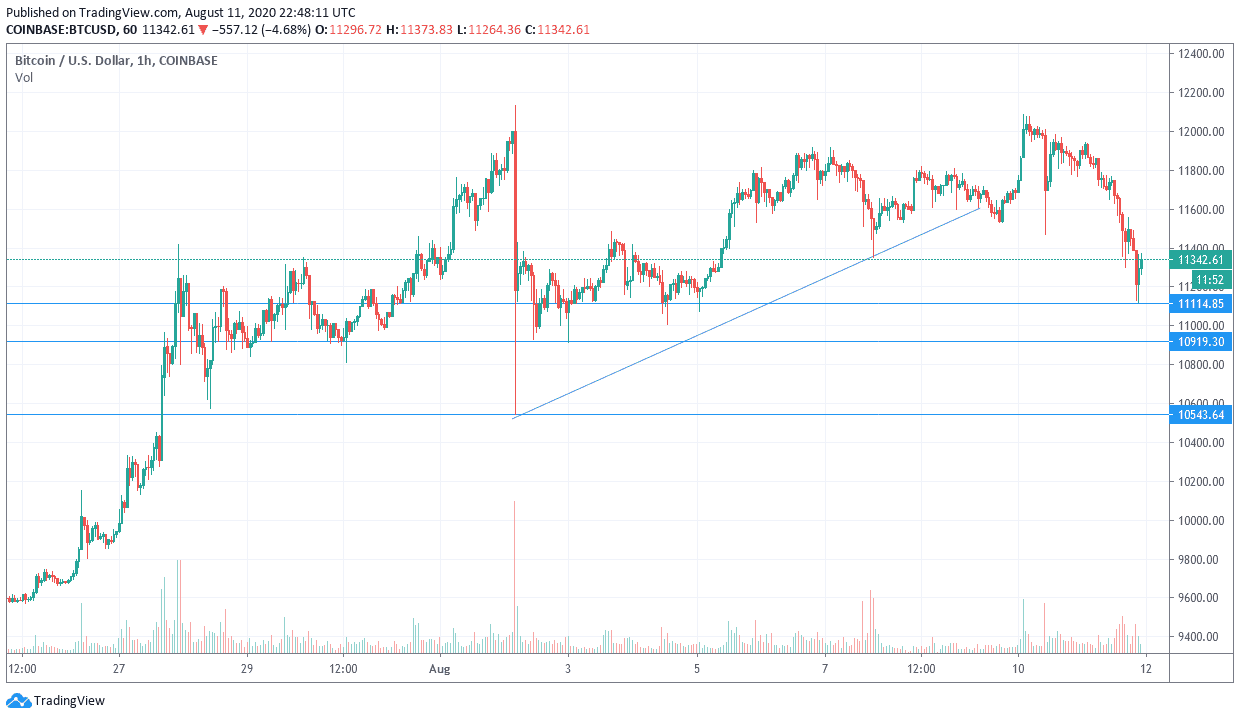

Bitcoin/USD: The beginning of bearish correction.

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo today.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $11700 or $12200.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $11,100.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

As I mentioned yesterday, the BTC/USD pair is facing strong resistance in completing gains above the $12000 resistance dollars. The selling operations due to the USD strength pushed the pair towards the $11130 support. Among the disturbing news for the cryptocurrencies market, California Attorney General Xavier Becera issued a consumer warning about scams involving digital assets or cryptocurrencies such as Bitcoin. He said there has been a batch of fraudsters introducing schemes that include digital assets to persuade consumers and investors to hand over their money under the pretext of making a lot of profit doing business with them.

Becera warned that frauds take many forms, with the same goal of separating people from their money. Consumers and investors are urged to always search for the company and its claims. He highlighted recent examples of unscrupulous actors who impersonated politicians, celebrities, and well-known businessmen on social media and YouTube channels in "gift" scams and falsely promising, for example, to double any digital assets sent to a specific digital asset portfolio.

Becera noted that these schemes are being attempted by fraud artists to take advantage of new technologies in order to steal their customers' hard-earned savings. At the same time, Becera noted, digital assets are new technologies that currently enjoy fewer regulatory guarantees and higher volatility than many other investment products. He added that the California Department of Justice is committed to protecting consumers and investors in this developing market.

In the short term, the BTC/USD pair retreated towards the lower trend line to support the ascending channel, a level that earlier showed an increase in buying sentiment among traders. Bitcoin is looking to re-test the $12,000 high. In the event of a rebound, the pair will test the $11918 high as a next bullish target. And the extended move above would push the price once more toward testing $12,000 resistance. Meanwhile, the bullish target of the channel lurks above $12,200. Conversely, failure to rebound from channel support would push the BTC/USD pair towards $11,500, an important support level. If the bearish momentum increases, the pair might move below the $10500 support.

Also adding to the downside pressures was the increase in Treasury yields and the stability of the US dollar. As investors returned to buy the US currency as a safe haven after China imposed sanctions on some US officials. This escalated the already existing tensions between Washington and Beijing.

The upside in BTC/USD is now in danger of facing further challenges if the US dollar shows signs of further strength. Meanwhile, investors are also focused on the release of the next US stimulus package. This could lead to uncertainty in the dollar market, which has historically driven the price of bitcoin up.

Regarding the USD, CPI reading will be announced.