BTC/USD: Waiting for a bearish correction

Today’s BTC/USD Signals

- Risk 0.50% per trade.

- Trades may only be entered prior to 5 pm Tokyo time Friday.

Long Trade Ideas

- Long entry after a bullish price action reversal on the H1 time frame following the next touch of $9500 or $10100.

- Place the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Short entry at the next touch of $13,400.

- Place the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

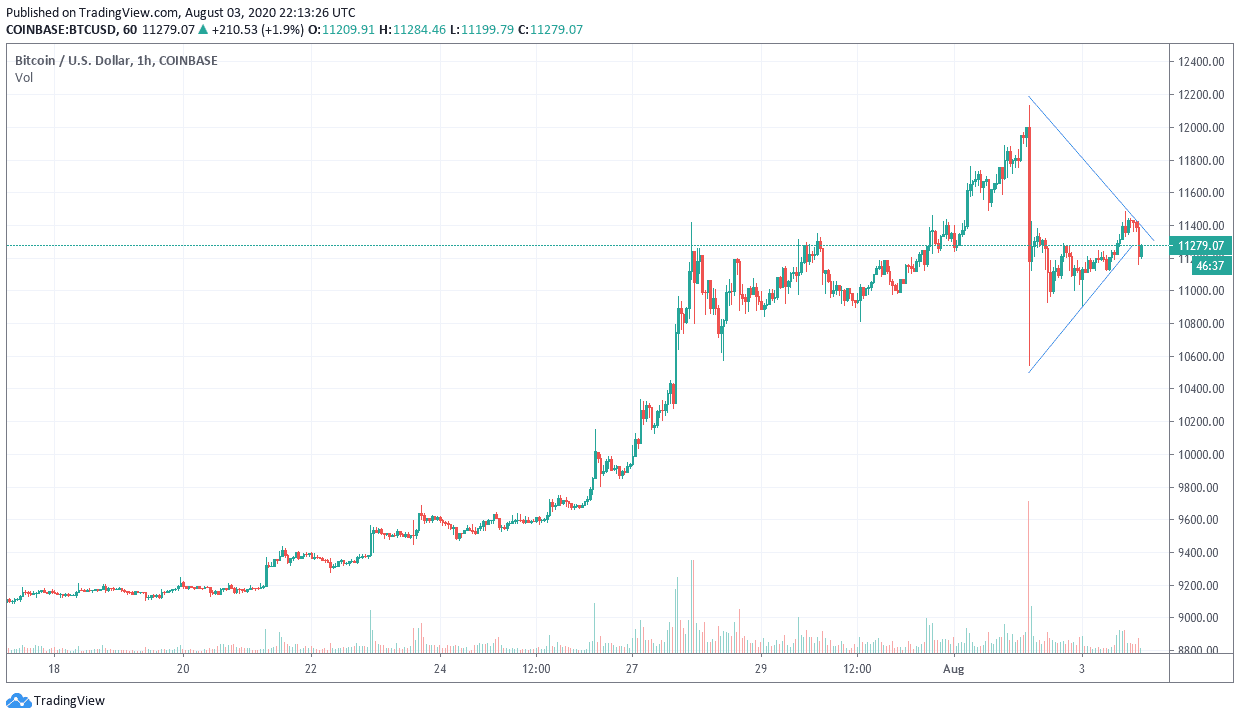

Bitcoin/USD Analysis

During yesterday's trading session, the BTC/USD pair moved in an upward correction range between $11485 and $10911 and was stable around $11300 at the time of writing. As I mentioned before, stability above the $10,000 psychological resistance is a catalyst for bulls, and the pair may push towards higher levels. The world's first cryptocurrency was exposed to strong fluctuations during the weekend, stable above $11,000 after the collapse to $10500, and currently the market value of Bitcoin exceeds $206 billion, while its dominance index fell to 60.7%.

The BTC/USD rebound was limited to $11,300, supported by the SMA50 on the Bollinger Band watch and upper line. Moreover, it was a strong resistance at the end of July. Once broken, the bullish trend is likely to gain momentum with the next focus on $11,400. With SMA50 on the hourly chart approaching. There is a need for a sustained move over this area to support the bullish trend with the next focus on $13,000. On the downside, the $10,000 level will continue to be significant psychological support that will affect investor sentiment if was breaks down.

Cryptocurrency experts expect more gains and growth amid a global appetite for safe-haven assets. Recently ETH/BTC reached its highest level since May 2019.

Regarding the US dollar, factory orders numbers will be announced.