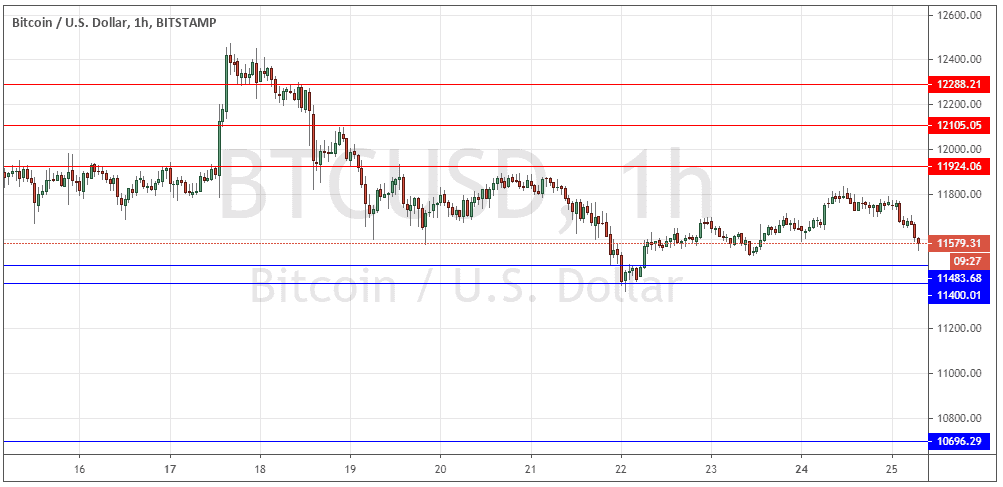

BTC/USD: Support at $11,400 likely to be tested soon

Yesterday’s signals were not triggered as neither of the key levels were reached.

Today’s BTC/USD Signals

Risk 0.50% per trade.

Trades must be taken prior to 5pm Tokyo time Wednesday.

Long Trade Ideas

- Go long after a bullish price action reversal on the H1 time frame following the next touch of $11,484 or $11,400.

- Put the stop loss $50 below the local swing low.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

Short Trade Ideas

- Go short after a bearish price action reversal on the H1 time frame following the next touch of $11,924, $12,105, or $12,208.

- Put the stop loss $50 above the local swing high.

- Move the stop loss to break even once the trade is $50 in profit by price.

- Remove 50% of the position as profit when the trade is $50 in profit by price and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

BTC/USD Analysis

I wrote yesterday that there was some short-term bullish momentum, but it looked likely that this would fade out completed as the price got close to the $12,000 area which should be resistant.

I wanted to stand aside from trading Bitcoin for the time being until the price breaks out of the $12,000 to $11,400 area.

These were good calls, as the price made a bearish turn yesterday once it reached the $11,800 area. The short-term price action is showing some bearish momentum as the price heads towards the nearest support level at $11,484.

Some currencies are advancing against the U.S. Dollar, but Bitcoin looks relatively weak. However, I think the support level at $11,400 is likely to hold, at least for a while, so as I see this level as likely to be very pivotal, and there is still a long-term bullish trend, I will take a long trade from a bullish bounce here. There is nothing of high importance due today regarding the USD.

There is nothing of high importance due today regarding the USD.